After the recent EUR/USD selling, which pushed it towards the 1.1168 support for two trading sessions, the pair could not go below that. With the dollar's decline, the pair returned at the beginning of this week’s trading to rebound to the 1.1270 level before settling around the 1.1255 level this morning, and ahead of the announcement of Eurozone PMI readings. The pair managed to rebound despite the bleak expectations of the German Central Bank.

In his monthly report, Bundesbank said that the German economy will shrink significantly in the current quarter and much more than the rate recorded in the first quarter. According to the German Central Bank, GDP will decrease by about - 10 percent in the second quarter. The Eurozone's largest economy contracted - 2.2 percent in the first quarter, the biggest slowdown since the first quarter of 2009, and the second largest drop since German unification.

The bank also said that the government's economic stimulus package should boost the recovery, but it will have no impact in the second quarter. The bank indicated that the package helped raise morale between companies and consumers.

The demand for the US dollar has increased recently as a safe haven, amid reports showing noticeable increases in the new cases of the deadly Coronavirus, the most prominent of which was in both the US states and China, and remained in a profitable position. Although reports indicated that infection cases in China were under control, the WHO warned that the epidemic was "accelerating and the world is in a new and dangerous stage" that led to the instability of global financial markets recently.

In the US, existing home sales fell more than expected in May, according to a report released by the National Association of Realtors yesterday. NAR said existing US home sales fell 9.7 percent to an annual rate of 3.91 million in May, after falling 17.8 percent to 4.33 million in April. Economists expected existing home sales to drop 4.8 percent to 4.12 million.

Existing home sales fell for the third month in a row and decreased 26.6 percent compared to the same month last year.

Commenting on the results, Lawrence Yoon, chief economist at NAR, said: “The sales completed in May reflect the signing of contracts in March and April - during the most stringent times of pandemic closings, and thus the lowest cyclical level.” He added that "home sales will definitely increase in the coming months as the economy reopens, and may even exceed last year's figures in the second half of the year."

The report stated that the average price of a US home currently in May was $ 284,600, down 0.7 percent from $ 286,700 in April, but rose 2.3 percent from $ 278,200 in May of 2019.

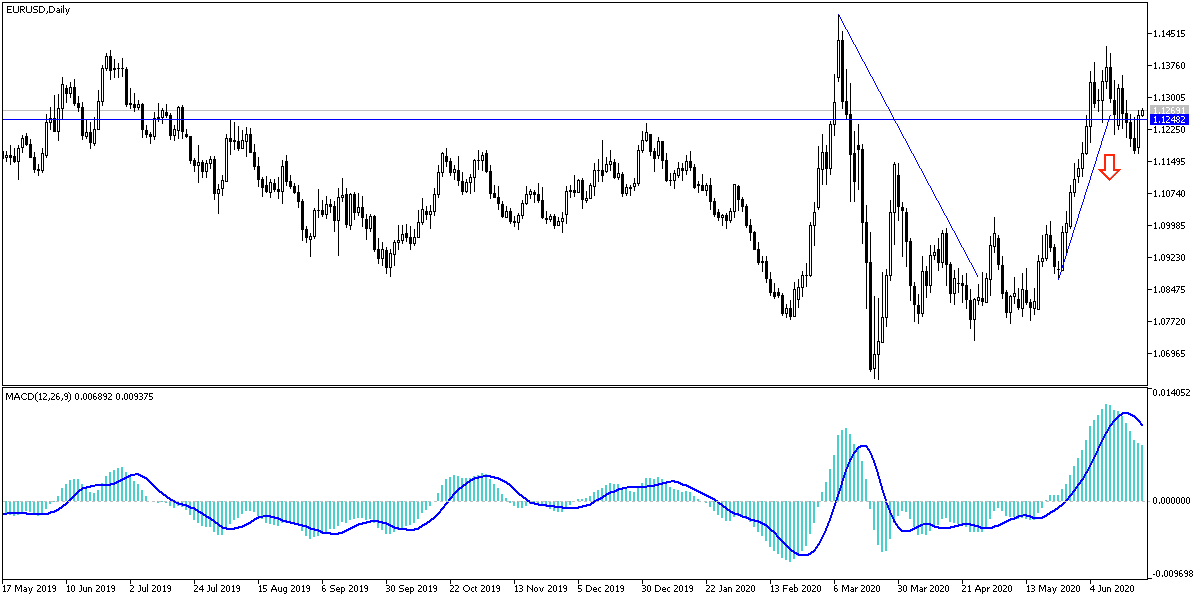

According to the technical analysis of the pair: Despite the recent EUR/USD bounce attempt, the downward pressure remains. A return to stability below the 1.1200 support will continue to support the bears controlling performance for a longer period. There will be no real chance for the bulls to regain their performance control without returning to around and above the 1.1400 resistance, and I still prefer to sell the pair from every higher level.

As for the economic calendar data today: First, the announcement of the PMI reading for the industrial and services sectors for the Eurozone economies. From the United States of America, we will have the release of new homes sales and the reading of the Richmond Industrial Index.