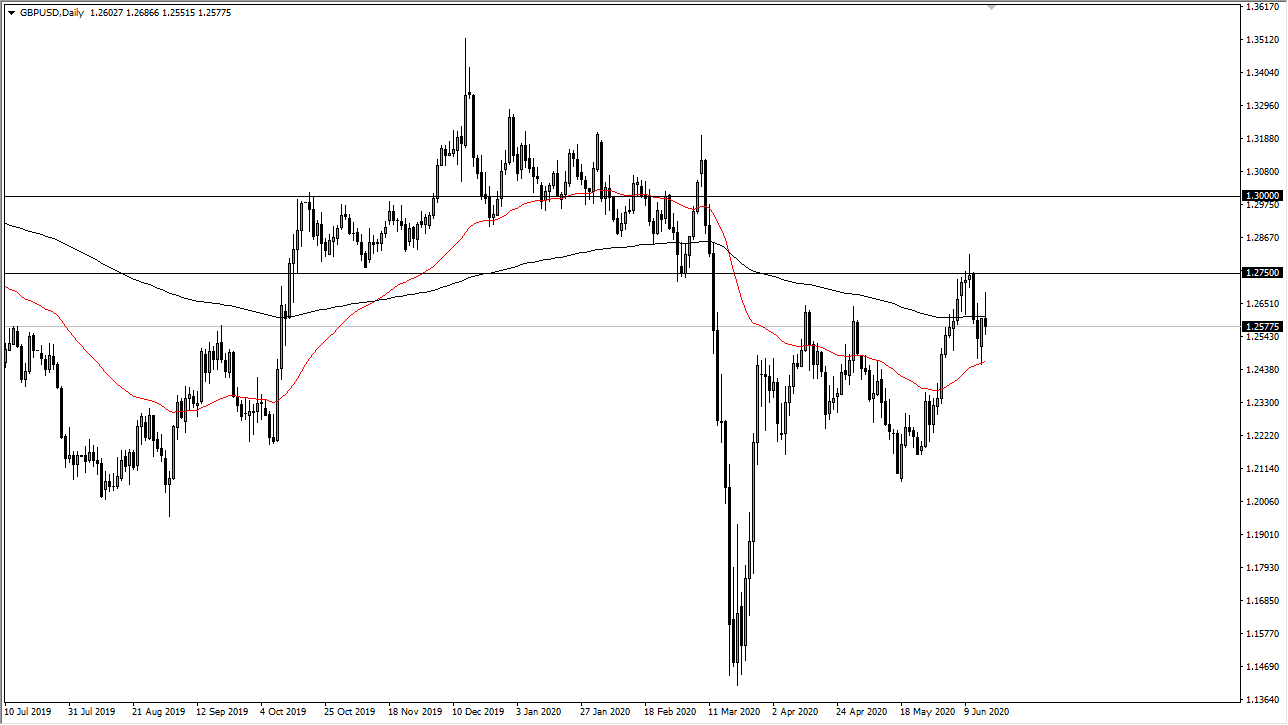

The British pound initially tried to rally during the trading session on Tuesday, and even stretched all the way to roughly 1.27. However, sellers came in and crushed the Sterling as we broke below the 200 day EMA again to form a bit of a shooting star. At this point, it looks as if this pair could continue to get lower, perhaps reaching towards the 50 day EMA initially. Breaking down below that level could open up further negativity, perhaps reaching down towards the 1.2250 level, an area that has been important more than once. Furthermore, the British pound comes with a whole set of issues that many other currencies down.

After all, the United Kingdom is still trying to open up its economy, and it certainly lags behind many others. The Brexit situation is still complete mess and it looks as if we are going to see a “hard Brexit” as the European Union has recently suggested that an extension was out of the question. And frankly, currency traders would probably prefer it that they simply did it and got it over with. Clearly the negotiations are going nowhere, and this will continue to be one of the biggest pressures against Sterling, despite the fact that we have the added pressure of the coronavirus situation.

The US dollar had a relatively decent day during the trading session on Tuesday, so of course it was reflected here anyway. The fact that we had those other issues clearly helped, but the 200 day EMA more than anything else is probably the most important technical indicator at the moment. To me it seems as if we could see more range bound trading than anything else in this general vicinity, with the 1.25 level being a magnet for price. If we do break out to the upside, the 1.250 level above would be significant resistance, so I think at that point we would probably see some sellers. On the other hand, if we were to break above that shooting star at the 1.2750 level, then the market could go looking towards 1.30 level. I do not think that happens in the short term, but it is a threat that we need to keep in mind. To the downside, if we were to break down below the red 50 day EMA, the move to the 1.2250 level will probably be somewhat rapid. After that, then we would be looking at a move to the 1.20 level.