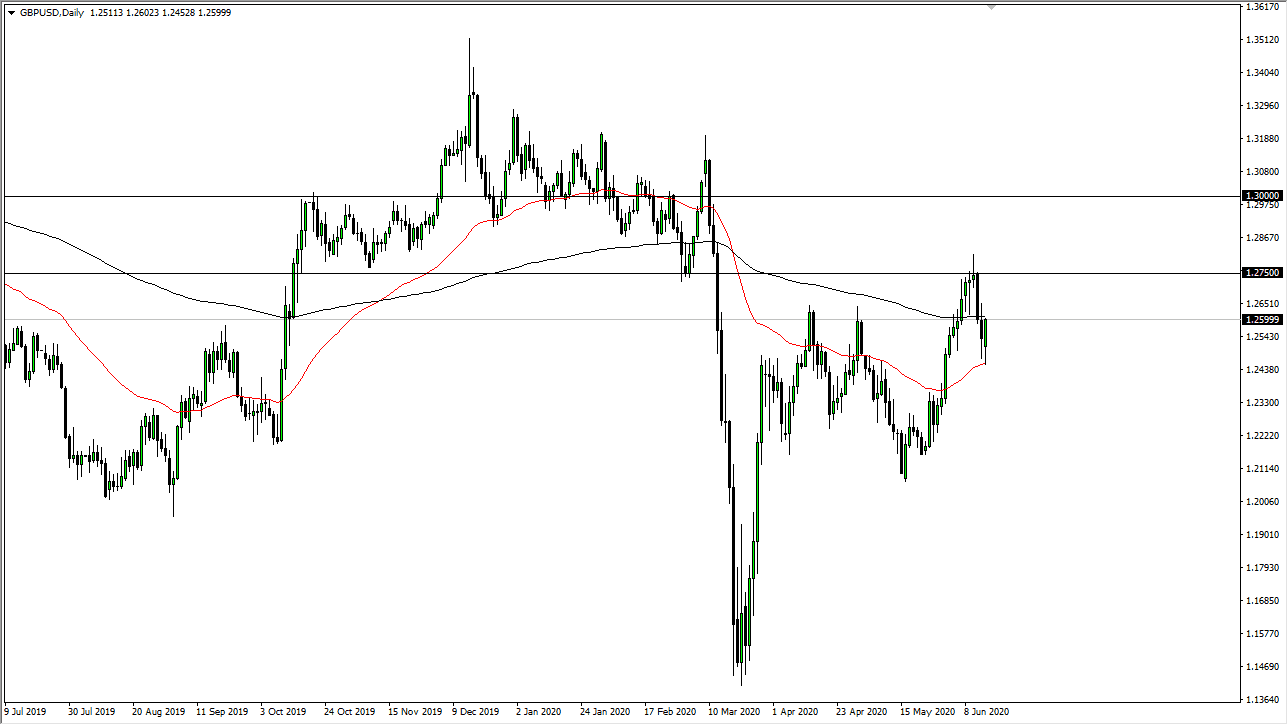

The British pound has initially fallen during the trading session on Monday to kick off the week but found enough support at the 50 day EMA to turn around and rally a bit. Having said that, the market clearly has a lot of issues trying to break above the 200 day EMA for any significant amount of time. In a sense, I think that the market will continue to go back and forth between the 1.2750 level and the 50 day EMA. I am likely to see an exhaustive candlestick as a sell signal.

I do not necessarily think that the British pound is going to break down significantly, but I do think that we will see sellers eventually. Breaking above the top of the candlestick from the Wednesday session, the shooting star that sits at the 1.2750 level, then I would believe that the market is likely to go to the 1.30 level. All things being equal though, it is worth noting that we have made a “lower low” followed by a “higher high.” In other words, the volatility is picking up, which makes trading much more difficult.

The only way to combat this type of volatility is to trade with small positions and start aiming for longer time frames. The other alternative is to trade small and use short-term charts, perhaps day trading with micro positions. It is really up to you and what you end up feeling comfortable with, but it is obvious that the market is going to be all over the place. The Bank of England is likely to continue to see reasons to get involved in the market, and of course the British economy has to worry about the Brexit situation.

I think we continue to bang around and make a lot of noise, essentially going nowhere. The idea that we are suddenly going to make a decision and go somewhere would be nice, but I just do not see that happening anytime soon. The market has gotten a bit ahead of itself, but the Federal Reserve trying to devalue the US dollar is something that is worth paying attention to. The 1.30 level above will be even more resistive than the 1.2750 level, so keep that in mind as well. To the downside, if we were to break down below the 50 day EMA we could go down to the 1.2250 level that I would not expect that to be easy.