Last Thursday’s signals were not triggered as there was no bullish price action when the support level at 1.1321 was reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken between 8am and 5pm London time today only.

Short Trade Ideas

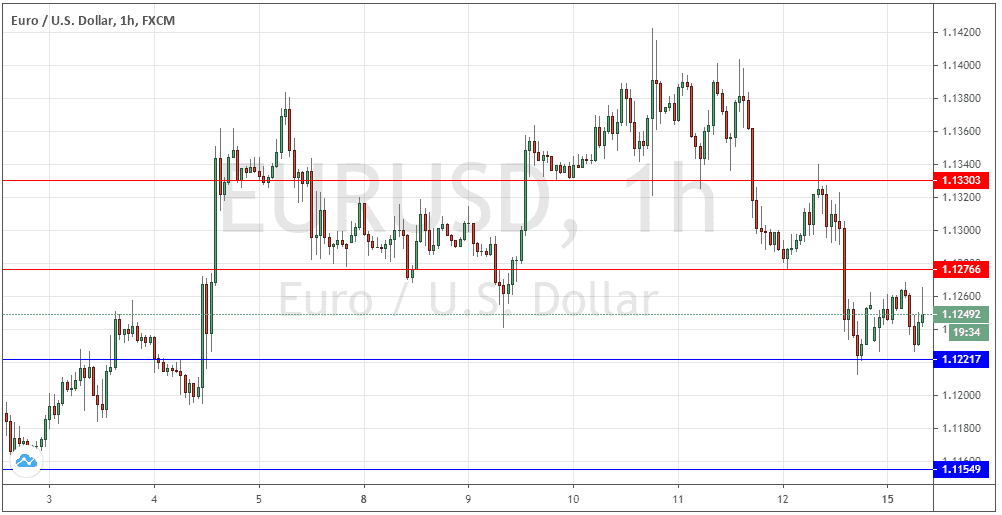

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1277 or 1.1330.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.1222 or 1.1155.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that as long as the support at 1.1321 held, we should see a renewed rise as risk sentiment bounces back, as it almost certainly would.

I was correct insofar as the level held over the London session that day, and I was also correct to see this level as pivotal, as once it broke down strongly, the price continued to fall.

The market environment has changed quite a lot over the past few days, with safe-haven assets such as the U.S. Dollar strengthening as risk sentiment sours as questions arise over instability and a second coronavirus wave in the U.S. as well as the permanence of the recent strong rise in unemployment.

It seems likely that the long-term bullish trend is over. A long-term price chart of this currency pair shows that the recent highs around 1.1400 have been long-term consolidative highs, so technically, a move downwards from here after a failure to rise higher was natural.

The support and resistance levels that have contained the price over recent hours look firm. Much will probably depend upon which level is broken first.

I have more faith in a bearish move due to prevailing market sentiment, so I will take a bearish bias here if we get two consecutive hourly closes later below the support level at 1.1222.

The Pound is weaker than the Euro, so traders looking to trade long of the USD today may do better looking for shorts in GBP/USD than in EUR/USD.

There is nothing of high importance due today concerning either the EUR or the USD.