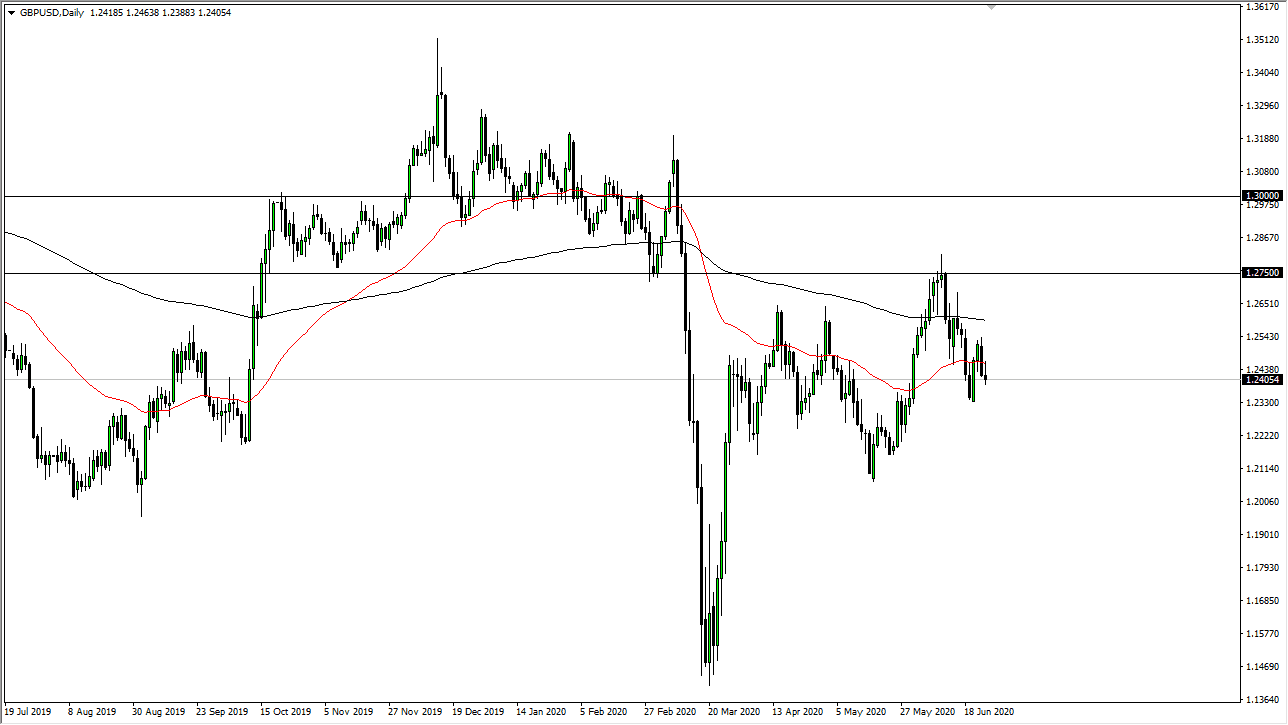

The British pound has rallied a bit during the trading session on Thursday but found quite a bit of resistance near the 50 day EMA as we ended up pulling back a bit. The candlestick for the trading session is a bit of an inverted hammer, which suggests that we may have a little bit of a move, but I think we are going to end up limping into the weekend, perhaps dropping a bit from here. Furthermore, I think that short-term rallies are to be sold into, but we may not get much of an opportunity to take advantage of that during the day on Friday as we are simply killing time and waiting for the next reason to move.

To the upside I believe that the 1.25 level above will offer a bit of resistance, but furthermore I believe that the 200 day EMA is an area that will cause some resistance as well. I think there would be sellers at both of those areas, but quite frankly I am not looking for anything big between now and next week. Alternately, if we were to break down below the bottom of the candlestick for the trading session on Thursday, then the market continues to go much lower. Overall, I think that the British pound continues to have a lot of issues when it comes to Brexit, the economy opening up finally, and of course the economic malaise that we see coming out of London in general.

Furthermore, the US dollar is considered to be a safety currency so keep in mind that a lot of traders will be looking at the geopolitical situation out there and of course the global trade situation that could have people running towards the US dollar. However, if the market sees more of a “risk on” type of situation they will probably run away from the greenback, thereby pushing the British pound higher by proxy. I do not think that longer-term that sustainable, and even if we do rally from here it is likely that we could be forming some type of rising wedge. A rising wedge of course is a negative sign, and if we can break down below the potential downtrend line, that could send the market right back down as well. I do not have any interest in buying, at least not quite yet.