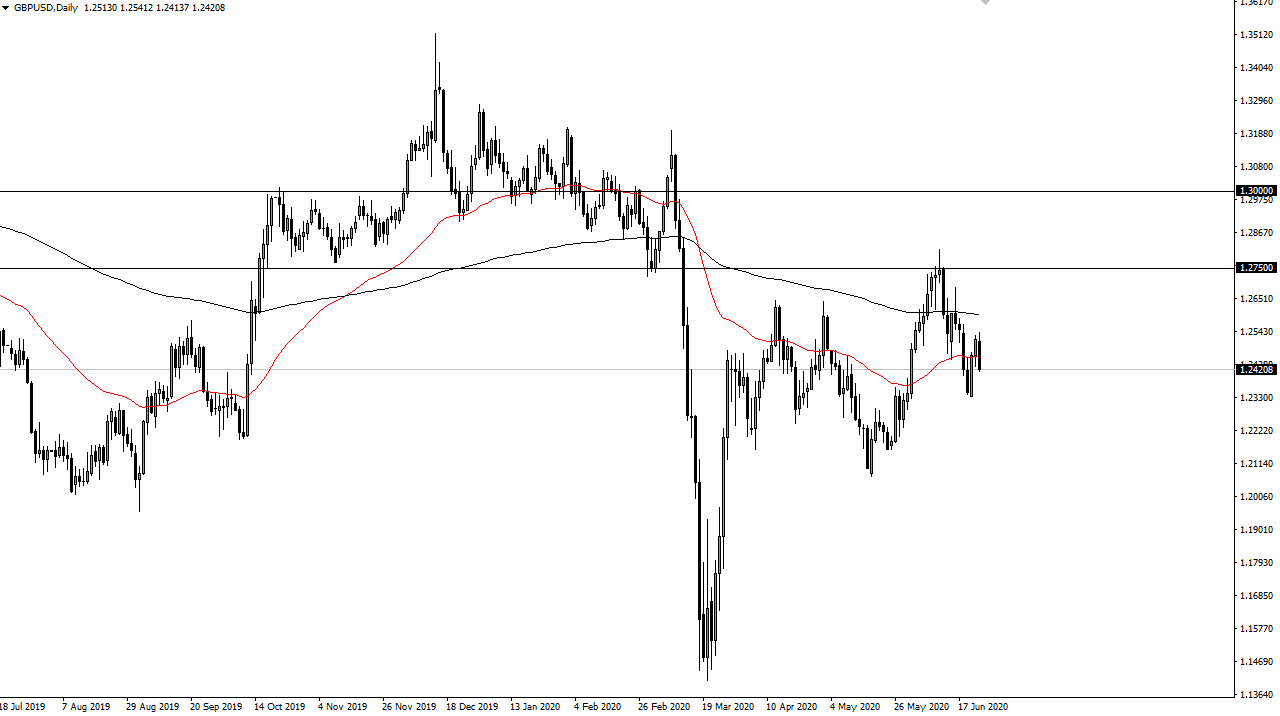

The British pound initially tried to rally during the trading session on Wednesday but fell hard during the trading session as traders started focusing on things like coronavirus numbers and a general “risk off” type of scenario. With that being the case, it makes quite a bit of sense that the market would selloff and sliced through the 50 day EMA as the demand for US dollars tends to pick up when there is fear out there. A lot of traders will go looking towards the US Treasury market, and therefore it makes sense that the US dollar rallies as a result. Because of this, I think we will go looking towards the 1.2250 level again, possibly even lower than that. The British pound had gotten far too ahead of itself.

Furthermore, the candlestick closed at the bottom of the range and that of course is a very negative sign. With all of that, I think there are plenty of reasons to think that the British pound has selling pressure ahead of it. The market continues to be noisy to say the least so even if we do break higher from here, I think that the 200 day EMA would also come into play and send this market much lower. To be honest, I believe that selling short-term rallies is the best way to go, as we had seen a lot of US dollar strength during the day. I anticipate that the day will probably feature a little bit of buying of the British pound and other currencies, but that will more than likely get squashed as we have to worry about a whole plethora of things at this point.

Keep in mind that I have even talked about the situations in the United Kingdom itself. The economy is trying to open up but from what we have seen elsewhere, it is difficult to imagine that the United Kingdom is going to be able to open up without another wave of coronavirus infections. Even beyond that, Brexit is nowhere near being figured out and that is going to continue to be an issue. 2020 was going to be a bad year for the British pound as far as headline risk is concerned, and that was without all of this extra nonsense. With this, I continue to sell rallies although I recognize that it could be very choppy and difficult.