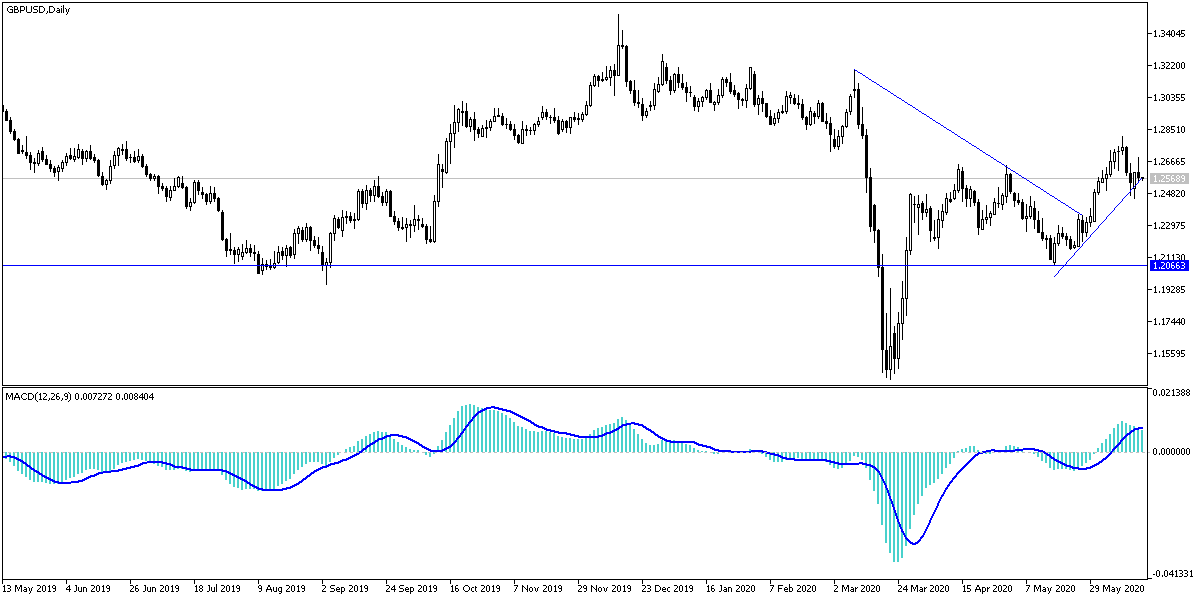

During yesterday's trading, the GBP/USD pair attempted an upward correction. Gains did not exceed, however, the 1.2688 resistance before retreating to the 1.2552 support at the time of writing, and before the release of important British inflation figures. The pair's gains were halted by the demand for the US dollar as a safe haven, amid renewed global geopolitical tensions. The Pound received some support to weather the strength of the greenback, amid lessening concerns over Brexit trade talks, although it could risk a crash later this week.

The biggest support for the British pound against the rest of the major currencies was supportive statements by Prime Minister Boris Johnson about the future of trade talks with the European Union after a meeting on Monday with European Commission President Ursula von der Lin. The pair was not greatly affected by the increase in geopolitical tensions in some parts of the world, especially between India and China after the outbreak of a border dispute between the two countries amounted to clashes.

The United Kingdom and the European Union have agreed to reinforce the dialogue language between them through several new rounds of negotiations now planned, amid speculation that the European Union may ease its claims over fishing rights. The President of the European Council, Charles Michel, however, is still determined on the so-called equal playing field, which has been a major stumbling block in the talks so far.

"Neither side wants to abandon a trade deal in favor of the WTO terms on trade, but for the UK in particular, the confusing next year system of customs duties and border checks could upset the economic recovery and investor influx. This, in turn, will affect the outlook for the Bank of England policy, and accordingly, monetary policy and economic performance will remain the strongest drivers for the British pound in the coming months,” said Jane Foley, strategist for foreign currencies at the Bank of Rabobank.

The Pound will react strongly to the BoE policy announcement tomorrow, as the bank's first opportunity to respond to GDP data, which revealed what some have called "the largest economic recession in the UK ever". It is also a clear opportunity for Governor Andrew Bailey to provide further clarity about the possibility of imposing negative interest rates as a policy tool.

The market expects another round of quantitative easing by the Bank of England this week, with expectations of adding 100 billion pounds of bond purchases to raise the total amount obtained by the bank to 745 billion pounds. However, the bank could announce more than that at 12:00 on Thursday.

According to the technical analysis of the pair: On the GBP/USD daily chart, stability above the of 1.2600 resistance remains in support of the bullish correction and the future of negotiations between the two sides of the Brexit will remain the most influencing factor on the course of this bounce. Despite the recent optimism, usually, each party wants to pressure the other to have the best deals, and there will not be a strong exit for the pair from the bullish channel without moving below the 1.2400 support. In general, I still prefer to sell the pair from every bullish level. Currently, MACD indicator is closest to overbought areas.

As for the economic calendar data today: From the United Kingdom, consumer price index and producer prices will be announced, showing inflation levels in the country. During the American session, building permits, housing starts and testimony Jerome Powell, governor of the US Central Bank, testimony will be announced.