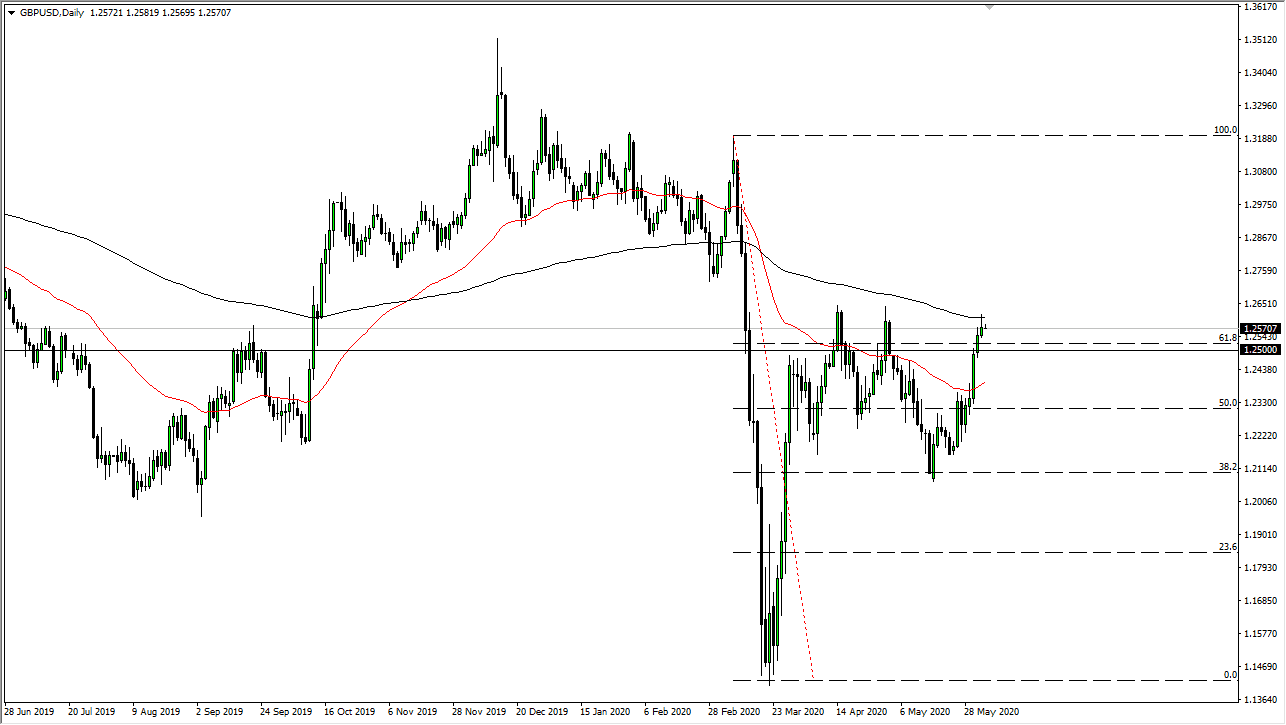

The British pound has rallied rather significantly during the trading session again on Wednesday, piercing the 200 day EMA. However, we have ended up forming a bit of a shooting star and that is a negative sign. Add to the fact that the market has failed at the 200 day EMA, then you have a recipe for negativity. A breakdown below the 1.25 level would confirm that we are more than likely going to continue to go much lower, and if that is going to be the case, I believe we are going to see a significant pullback.

If we break down below the 1.25 level, I think that there will be a lot of “momentum chasers” suddenly caught, and they will be looking to bail out of the market. That will lead to more selling, and therefore we should go looking towards the 50 day EMA. Ultimately this is a market that I think continues to see plenty of volatility, and as the United Kingdom faces a slew of headwinds, it makes quite a bit of sense that we would see a lot of speculation on both sides. Even if you are bullish of this market though, you are probably going to need to find the pullback in order to take advantage of value, so I think everybody will be happy with a little bit of a drop from here.

I do believe that the 200 day EMA will attract a lot of attention, but I am also the first person to admit that it does not always produce a reaction. It simply a lazy way of looking at the trend, but a lot of people use algorithms that pay attention to that figure and of course longer-term trend traders tend to pay quite a bit of attention to it as well. At this point, the market breaks above the 1.2650 level, then it is likely that the British pound will go looking towards 1.30 level. It is a bit difficult to get long now, either you have started buying several candles ago, or you are waiting for the next signal. I believe you will get that signal in the next couple of days but right now you are probably better off waiting for the trade. Trying to get too far ahead of the situation is essentially gambling, which is what a lot of traders have been doing over the last couple of weeks.