A series of new economic data confirms the UK has most probably embarked on a slow path to recovery from the April lows. Unlike many governments, Prime Minister Boris Johnson has cautioned from the beginning that any recovery will take time but eventually result in a more dominant economy. Brexit, despite popular belief, is set to contribute significantly to exports and boost the service sector. Over 70% of UK companies have no business in the EU and well-positioned to capitalize on market-friendly policies after the transition period ends this year. Volatility is expected to remain elevated, but in the short-term, the double breakout in the GBP/CAD can lead to an extended push higher.

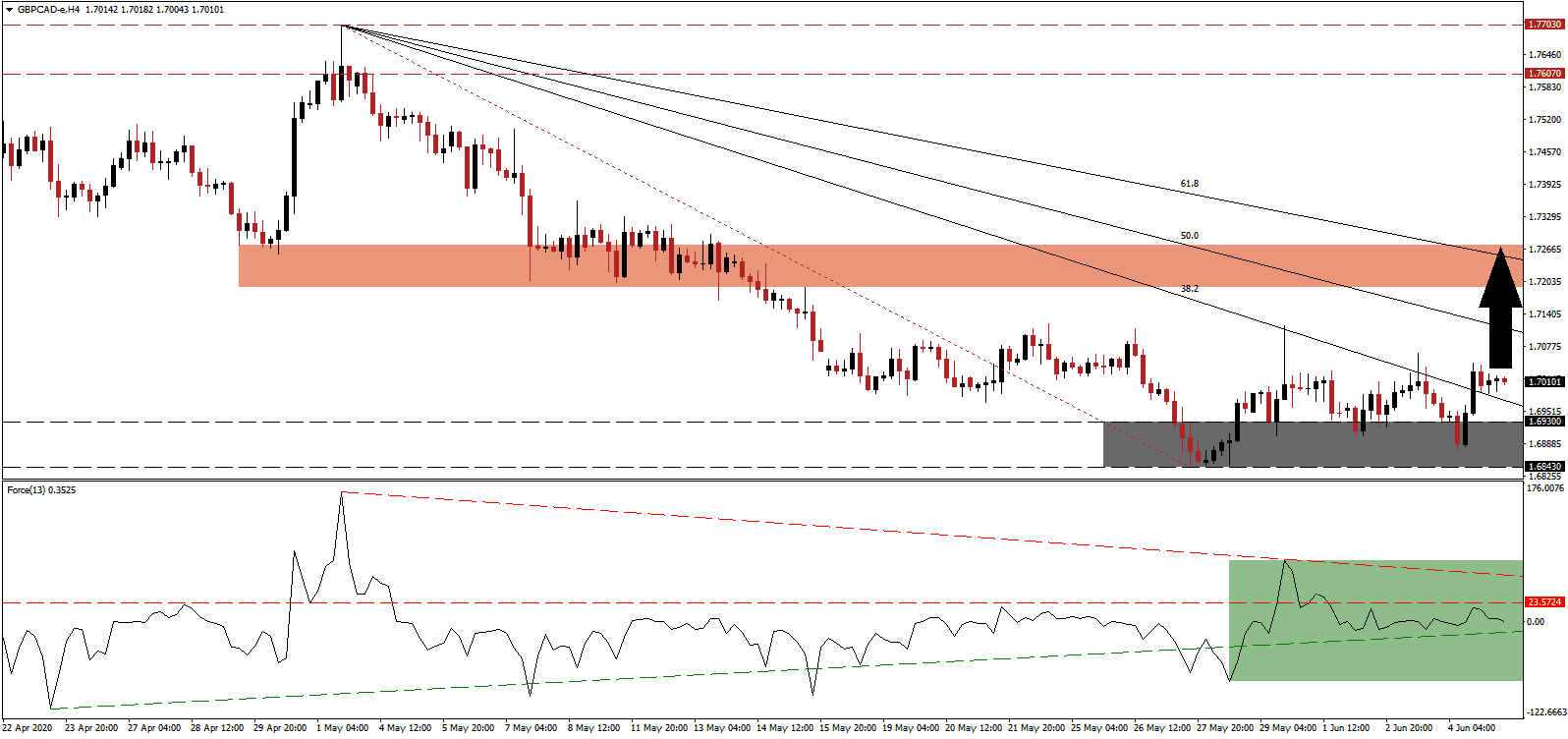

The Force Index, a next-generation technical indicator, points towards a mild uptrend, driven higher by its ascending support level. Bulls have regained control of the GBP/CAD after a move above the 0 center-line. It is expected to lead to a breakout above its horizontal resistance level, converting it into support. Momentum from the conversion could suffice to elevate the Force Index above its descending resistance level, inspiring more gains.

UK consumer spending and job vacancies have improved after lockdown restrictions were eased. One essential driver for consumer confidence is the resilient housing sector, adding a mild bullish bias to this currency pair. PMI data is recovering, but compares against all-time lows and remains deep in recessionary territory. It is mirrored in Canada, also home to a sound housing market with economic data pointing towards the start of a slow recovery. The size and diversity of the UK economy dwarf that of the commodity-dependent Canadian one, adding to the breakout in the GBP/CAD above its support zone located between 1.6843 and 1.6930, as marked by the grey rectangle.

Adding another roadblock to the recovery potential of Canada is the pessimism regarding their finances and the economy. It is ranked last in the G-7 and will harm consumer spending and business investment. Since the 2008 global financial crisis, the average Canadian debt-to-income ratio stood at 176%, with a saving rate of 3.6%. It adds to bullish pressures in the GBP/CAD after the breakout above its descending 38.2 Fibonacci Retracement Fan Resistance Level. Price action is on course to challenge its short-term resistance zone located between 1.7192 and 1.7274, as identified by the red rectangle. More upside is probable, given dominant positive progress out of the UK.

GBP/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.7000

Take Profit @ 1.7275

Stop Loss @ 1.6920

Upside Potential: 275 pips

Downside Risk: 80 pips

Risk/Reward Ratio: 3.44

In case the Force Index collapses below its ascending support level, the GBP/CAD could be pressured into a breakdown. The downside potential remains limited to the next support zone located between 1.6617 and 1.6752. Due to the increasingly bullish long-term outlook for the UK economy, Forex traders are recommended to view any move lower as an excellent buying opportunity.

GBP/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.6820

Take Profit @ 1.6620

Stop Loss @ 1.6920

Downside Potential: 200 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 2.00