Increasing pressure has pushed the GBP/USD pair to continue the sharp losses which pushed it towards the 1.2250 level, the lowest for a month, before settling around the 1.2300 level in the beginning of Tuesday’s trading. This was before the announcement of the growth rate of the British economy and Jerome Powell's important testimony. In the same path of decline, the British pound fell to its lowest level in three months against the Euro, as investors withdrew capital from a country facing the double prospects of a slow economic recovery from the Coronavirus and the sub-trade deal for Brexit at the end of 2020.

This is while Covid-19 mortality and infection cases in the UK continue to decline, but it appears that the pace of economic recovery will be slower than in other developed markets, as the recent economic sentiment index of the European Council showed that the country’s recovery is lagging behind its European counterparts. At the same time, there are fears that support for the financial and monetary policy of the crisis in the United Kingdom is also lagging behind the measures taken in the Eurozone and the United States, which could force the British economy to lag behind the global economy in the coming months.

Adding strongly to pressure on the Pound was the path and future of Brexit trade negotiations, as the Pound began the new week disappointed by comments from Prime Minister Boris Johnson during the weekend that the UK would be ready to accept a Brexit trade deal similar to one with Australia. An Australian-style deal is a bare trade deal that is effectively based on the terms of the World Trade Organization and is therefore effectively an exit from the European Union, and therefore the comments represented the UK’s toughening rhetoric towards the European Union on this issue, which should contribute to heightened market anxiety regarding the future of this important file.

Commenting on the ambiguous future of the pound, Robert Howard, a market analyst at Reuters said: "The pound may drop below 1.00 against the Euro for the first time if Britain leaves the European Union" on the same terms as Australia", because this would be equivalent to" a hard Brexit." And added "Australia does not have a comprehensive trade agreement with the European Union; Much of the trade between the European Union and Australia follows of the World Trade Organization rules”

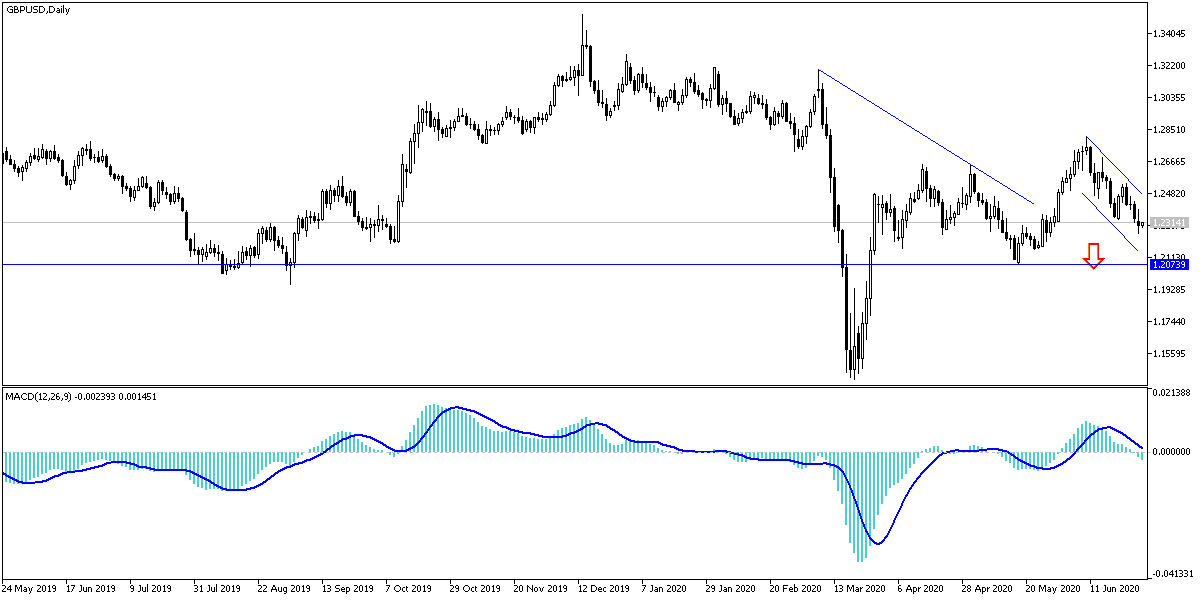

According to the technical analysis of the pair: As expected in recent technical analyzes, the GBP/USD pair breaching to the 1.2320 support will raise the strength of the bearish momentum to push the pair to stronger support levels, which already happended, and the pair retreated to the 1.2250 support. Breaking that level will push the pair to the next psychological support expected at 1.2000. There will be no real chance for the pair to reverse the current downtrend without moving above the 1.2625 resistance, otherwise the bearish bears will remain stronger. Currency traders are watching for the British currency to gain support from a breakthrough in the Brexit talks and the return of investor risk appetite.

As for the economic agenda data today: From the UK, the country's GDP growth rate will be announced along with the rate of business investment and the current account. During the US session, we will have the Purchasing Managers Index from Chicago, the US Consumer Confidence, and the testimony of US Central Bank Governor Powell, along with the US Treasury Secretary, before the US Parliament to illustrate stimulus plans for the world's largest economy.