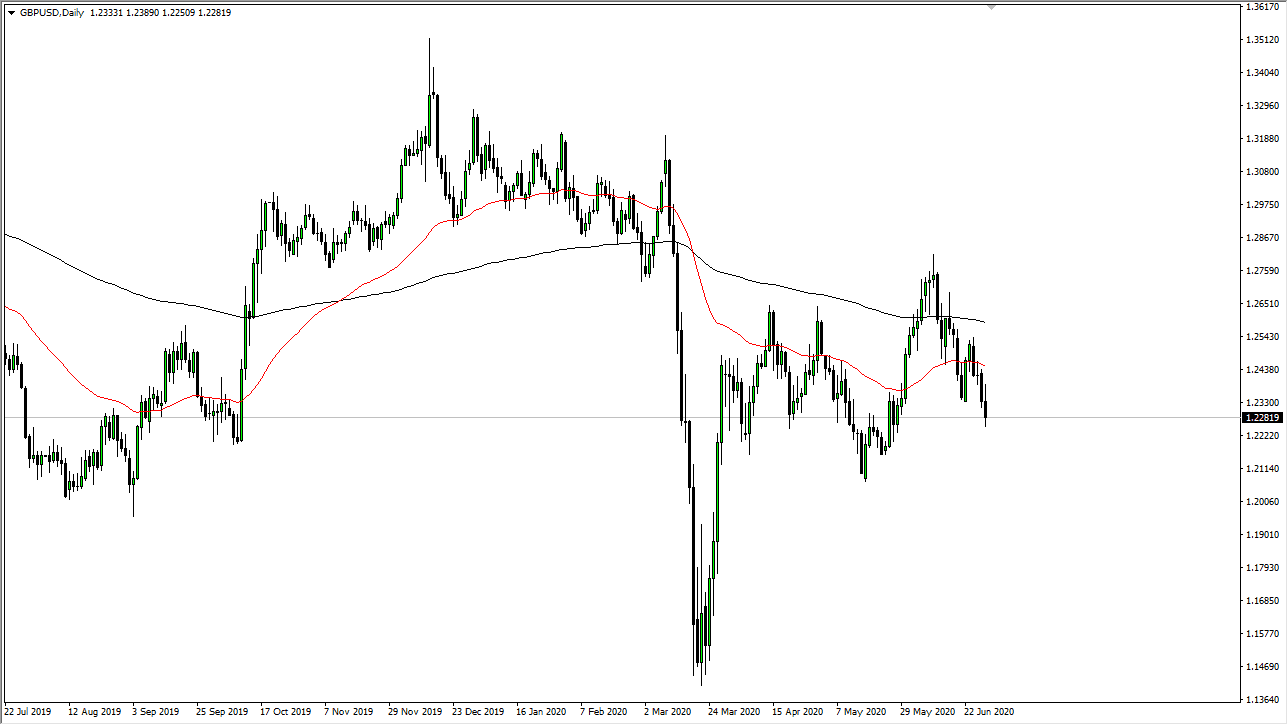

The British pound initially tried to rally during the trading session on Monday, but then rolled over again to break down below the 1.23 level. Ultimately, this is a market that I think will continue to see a lot of bearish pressure in due to the fact that the United Kingdom continues to suffer from higher than usual coronavirus numbers, and even though the economy is starting to open up, albeit slowly, the reality is that there is still a lot of concern there. Furthermore, we also have to worry about the Brexit situation which still looks like it is going to be a “hard Brexit.” This of course is what the market fears the most when it comes to the British pound and all things British related, as it would be a hard shift in the economic situation.

To the downside, if we were to break down below the lows of the trading day, it is likely that we could go down towards the 1.20 level. This is a market that I think will continue to see a lot of volatility and negativity, but if we were to break down below the 1.20 level, then we could see a massive amount of trading down towards the 1.1750 level. Ultimately, this is a market that I think we continue to see sellers in, so therefore I have no interest in buying.

Looking at this chart, I think it is only a matter of time before we can start fading rallies again, as the 50 day EMA will cause quite a bit of resistance. A breakdown from the 50 day EMA then opens up the possibility of a move towards the 1.20 level as well. Even if we break above the 50 day EMA it is highly likely that there will be extreme amounts of resistance all the way up to at least the 200 day EMA. In other words, the more .26 level is going to continue to offer resistance as well. I do not see any opportunity to buy the British pound anytime soon, as there are far too many issues out there and the US dollar will be favored in a world that has a lot of fear as the US Treasury market will be a major destination for currency as well. Expect volatility, but look for signs of exhaust the start shorting again.