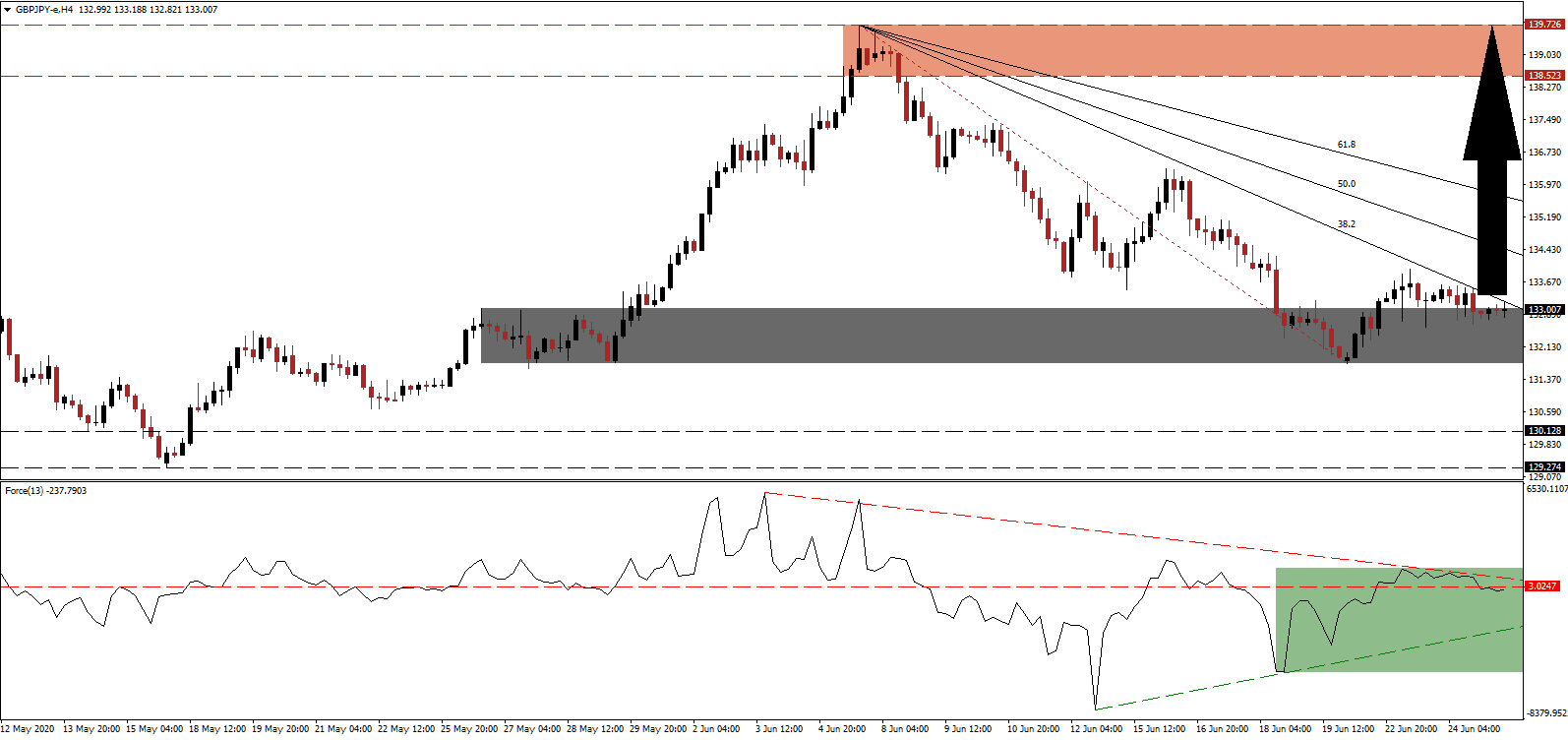

While the UK economy is predicted to contract by 10.2% in 2020, matching the Eurozone, it is above forecasts for France, Italy, and Spain, and expected to drop by 12.5%, 12.8%, and 12.8%, respectively. This assessment is per the latest update to the global economic outlook by the International Monetary Fund. It does trail estimated for Canada, Germany, Japan, and the US. Brexit remains on course, which will deliver an essential boost to the UK. It remains mispriced by markets, and miscalculated by forward-looking GDP forecasts, adding a distinct bullish catalyst to the British Pound. After the GBP/JPY descended into its short-term support zone, bullish pressures started to accumulate.

The Force Index, a next-generation technical indicator, was pressured below its horizontal support level, by its descending resistance level, as marked by the green rectangle, converting it into resistance. A positive divergence preceded the initial breakout in this currency pair, suggesting a potential end to the correction. The ascending support level is favored to push this technical indicator above the 0 center-line, granting bulls complete control of the GBP/JPY.

By the end of 2021, the global economy is on course to lose $12 trillion, a value likely to be revised higher, and debt-to-GDP is set to surge past 100%, while the IMF predicts living standards in 95% of countries to decrease. With a debt crisis imminent, due to the favored Covid-19 response by governments and central banks, international finance will fulfill a more defining role in the post-Covid-19 economy. The UK is perfectly positioned, post-Brexit, to take advantage of emerging opportunities. It adds to breakout pressures in the GBP/JPY, after reaching its short-term support zone located between 131.748 and 133.029, as identified by the grey rectangle.

Japan is faced with a worrying surge in new Covid-19 clusters, with the government noting infections in office buildings as an extreme concern. The 11.9% plunge in global trade, estimated by the IMF, is adding to stress for Japan’s export-reliant economy, and most recent data disappointed. While the Japanese Yen remains supported by safe-haven demand, Forex traders will find an excellent hedging opportunity in the GBP/JPY. A breakout above the descending 38.2 Fibonacci Retracement Fan Resistance Level is set to spark a short-covering rally. It may suffice to pressure price action back into its resistance zone located between 138.523 and 139.726, as marked by the red rectangle.

GBP/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 133.000

Take Profit @ 139.700

Stop Loss @ 131.700

Upside Potential: 670 pips

Downside Risk: 130 pips

Risk/Reward Ratio: 5.15

Should the descending resistance level pressure the Force Index to the downside, the GBP/JPY may follow suit. The downside potential remains limited to its support zone between 129.274 and 130.128, presenting Forex traders with a secondary buying opportunity. Despite the current GDP outlook for the UK calling for a more severe contraction than in Japan, the outlook remains significantly more bullish.

GBP/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 131.000

Take Profit @ 129.300

Stop Loss @ 131.700

Downside Potential: 170 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 2.43