Looking at this currency pair, we have seen a lot of negativity, and that makes quite a bit of sense considering there are concerns about the United Kingdom and its economy. Furthermore, there is Brexit to worry about which still looks as if it is going to be a “hard Brexit.” If that is going to be the case, people will be worried about what happens with the British pound next, as there will probably be a lot of negativity thrown its way. Beyond that, we have the Bank of England adding to the pressure.

The Bank of England is currently testing out the waters for the idea of negative interest rates. If that is going to be the case, this will be horribly negative for the British pound, as it will drive money away from fixed assets and that country. Having said that, there are other central banks around the world going that route so it is possible that it might be more of a “beggar thy neighbor” scenario where people will start to look at “less bad” currencies as a value. After all, the currency markets are a game of relative value, so that of course could throw another kink in the price action.

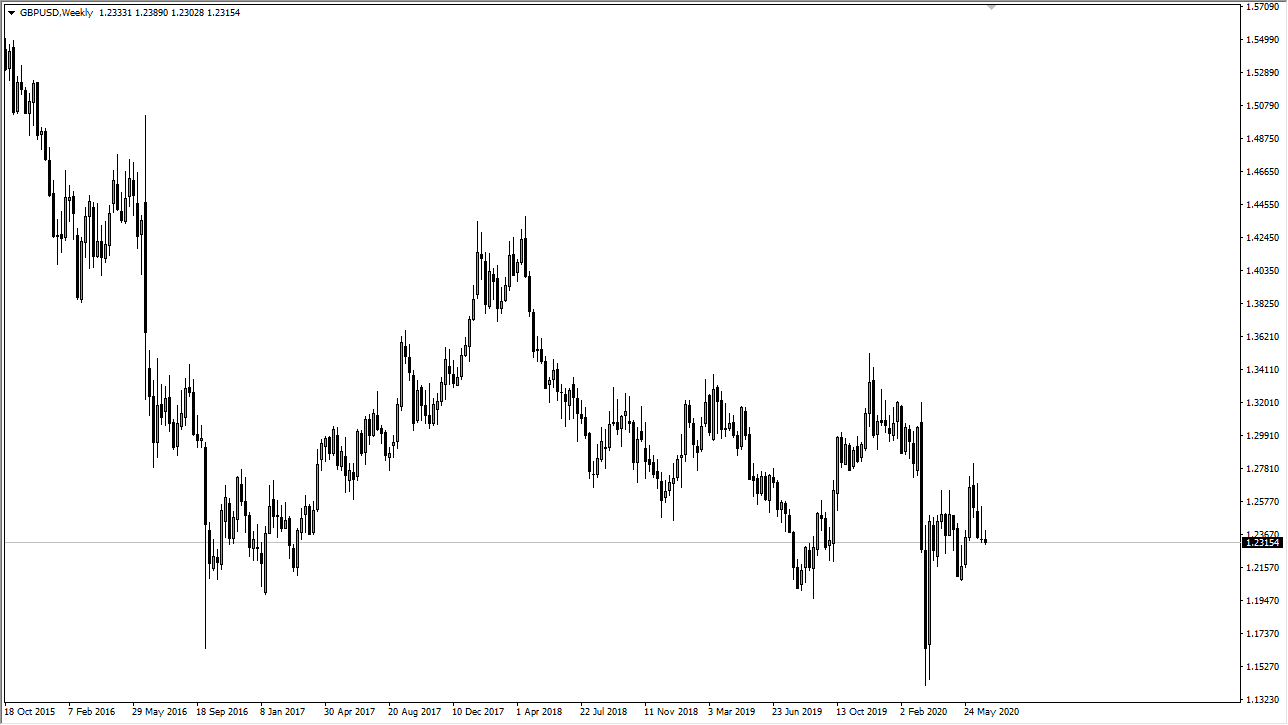

When it comes to this specific pair though, it is likely that the US dollar will continue to be a bit more tenable to own than the British pound, due to the fact that you have the safety of the US Treasury market, which has been attracting a lot of demand. As long as that is going to be the case, there will be a lot of demand for US dollars, so with all of that being said it does make sense that we continue to go lower. After all, you can see that we are most recently rallied towards the 1.2750 level and then have fallen right back down. The floor underneath at the 1.20 level looks highly likely to be tested, and if we do break down below there, we could go looking towards the 1.1750 level. However, if it holds then we could see a bit of a bounce only to be sold off yet again. It is difficult to get overly excited about going long of this pair so I think this will either be a breakdown, or more of a “fading the rallies” type of market for the next month.