Retail traders ignore data suggesting a more lengthy recovery, as evidenced in the acceleration of global risk-on sentiment, based on hopes for a V-shaped economic recovery. Singapore started to reopen its economy yesterday, with phase one resulting in 75% of activities to resume. The initial plan was to assess the situation over the next four weeks. National Development Minister Lawrence Wong did note if the first two weeks will see low and stable infection rates, plans for a full reopening will be expedited. Despite the positive news flow out of Singapore, the GBP/SGD completed a breakout, converting its short-term resistance zone into support.

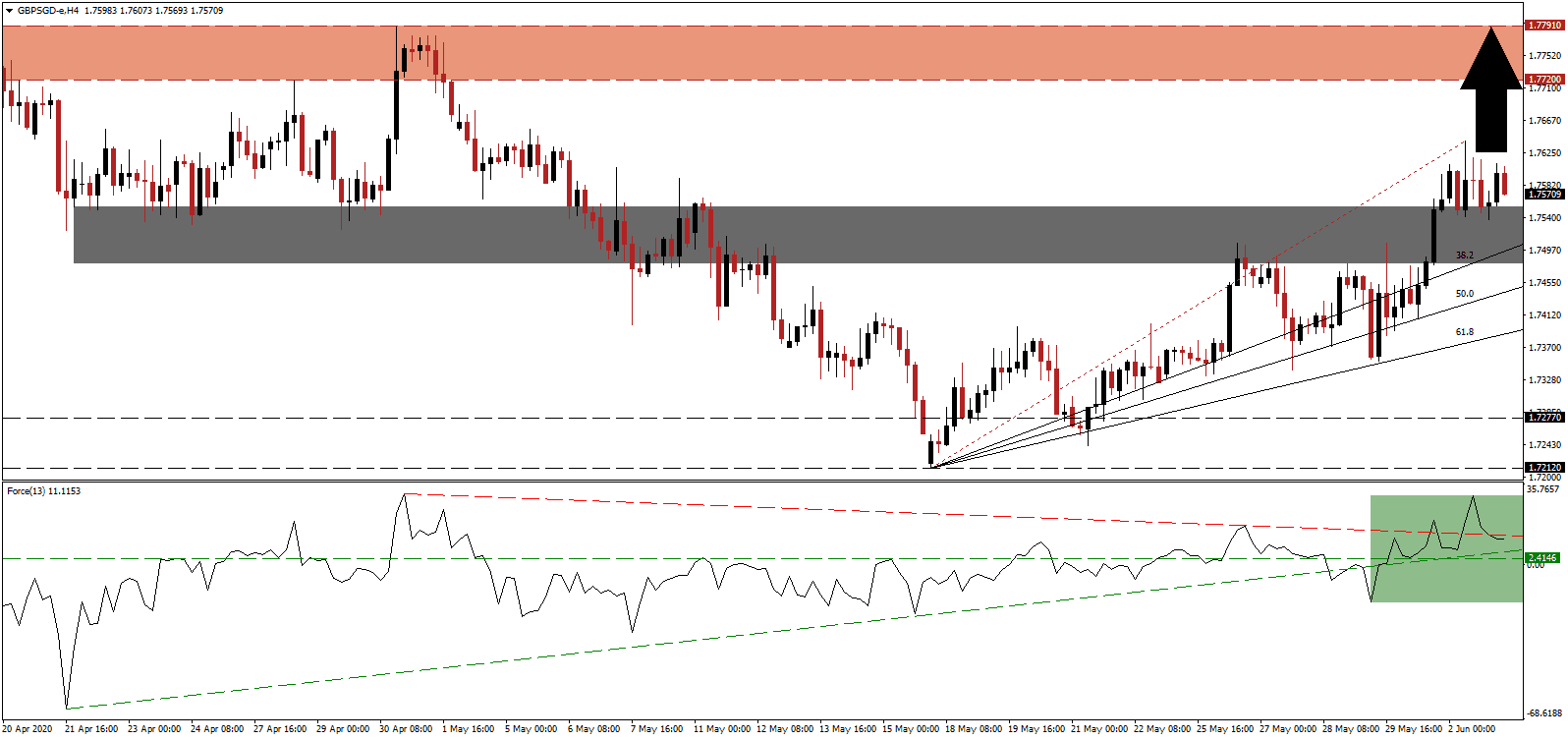

The Force Index, a next-generation technical indicator, pushed to a multi-week peak before retreating below its descending resistance level. A series of three higher highs confirms the presence of bullish momentum, and the Force Index remains above its horizontal support level, as marked by the green rectangle. The ascending support level is adding to upside pressure, with bulls in charge of the GBP/SGD as this technical indicator maintains its position above the 0 center-line.

Throughout the lockdown, due to the Covid-19 pandemic, the pharmaceutical sector provided a bright spot for Singapore. This trend is anticipated to continue moving forward, especially with the surge in global cases of the virus. It comes at a time governments are easing lockdowns, and while the severity has been ignored, for now, risks continue to rise. Dominant bullish momentum is favored to extend the advance in the GBP/SGD following the breakout above its short-term support zone located between 1.7480 and 1.7554, as marked by the grey rectangle.

While a minor pullback in this currency pair into its ascending 38.2 Fibonacci Retracement Fan Support Level is possible, as long as risk-on sentiment expands and fundamental data is ignored, the GBP/SGD is well-positioned to push higher. The next resistance zone awaits price action between 1.7720 and 1.7791, as identified by the red rectangle. UK Prime Minister Boris Johnson is preparing a speech, which is expected to outline the UK in a post-Covid-19 world, and could provide a short-term catalyst to the British Pound.

GBP/SGD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.7570

Take Profit @ 1.7790

Stop Loss @ 1.7500

Upside Potential: 220 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 3.14

In case the descending resistance level collapses the Force Index, the GBP/SGD is likely to enter a corrective phase. A breakdown below the 50.0 Fibonacci Retracement Fan Support Level may provide the downside volume for an extension into its long-term support zone located between 1.7212 and 1.7277. Forex traders should take advantage of any sell-off with new but orders, supported by an increasingly bullish outlook for the UK economy.

GBP/SGD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.7410

Take Profit @ 1.7270

Stop Loss @ 1.7470

Downside Potential: 140 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 2.33