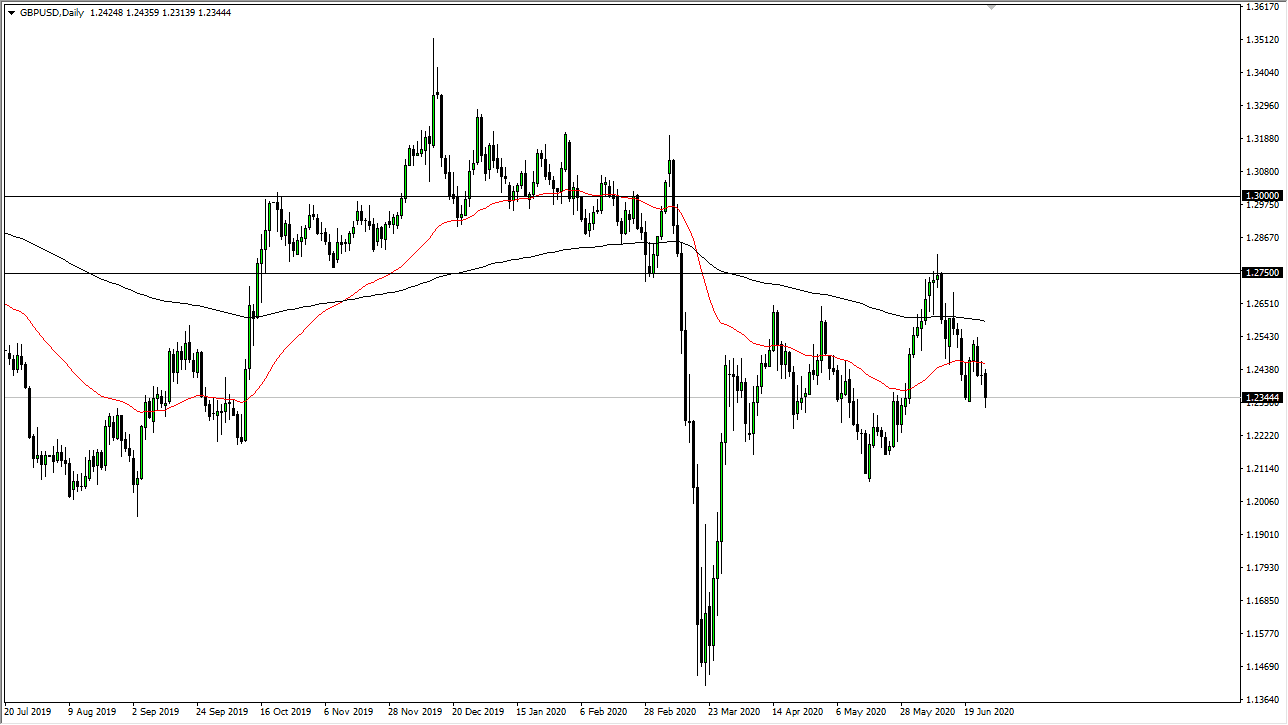

The British pound broke down during the Friday session and found the 50 day EMA to be a bit too resistive to continue going higher. The fact that we pulled back the way we did from the 50 day EMA suggests to me that we are more than likely going to continue to see more downward pressure, and I like the idea of fading rallies over here. On a break down below the lows of the trading session on Friday, that opens up a move down to the 1.2250 level, and then possibly the 1.20 level over the longer term.

The British pound is especially sensitive and vulnerable at this point, as we continue to see a lot of concerns about the British economy reopening, and with the Brexit situation not getting any better. As that is the case, I think that the market will continue to look towards the downside as a potential move sets up towards the crucial 1.20 level. A breakdown below there could get things moving in a rather ugly manner against Sterling.

Keep in mind that this pair does tend to fall and “risk-off” scenarios, and we certainly could see one of those pop up at any given moment based upon what we have seen around the world due to the pandemic seemingly not going anywhere. The market may have gotten a bit ahead of itself and therefore it looks as if the British pound is a bit overvalued, at least in the short term. From a historical point of view, it is ridiculously cheap, but we have a long way to go before sentiment changes, and you need that in order to push the market higher.

If we do break to the upside, the 50 day EMA is currently trading right around the 1.2450 level, and then of course you have the 1.25 handle above there causing resistance. After that, right around the 1.2550 level we have the 200 day EMA, so I see rallies at this point being limited at best. If we were to be able to break above that mass, then the 1.2750 level would be the next target as it has been both support and resistance several times in the past. All things being equal, I think this is a market that needs to make a return to the lows near the 1.20 level, and possibly beyond if things get worse.