The US labor market results this week will be under close watch by forex investors, because it will lead to a strong response to the US dollar. Investors are taking advantage of the recent optimism that prevailed in the global financial markets to abandon the US currency as a safe haven for some time. Which contributed to the gains of the GBP/USD pushing it to the 1.2575 resistance, its highest for a month, before settling around the 1.2550 level in the beginning of Wednesday’s trading. Despite the GBP's recent gains, expectations remain strong that it will experience more volatility soon in response to important talks between the two sides of Brexit.

The UK and European Union have begun a final scheduled round of trade negotiations, and there is still little confidence that the two sides will make progress, ensuring that June could be a decisive month for the British pound. Recent gains have been stalled after media reports from both European Union and UK camps that unless either side turns around regarding a number of essentials, it may not be possible to reach an agreement. This would make the two sides compelled to deal with WTO trade items at the beginning of 2021.

Despite the cautious optimism of the Brexit process, expectations confirm that the two sides will reach an agreement in the end, and it may be at the end of this year. The UK position remains that if little progress is made by June, it will begin planning trade on WTO terms as the main scenario when the transition period ends in December. This subversive scenario will be negative for the British Pound and there will be no further negotiations that is planned before the deadline at the end of June, to request an extension of the transitional period.

On the economic side. Activity in the UK's main real estate market - defined as the market for residential property worth more than £1m - has fallen alongside broader economic activity, and analysis of this market by mortgage broker Enness Global shows that the volume of transactions across the UK real estate market for properties of £1m+, failed to bounce back after the December election result. Despite this decline, average selling prices over the past three months recorded the most steady upward performance in the past year. Enness Global analyzed data on real estate transactions that exceeded the threshold of one million pounds sterling to see how sales prices and transaction numbers had been achieved in the past 12 months and since the December election result.

The data indicates that the number of transactions amounting to one £1+ transactions has already increased on a monthly basis before the December elections. However, while the market generally rebounded in the aftermath of the elections, real estate transactions declined by £1m or more, averaging -45% per month between December and March. The biggest monthly drop of was by -87% and happened between February and March, came as the country neared a close and many buyers and sellers sat in a sharp position due to more market uncertainty.

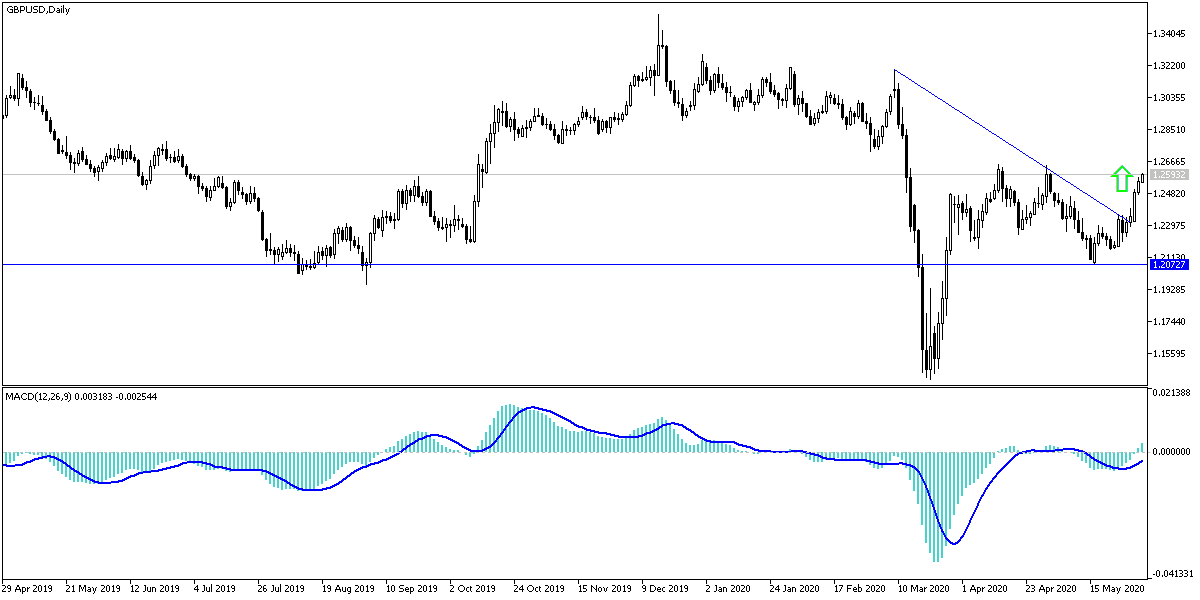

According to the technical analysis: GBP/USD gains are at a halting state with the loss of momentum to achieve more and the return of fears of a dark future for Brexit with an important date that determines its fate, and accordingly, currency traders may consider selling to reap profits and prepare for extreme fluctuation in the coming days. Closer Resistance levels are currently 1.2565, 1.2630 and 1.2700, and the bears will gain control of performance with the return of movement towards the 1.2330 support, and I still prefer to sell the pair from each higher level.

As for the economic calendar data today: From Britain, the services PMI be announced, and from the United States, the ADP survey to measure the change in the numbers of US non-agricultural jobs will be announced, then the ISM PMI for US services, US factory orders and crude oil stocks will be announced.