During yesterday's trading session, we noticed a strong activity of the EUR/USD price, and the bulls control of performance was stronger, as the pair first rose to the 1.1390 resistance and the largest activity for the pair as was after the announcement of the monetary policy of the US Federal Reserve Bank, as it moved aggressively to the 1.1422 resistance, its highest level in three months, and with the markets absorbing what was announced, the pair settled around 1.1375 at the beginning of Thursday's trading. Before the US Fed announcement, the single European currency was gaining momentum amid speculation that the European Central Bank (ECB) cleaning of the Eurozone banking sector may be in the pipeline, while the dollar continued to collapse for several weeks.

Reuters has reported that the European Central Bank is considering a new strategy whereby it will exempt commercial banks from bad loans related to the Corunavirus that could restrict lending to companies and families at a time when it is more necessary than ever for economies in which credit continues to flow. Some southern European countries have already faced bad loan problems in their banking sectors that were preventing lending even before the coronavirus appeared.

European regulators have worked for years to reduce the mountain of bad loans that have accumulated in some countries after the debt crisis, which saw the rate of bad loans in Italy decrease by half in the three years to 2020, but the virus and the damage caused by the measures used to contain it, led to reversing this progress. The proposals, reported by Reuters, are the latest to suggest a strong response from European policy, although they will be controversial in some parts of the European Union.

From the United States, The Federal Reserve Board indicated that it expects to keep the key interest rate close to zero until 2022. At the same time, the bank confirmed that it will continue to purchase approximately $120 billion in treasury and mortgage bonds per month to maintain long-term borrowing rates in the long run to stimulate spending and growth.

The Fed’s message, through its statement after its recent policy meeting, at a hypothetical news conference for President Jerome Powell, was that the bank was ready to do more to help support a fragile economy that is facing so much uncertainty. Powell admitted that he and other Fed policy makers have a blurry outlook about how the economy will improve in the coming months.

For his part, Powell indicated that the US labor market "may have reached the bottom" last month, while employers surprisingly added 2.5 million jobs, according to a government report released last Friday. But he stressed that nearly 21 million Americans are still unemployed and that the strong jobs report was not enough to ensure the economy is getting back on track - or changing the Fed’s intention to keep interest rates very low.

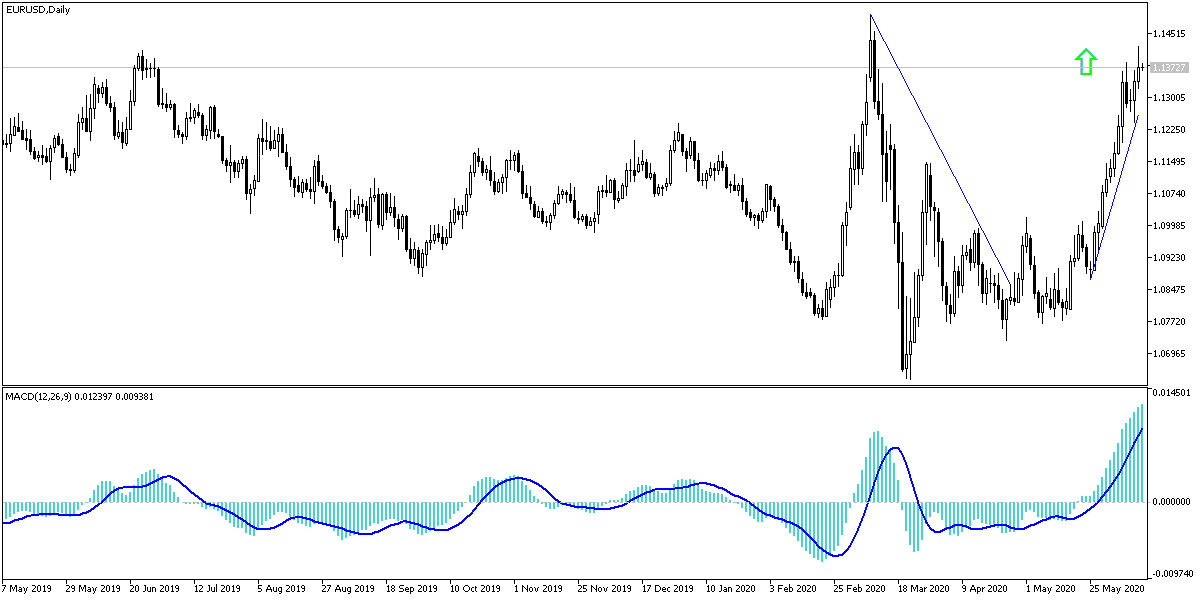

According to the technical analysis of the pair: On the EUR/USD daily chart, the bulls' control over performance increased. At the same time, the technical indicators began to give confirmed signs of reaching strong overbought areas. Therefore, it is possible to sell to take profits at any time, and the nearest resistance levels for the pair currently 1.1395, 1.1465 and 1.1530 respectively. Bears may be able to turn direction if the pair drops to the 1.1245 support. The European dispute over the approval of the recently announced stimulus plans, and consequently the gains of the Euro, will continue to face a threat.

As for the economic calendar data today: The Euro will react to the results of the Euro group meeting. The biggest interest in the US data results will be on the PPI and the reading of the weekly jobless claims.