The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. The current market environment has changed from one of crisis to rebound, despite the growth in the global coronavirus pandemic which continues.

Big Picture 7th June 2020

In my previous piece last week, I suggested two trades for this week: long of Silver in USD terms, and long EUR/USD after a daily close above 1.1142. Silver fell by 2.44% last week, but after closing at 1.1169 on Tuesday, the EUR/USD currency pair ended the week up by 1.08%.

Last week’s Forex market saw the strongest rise in the relative value of the Australian Dollar and the strongest fall in the relative value of the Japanese Yen.

Fundamental Analysis & Market Sentiment

The world is not coming to an end, but we are living in an extraordinary time of global health crisis, the type of which has not been seen in one hundred years. There is both fear and optimism, but it is important to remember that the evidence shows that the vast majority of people are going to survive and be healthy.

Recent days have seen daily new confirmed coronavirus cases hit new all-time highs. This is a sign that globally, the wave of disease is not dying down yet.

We see the epicenter of the global coronavirus pandemic move into Latin America, with Brazil now seeing more new deaths from the virus than any other country in the world. The rolling averages of deaths and new cases has finally begun to decrease significantly in the U.S.A. as a whole and in the U.K., which has recorded more deaths than any other country in Europe. European nations are beginning to relax restrictions, as is the U.S.A. in a patchy way.

Most OECD nations are now seemingly past the peak the of their first waves of coronavirus and have either begun to relax restrictions or are close to doing so. However, there is no guarantee that these relaxations will not quickly lead to second waves.

Latin America and the Caribbean are now responsible for approximately 44% of confirmed new daily deaths, with the U.S.A. at about 21% and Europe a little less than 20%. Brazil has the highest daily death toll of any country in the world. The strongest exponential growth in new confirmed cases is happening in Brazil, India, Russia, Mexico, Peru, Pakistan, Chile, Qatar, and Egypt.

The U.S. stock market rose again last week, closing at a new 3-month high and regaining more than 80% of the decline seen in February and March. These are bullish signs for stock markets, suggesting that markets are somehow either setting aside the impact of the virus or believe the ultimate economic damage will be considerably less than has been supposed.

Last week produced surprisingly positive U.S. economic data, with the latest non-farm payrolls number showing that more than 2.5 million new jobs were created, while the consensus forecast expected a net loss of approximately 7 million jobs.

It has become clear that those countries which have fared best with their first waves of coronavirus are smaller nations such as Denmark, Norway, Greece, Austria, Denmark, Israel, and the Czech Republic.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows last week printed a bearish candlestick which again closed below the former support level at 12470 shown in the price chart below. There is still a long-term bullish trend reflected in the fact that the price is higher over both 3 and 6 months, but the breaching of support and the fact this trend barely exists anymore are significantly bearish factors. Overall, next week’s price movement in the U.S. Dollar looks marginally likely to be downwards, but there is some evidence we may well start to see support as the price gets to about 12200.

S&P 500 Index

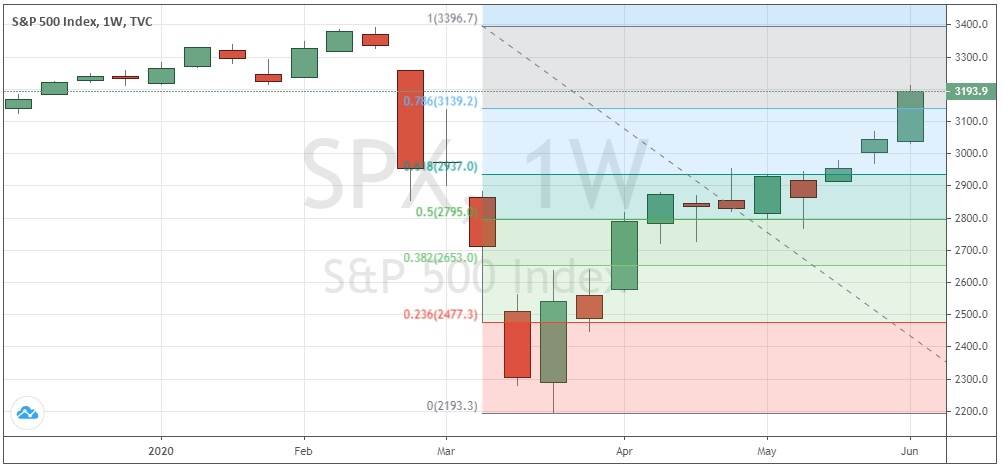

The major U.S. stock market index the S&P 500 Index – the biggest market index in the world – rose strongly last week and again closed well above its 200-day moving average and above the psychologically important round number at 3000. It has now recovered more than 80% of its sharp loss incurred during February and March.

The Index is somewhat likely to rise further over the coming week.

AUD/USD

We saw a strong rise last week in this currency pair to close at a new 5-month high. The weekly candlestick closed near the top of its range and was of above-average volatility, suggesting a further rise over the coming week is more likely than not. However, it is worth noting that the key round number of 0.7000 is close to the current price and this area may act as strong resistance.

Bottom Line

This week I forecast the best trades are likely to be:

- Long of the S&P 500 Index following a bearish pullback on the daily chart which then reverses with a bullish day.

- Long of AUD/USD following a daily (New York) close above 0.7000.