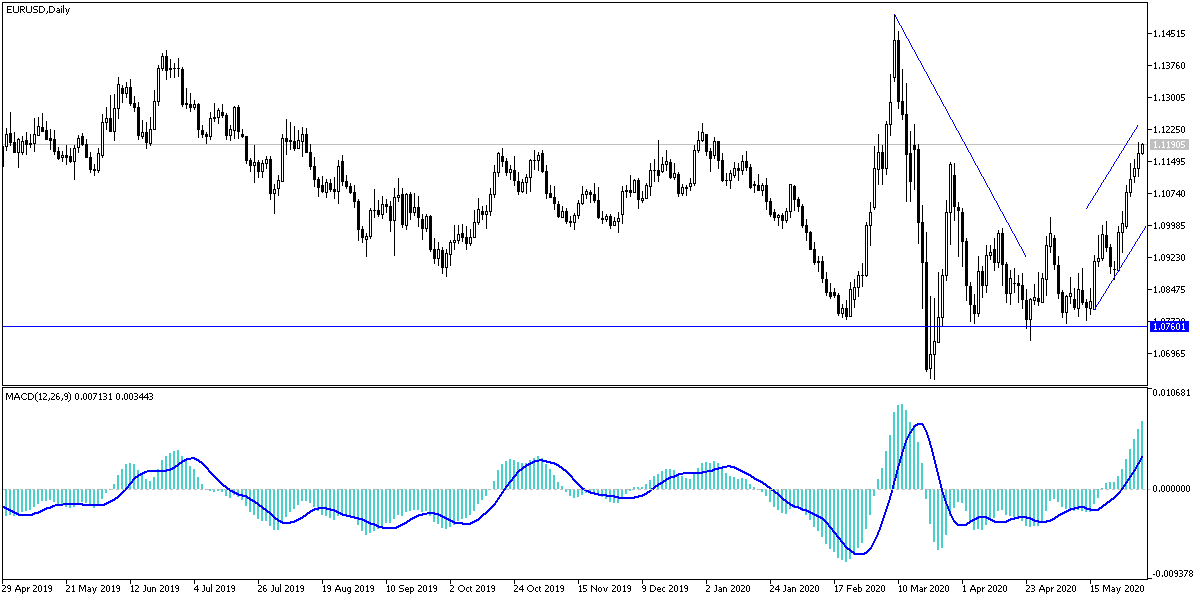

The EUR/USD pair continued its bullish correction, with gains reaching the 1.1195 resistance level, the highest in two and a half months, before settling around the 1.1167 level in the beginning of today’s trading, and before the announcement of the first important US labor market data for this week. The Euro is still reaping optimism gains from the reopening of global economies and the rising, albeit gradually, of the closure policy adopted for months to contain the rapid spread of the Coronavirus. As is normal, there will be no permanent ascending path or vice versa. Currency investors are now wondering about the most appropriate time to sell the pair.

The return of global geopolitical tensions will favor the return of USD gains as a safe haven. The dispute between the two largest economies in the world is not over. The USD reached its peak in March amid an increase in demand for the US currency as a safe haven with the collapse of markets due to the rapid spread of the coronavirus, but the currency quickly stabilized and began to decline after major market interventions by the US Federal Reserve and other global central banks.

The DXY Dollar Index - a broad measure of the dollar’s value against a basket of six major currencies - fell from a slightly higher peak from the 102 peak to subsequently trading in a neutral range around 100. The continued recovery in stock markets during May saw a decline in demand for the US dollar, and the DXY entered a more specific trend towards 97 as a result, a move that coincides with the EUR/USD break of the 1.1000 resistance and the move towards its recent gains.

With continued efforts to contain the spread of the epidemic, especially with the resumption of the global economy, France is launching an official app to track contact with people infected with the virus, and aims to contain new outbreaks while gradually reducing the restrictions on closures, becoming the first European country to deploy smart phone technology amid escalating discussions about data privacy. The StopCovid app was launched on Tuesday when the French government began allowing people to go again to restaurants, cafes, gardens, beaches, museums and monuments. It is available on Apple App Store and Google Play Store.

Neighboring countries including the United Kingdom, Germany, Italy and Switzerland are developing their own applications, although they use different technical protocols, which raises questions about compatibility across European borders.

Authorities hope that the application can help manage the virus outbreak while reopening the economy in France, which has been living under some tight restrictions in Europe since it became one of the countries worst hit by the epidemic, with nearly 29,000 deaths. Some Parisians were eager to adopt technology to help bring life back to normal.

According to the technical analysis of the pair: We are waiting for profit-taking sell-offs at any time, as with its recent gains, the point of technical indicators has reached strong overbought, and accordingly, we expect sales from the resistance levels of 1.11950, 1.1235 and 1.1300, respectively. Without the pair moving towards the 1.1000 support level – previous psychological resistance - there will not be a break of the last upward channel.

As for the economic calendar data today: From the Eurozone, the German rate of change in unemployment will be announced, then the producer price index and the unemployment rate for the region as a whole. As for the US economic data, the ADP survey will be announced to measure the change in the number of US non-agricultural jobs, then the ISM PMI for services, US factory orders and crude oil inventories.