After the recent EUR/USD sell-off and in light of the US dollar strength as a safe-haven currency with the beginning of a coronavirus second wave, this pair has moved below the 1.1200 support level. The pair tried to bounce back at the end of last week's trading by moving towards 1.1240 and closed the trading around 1.1217. Currency traders are waiting for the opportunity to have an upward correction, which will depend on the markets neglecting new Covid-19 cases and taking more risk.

The spread of the epidemic globally amid remarkable containment success in Europe, was not translated into severe losses for the European single currency. This places a question mark on the global recovery that could keep stock markets and the currencies attached to them all low, which the Euro later followed. Some analysts warn of further depreciation of the Euro in the coming days, although others are looking for an upward trend.

Chris Turner, head of regional research at ING, believes that the EUR/USD pair may briefly drop to the 1.1100 region, before it bounces back up, and expects the pair to perform well for the remainder of 2020. The real threat to these expectations is the increase in new Covid-19 cases in the United States, stock profit-taking, and the start of a trade war between the United States and China.

On the other hand, many analysts believe that a strong second wave of the pandemic in the United States will be sufficient to maintain more demand for the dollar and a further decline in global stock markets, which may be bad news for the Euro due to the positive relationship it has with stocks, in addition to the negative relationship between the euro and the dollar index.

The United States was among the last large and developed country to be infected with the virus and was also among the first to come out of its "closure" policy, announcing guidelines on April 16 to reopen the economy in May after Germany did the same. Germany, however, spent more time dealing with the virus under the "closure" terms and had a comprehensive testing system, which may have played an important role in the European situation with the disease doing much better than in the United States.

The single European currency will be negatively affected by the risk of imposing new US tariffs on European products, besides the main driver of the exchange rate. This is the risk avoidance dynamics in relation to the epidemic developments, and therefore, the potential deterioration in market sentiment will be in favor of the US dollar. In July, negotiations are expected to increase over the European Economic Recovery Fund.

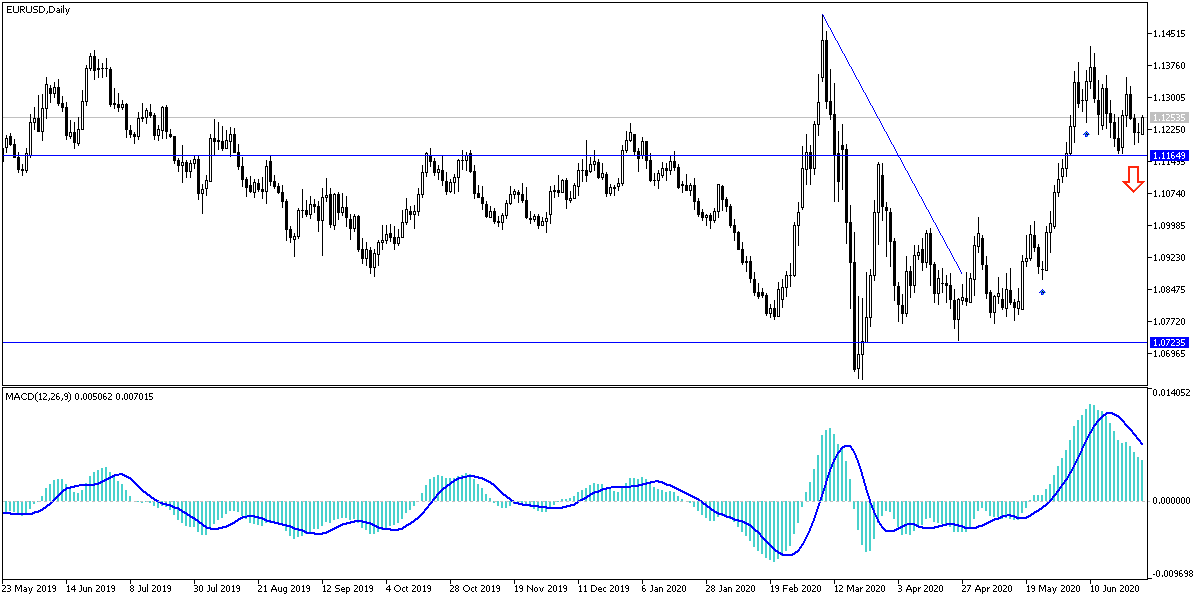

According to the technical analysis of the pair: As I mentioned before, EUR/USD stability below the 1.1200 support will increase the bear’s control pushing the pair towards stronger support levels, and the closest ones are 1.1155 and 1.1080. There will be no chance of the bulls control without breaking above the 1.1460 resistance. The downside opportunity will remain the strongest as long as the market fears of a second wave of Covid-19 outbreak exist. Opening a front for the US trade war against Europe will not be in favor of a stronger Euro.

As for the economic calendar data: the German consumer price index will be announced, then the pending US home sales data.