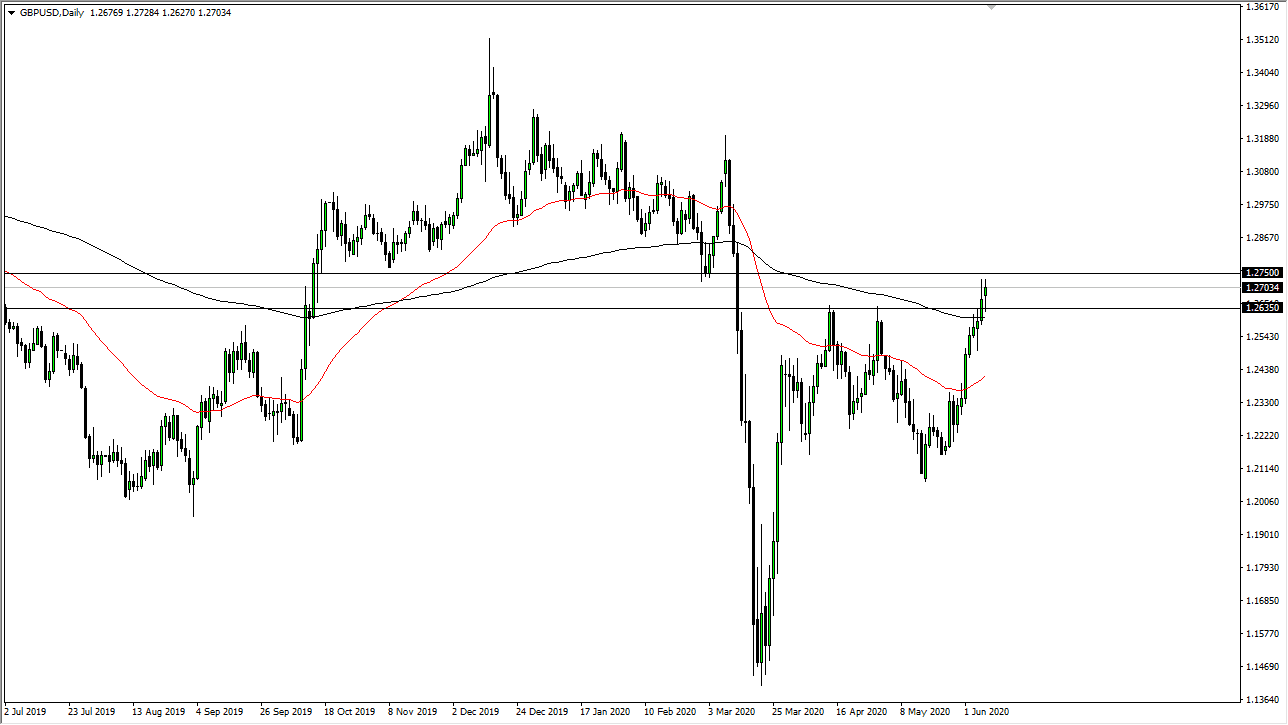

The British pound initially gapped higher to kick off the week, but then pulled back towards the 1.2635 level, and the 200 day EMA to find enough buyers there to turn around and form a bit of a hammer like candlestick. The market looks as if it is trying to break above the 1.2750 level, an area that had previously been massive support. If we can break above there, then the market is likely to go looking towards 1.30 level after that, which is the next major resistance barrier. Yes, there is a significant amount of noise in that area but now that we have broken above the 200 day EMA it is likely that we are going to see a little bit of support in that area.

The British pound is granting higher in general, but at this point in time it is likely that the market is going to go looking towards the 1.30 level because it had been resistance in the past. If the market breaks above there, then the British pound has completely broken trend, and will continue to go higher for years. That being said, I think that the market is getting a bit stretched but price is price, and shorting the British pound has been a painful trade for anybody who has done it, even though the fundamentals do not suggest that the British pound should be gaining strength at all. However, liquidity being thrown into the market by the Federal Reserve seems to be tromping everything else, and therefore the US dollar has suffered.

We do have to worry about the Brexit still, and it looks very unlikely that we are going to get any type of resolution to a UK/EU trade deal. If that is going to be the case, then the British pound will eventually take it on the chin. However, we are not near that quite yet, and it certainly looks as if a move above the 1.2750 level is going to be attempted. The fact that the market has already pulled back to test the previous resistance barrier and then bounced is a good sign, so it is highly likely that we could see that happen sooner rather than later. I do not like owning the British pound, because I think it comes with too many issues. However, price is going higher and that is really at the end of the day all that matters.