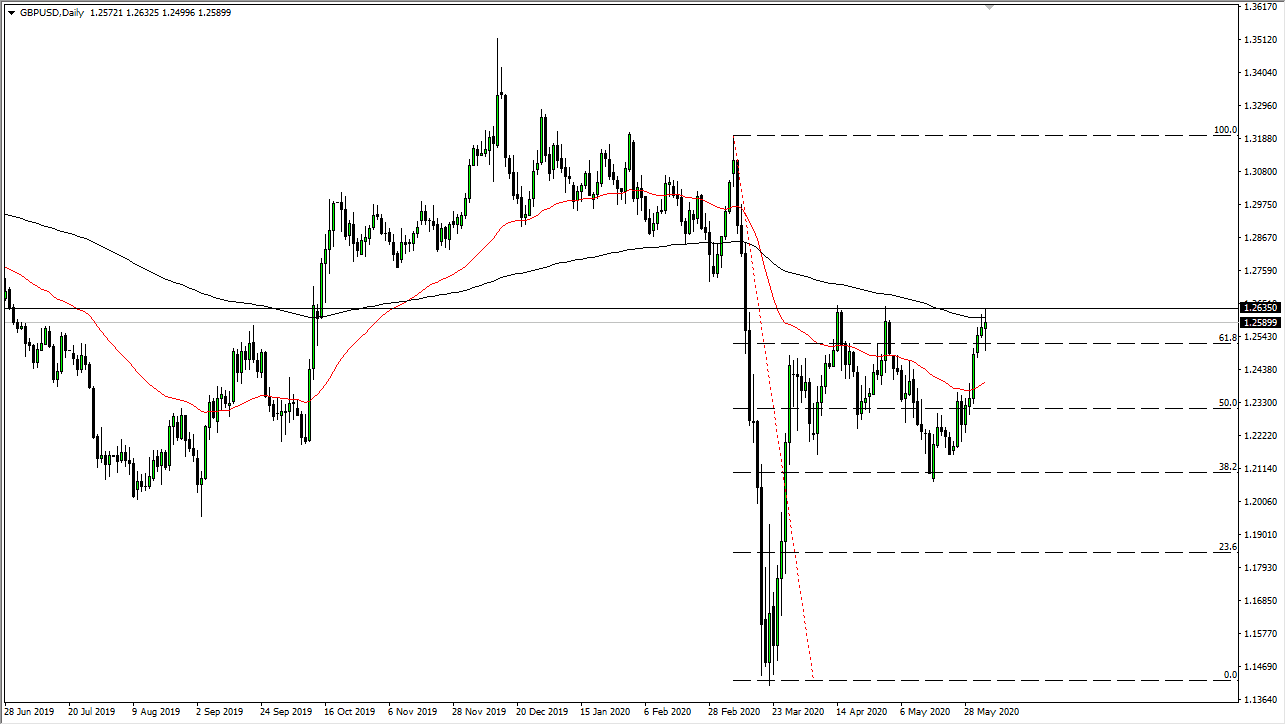

The British pound was all over the place during the trading session on Thursday, as we continue to tussle with the idea of the 200 day EMA. Because of this, it is obvious to me that the market is trying to figure out where to go from here, and it is likely that we will see it make its decision relatively soon. The 200 day EMA is in the neighborhood of trading right now, and that of course causes a lot of algorithms to trade back and forth based upon the trend defining indicator. Ultimately, I believe that the market is going to go looking towards the 1.2650 level for some type of clarity, and if we can get above there on a daily close, then it could be a huge signal.

Ultimately, it will be interesting to see how this plays out that we are clearly at a point of inflection so it will be interesting to see whether or not the US dollar can make it stand here or if we see the British pound completely ripped through the resistance and go much higher. If we can break above the short term resistance where we have made a triple top, then it opens up the possibility of a move all the way to the 1.30 level.

I can give you a million reasons as to why the British pound should not be going higher against the US dollar, but at the end of the day none of that matters. Yes, there are concerns when it comes to Brexit and of course the fact that the United Kingdom will remain somewhat lockdown even while it does open, and there is the idea that the Bank of England may go towards negative rates, but the British pound rallies anyway. The reason for that of course is probably more along the lines of the Federal Reserve trying to kill the US dollar, and so far, making a good go at it. With that being the case, I believe the volatility is going to get worse, not better, so do not be surprised at all to see this market for around in this area. If we break down below the bottom of the candlestick for Thursday, then it is likely we go down to the 1.2350 level. At this point, I would suggest that just about anything is possible from this point.