The eyes of currency traders today are heading towards the European Central Bank and its monetary policy decisions under the leadership of Lagarde. The EUR/USD price is receiving the event in light of strong bullish momentum that pushed it towards the 1.1257 resistance, the highest level for two and a half months, before stabilizing around the 1.1230 level of in the beginning of Thursday’s trading. Euro gains increased against the other major currencies as investors await further stimulus from the ECB, and the results of the services sector data from China and Europe boosted risk sentiment.

The data results showed that the services PMI reading in China rose to 55.0 in May from 44.4 in April, indicating a recovery in the sector. The pace of growth was the steepest since October 2010. The Eurozone PMI for services rose to a reading of 30.5 in May from a reading of 12 in April, above an expected reading of 28.7 and the highest reading in three months.

On the other hand, data from the European Statistics Office showed that the unemployment rate in the Eurozone increased in April, with member states implementing a policy of closure to contain the Covid-19 epidemic. The unemployment rate rose to 7.3 percent in April from 7.1 percent in March. But this was below economists' expectations of 8.2 percent. Data from the Federal Labor Agency showed that German unemployment increased more than expected in May amid the Corona virus pandemic. The number of unemployed people rose by 238,000 from the previous month to 2.875 million in May. Economists expected an increase of 200 thousand.

Regarding the ECB’s decision on monetary policy, economists expect the bank to maintain the interest rate as is and boost the emergency pandemic purchase program by 500 billion Euros, to reach 1.25 trillion euros.

In a new development of the series of tensions between the United States of America and China. The Trump administration has moved to prevent Chinese airlines from traveling to the United States in a new escalation of trade and diplomatic tensions between the two countries. The US Department of Transportation said it will suspend passenger flights for four Chinese airlines to and from the United States from June 16. The decision came in response to China's failure to allow United Airlines and Delta Airlines to resume flights to China this month. The airlines suspended those flights earlier this year in response to the coronavirus pandemic that started in China's Wuhan province.

The Ministry of Transport said that China violates an agreement in 1980 between the two countries, which covers each other's airlines. The ministry said it will continue talks with Chinese officials to settle the dispute. The ministry added that President Donald Trump could implement the order before June 16. The administration hinted to a move last Wednesday, when it protested to the Chinese authorities that Beijing was preventing US airlines from competing fairly against Chinese airlines.

The four airlines affected by the order are: China Airlines, China Eastern Airlines, China Southern Airlines, and Xiamen Airlines. Prior to the epidemic, there were about 325 passenger flights per week between the United States and China, including flights operated by United, Delta and American Airlines. While American airlines have suspended flights, China Airlines has continued scheduled flights between the two countries - 20 flights per week in mid-February and 34 flights per week by mid-March.

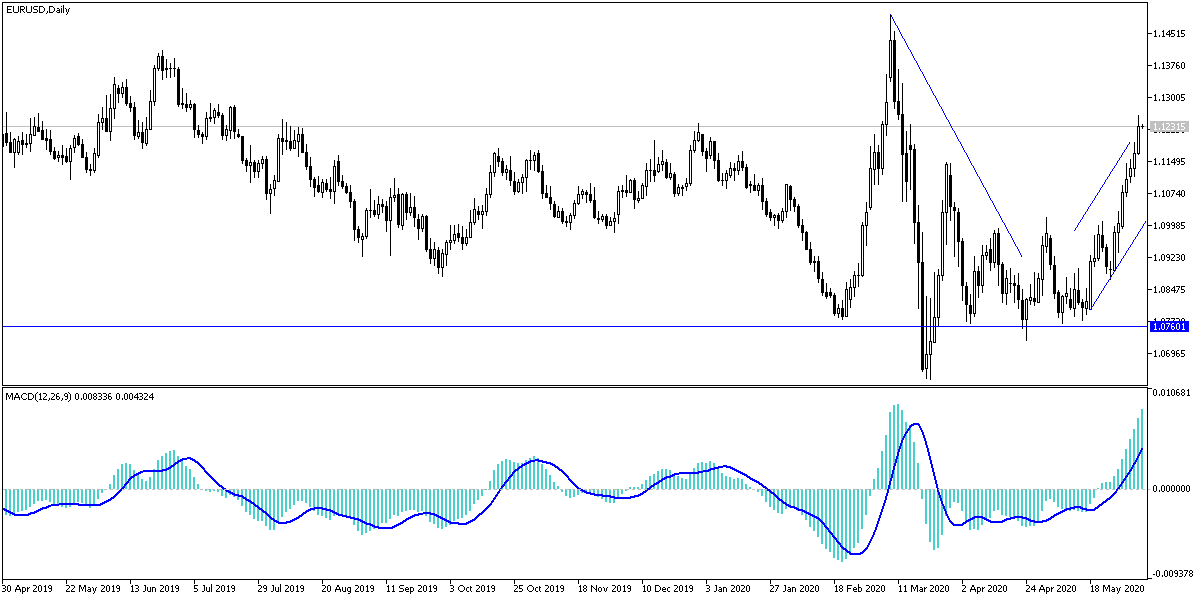

According to the technical analysis: The EUR/USD price reached all the resistance levels that we identified in the recent technical analyses as targets of the bulls to cause a shift in the direction of the pair. Stability above the 1.1200 resistance supports the technical indicators move towards strong overbought areas and may start selling to take profits if the ECB decisions come without the aspiration of the markets. The nearest resistance levels are now at 1.1255 and 1.1330, respectively. The trend may remain bullish for a while until returning to the 1.1000 support boundary.

As for the economic calendar data today: From the Eurozone, attention will be paid to the monetary policy decisions of the ECB and the statements of its governor, Lagarde. From the United States, jobless claims, trade balance, non-farm productivity and work unit costs will be announced.