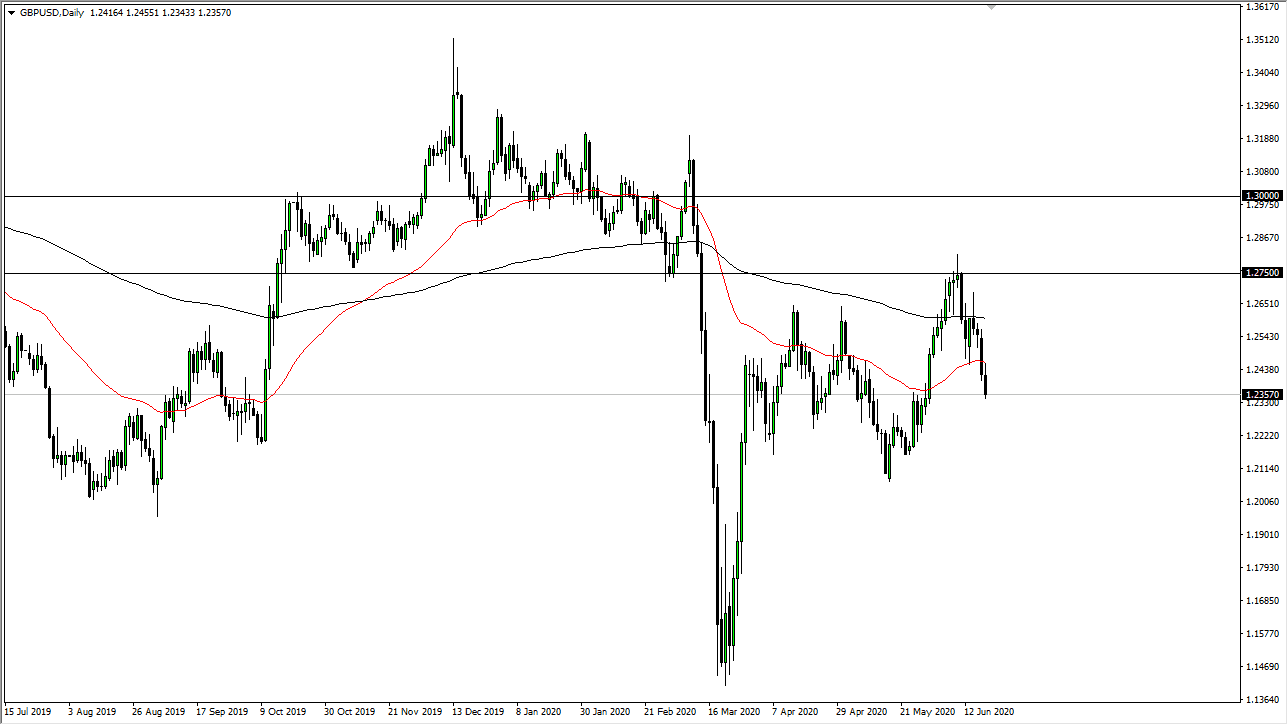

The British pound has fallen down to the 1.2350 level during the trading session on Friday, as the Bank of England has shown itself to be extraordinarily loose with monetary policy and likely to get even worse. Furthermore, the market has broken below the 50 day EMA and even retested it before breaking down. There are plenty of sellers between the 50 day EMA and the 200 day EMA, so it is only a matter of time before sellers jump in. Furthermore, the British pound is likely to be sold off against the US dollar-based upon a “risk-off” type of situation.

Another major factor here is the fact that the United Kingdom is essentially closed, and even though they are trying to open up the economy, they are doing so very slowly. There is still the Brexit to think about, which is a never-ending drama. There are entire trading careers that have only known the Brexit situation to be in the background, as we are heading into four years of stagnation when it comes to this ridiculous behavior by politicians.

The US dollar is considered to be a safety currency, and that makes quite a bit of sense if we continue to look at trouble in the United Kingdom, and of course, the rest of the world. After all, if the coronavirus is going to continue to crush global economic figures, then that will have people looking for treasuries. Treasuries are denominated in US dollars, so we continue to see the greenback being driven out. As long as there are a lot of concerns out there, there is always going to be a bid for the dollar.

On the downside, I think the 1.21 level will offer support and that could be the target after we break through the 1.2250 level which is an area that has been important more than once. Rallies at this point will continue to be sold into and I do not have a scenario in which I am wanting to buy the British pound, at least not in the current backdrop that we have. We have gotten pretty stretched though, so do not be surprised if we start out the week with a short-term bounce that traders will be looking to take advantage of.