With the beginning of this week’s trading, the EUR/USD pair succeeded in rebounding higher, reaching the 1.1332 resistance, after the recent downward corrections that pushed the pair towards the 1.1212 support. It settled around the 1.1345 level in the beginning of Tuesday’s trading and ahead of the German ZEW reading as well as a bunch of important US economic releases. The single European currency continues to receive more optimism among investors, highlighting more stimulus plans by the European Union and the European Central Bank, despite some objections from some countries to the wording of some of these plans. Investors returned to risk as borders reopened across Europe after three months of closures that began chaotically in March, as Spain prioritized entry to the first batch of thousands of Germans who were allowed to travel to the Balearic Islands. The country waived 14 days of quarantine to test best practices with them in the era of the Covid-19 virus.

It is not expected that the 27 European Union countries, as well as those in the Schengen passport-free travel zone, which also includes a small number of countries outside the European Union, such as Switzerland, will open up to Americans, Asians and other visitors from outside the continent until at least the beginning of next month, and possibly later.

In this context, French President Emmanuel Macron announced the reopening of the borders on Monday as well as restaurants in Paris, and said it was time "to turn the page on the first chapter of the crisis" and "rediscover our taste for freedom." But at the same time, he warned, "This does not mean that the virus has disappeared, and we can completely put our guards down... the summer of 2020 will be an unparalleled summer”.

This caution is widespread after more than 182,000 coronavirus related deaths in Europe. According to the Johns Hopkins University tally, the region has more than two million infection cases out of 7.9 million confirmed cases worldwide.

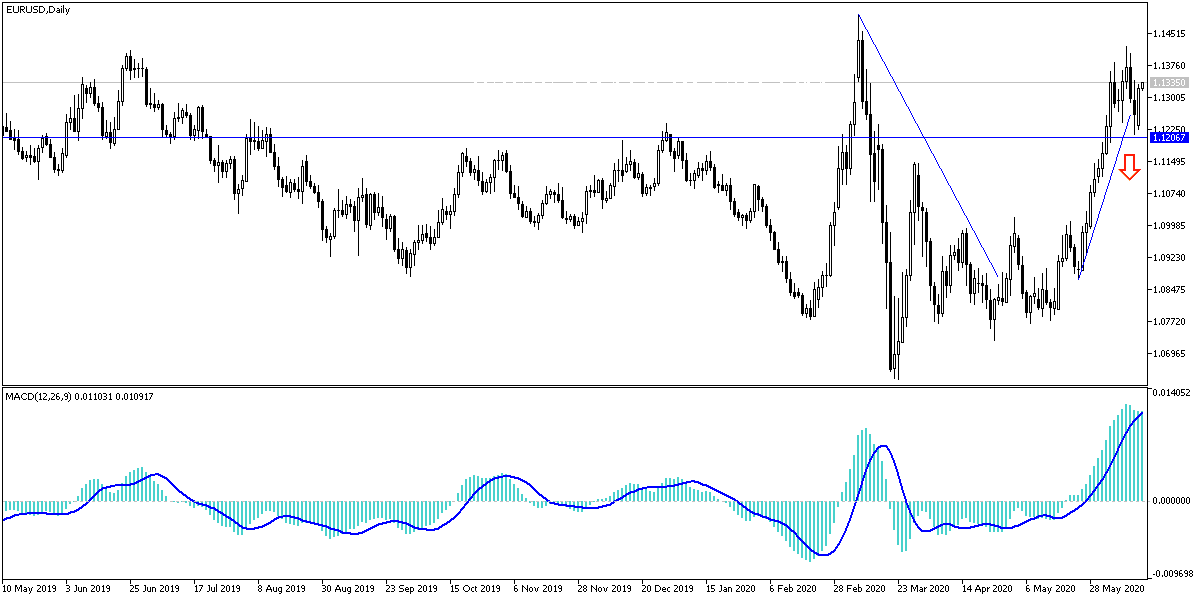

According to the technical analysis of the pair: On the EUR/USD daily chart, the bulls still have the opportunity to push the pair higher, especially if the investor optimism increases from the reopening of the global economy, and positive results were announced from both the Eurozone and the United States. A return to breach of the 1.1400 resistance will increase the strength of this expected reversal. There will be no threat to the bullish momentum without the pair breaking below the 1.1200 support. Bearing in mind that the European Council will meet this week to provide more detail to the European Economic Recovery Fund and how it will work. The meeting of European Union leaders is scheduled to end on Friday, and any apparent disagreement between members may spoil the current optimism wave, and thus, Euro’s gains will quickly collapse.

As for the economic calendar data today: From the Eurozone, the German ZEW index reading will be announced. During the American session, the US retail sales numbers and industrial production rate will be announced, and then statements of the Federal Reserve Governor Jerome Powell.