The pressure on the single European currency increased with the failure of European leaders to reach a deal to revive the European economy along with the increasing numbers of deadly coronavirus infection with the reopening of the global economy, which brought the US currency momentum to move the EUR/USD to the 1.1168 support. This is the lowest level in two weeks, before closing the week's trading around 1.1177. European Union leaders have found that a quick deal on the future long-term budget for the block and a billion-euro recovery plan after the pandemic, is still far from being agreed upon, as Covid-19 virus destroys their economies.

After a four-hour video summit aimed at paving the way for a compromise this summer, there was common ground on the need for a swift response, but differences continued between leaders of European Union member states. Therefore, the President of the European Union, Charles Michel, said, "It is necessary to take a decision as soon as possible," announcing that he plans to hold a personal summit of the leaders of the bloc’s 27 countries in mid-July.

For her part, European Commission President Ursula von der Lin, head of the executive arm of the European Union, said she hoped to reach an agreement before the European Union closes for summer vacation in August. Accordingly, Von der Lin said, "The leaders unanimously agreed that the severity of this crisis justifies an ambitious joint response, combining solidarity, investment and reforms". Several leaders stressed the need to do everything in their power to reach an agreement soon in the European Council before the summer holidays.

The package was designed to help member countries’ economies mitigate the effect of the coronavirus, and it was not welcomed unanimously. Von der Lin said that disagreements still remain on topics such as package size, how to send money and the balance between grants and loans in the redemption fund.

To tackle the economic crisis, von der Lin suggested a revised long-term budget for the period 2021-2027 that represented about 1.1% of European GDP after leaving the UK, along with the temporary boost to the € 750bn group. This was set aside to fight the virus. The entire package is a massive stimulus of 1.85 trillion Euros for the struggling bloc economies.

On the economic level. The cost of employment in the European Union for the first quarter exceeded expectations at 2.3% with a reading of 3.4%. The general index of consumer prices in the Eurozone for the month of May matched the forecasts (monthly) and (annually) at -0.1% and 0.1%, respectively. The core CPI came in line with expectations, while construction production fell by -28.4% from -17.5%. Seasonally adjusted building production for April improved by -14.6% compared to -15.7% in the previous month.

In the United States, retail sales for the month of May exceeded expectations on a monthly basis by 5.5%, with a 12.4% rate. On the other hand, industrial production fell to a reading of -1.4% on a monthly basis. The results of building permits and housing starts were disappointing, and initial and ongoing jobless claims came higher than expected.

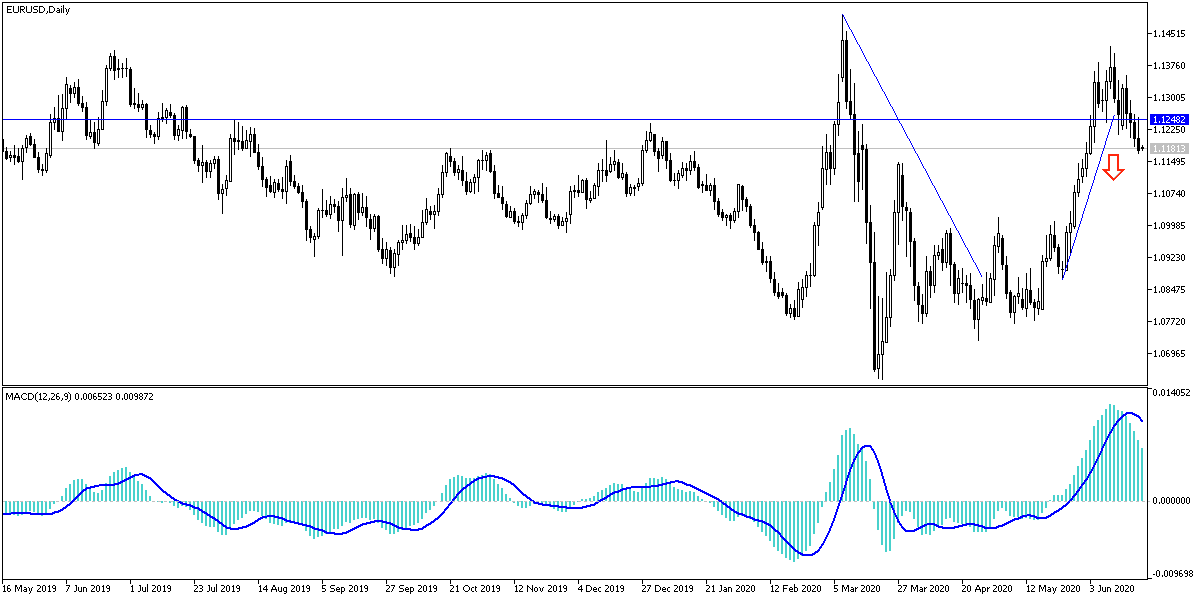

According to the technical analysis of the pair: In the short term, the EUR/USD appears to be trading inside a bearish channel on the 60-minute chart. This indicates a short-term bearish bias in market sentiment. Therefore, the pair is also declining towards oversold levels for the RSI, and bulls will target short-term retracements at around 1.1263 or higher at 1.1322. On the other hand, the bears will look to for short term profits by extending the drop towards 1.1162 or less at 1.1097.

In the long run, and according to the performance on the daily timeframe, it appears that the EUR/USD has recently retreated after the sudden rise. Where the pair rose to the 1.1383 top before retreating to stabilize at 1.1215. This drove the pair to the RSI normal trading area for 14 days. Several levels remain above 100 days and 200 days SMA lines. Thus, bears will look to extend the current decline towards 1.1048 or less at 1.0863. On the other hand, bulls will look for profits from the bounce at around 1.1383 or higher at 1.1562.

As for the economic calendar data today: From the Eurozone, the consumer confidence index and the monthly report from the German Central will be announced. Then existing US home sales will be released.