For the sixth consecutive day, the EUR/USD pair has moved in the range of its channel to correct upwards, with gains reaching the 1.1153 resistance, the highest level in two and a half months, before settling around the 1.1135 level at the time of writing. As optimism about the global economy continues to diminish the safe havens appeal such as the US dollar, the US dollar index DXY is trading in a downward direction, dropping 0.6 percent to its lowest level in more than two months. The continued weakening of the dollar came after a report from the Institute of Supply Management showing manufacturing activity in the United States contracted at a slower rate in May.

ISM said its PMI rose to a reading of 43.1 in May from 41.5 in April, and the result is slightly lower than the economic estimates for a reading of 43.6. While the index rebounded from its lowest level since April 2009, reading below 50 still indicates a contraction in industrial activity.

However, Timothy R. Fury, chair of the ISM Manufacturing Survey Committee, said the latest figure indicates growth in the overall economy after the April contraction. The ISM report came on the heels of a special survey that showed Chinese manufacturing growth in May. China's Caixin Manufacturing PMI came in at 50.7 in May, beating forecasts of 49.6 and above 49.4 in April. A reading above the 50 level indicates growth in manufacturing activity.

A separate report from the US Commerce Department showed a sharp drop in construction spending in the United States in April, although the drop was much lower than economists had expected. Construction spending in the United States of America fell by -2.9% in April, the largest drop in 18 months, with wide declines in all construction activities as project closures hindered projects amid orders for workers to stay in their homes. The April drop was the biggest monthly drop since a -3% drop in October 2018. This came after a flat reading in March. Expenditure on residential construction decreased by 4.5% in April, with construction for one family houses reduced by 6.6%, and the smaller apartment sector decreased by 9.1%. Construction of non-residential projects decreased by 1.3%, as office buildings, hotels and the sector that includes shopping centers, decreased.

There is hope that construction activity will increase as government orders to stay at home are raised. However, many economists worry that recovery from the severe recession that has seen millions of workers lose their jobs may take a lot of time.

Overall, investors remain generally optimistic about reopening economies despite political turmoil across the country after the death of George Floyd, forcing a number of large retailers to temporarily close their stores in areas hard hit by the protests.

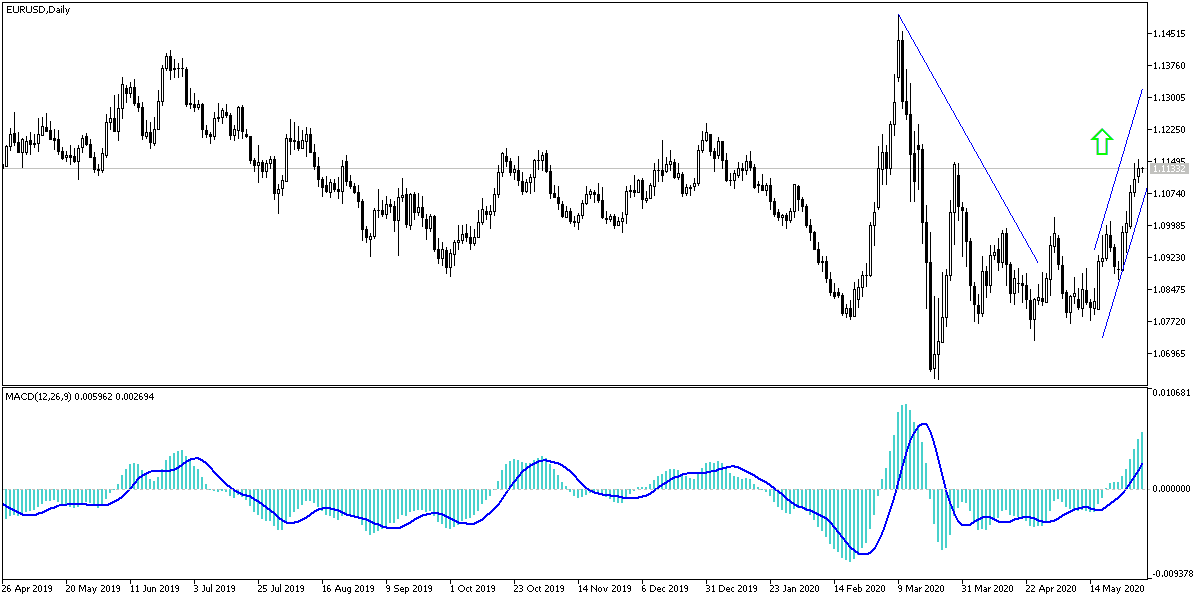

According to the technical analysis of the pair: On the daily chart, the formation of the EUR/USD bullish channel is getting stronger, and the bulls are sticking to their recent gains while awaiting stronger developments on the markets that are affecting investor sentiment the most. The conflict between the United States of America and China will be the most influencing on the performance in the coming period. So far, the technical indicators have reached overbought areas and the absence of incentives will support profit-taking selling. This can be considered if the pair moves towards the resistance levels at 1.1165 and 1.1230, respectively. And there will be no return to bear control without the pair moving towards the 1.1000 support – previous psychological resistance -.

As for the economic calendar data today: From the Eurozone, the rate of change in the Spanish unemployment and the budget numbers for the French government will be announced. There are no significant US data releases today.