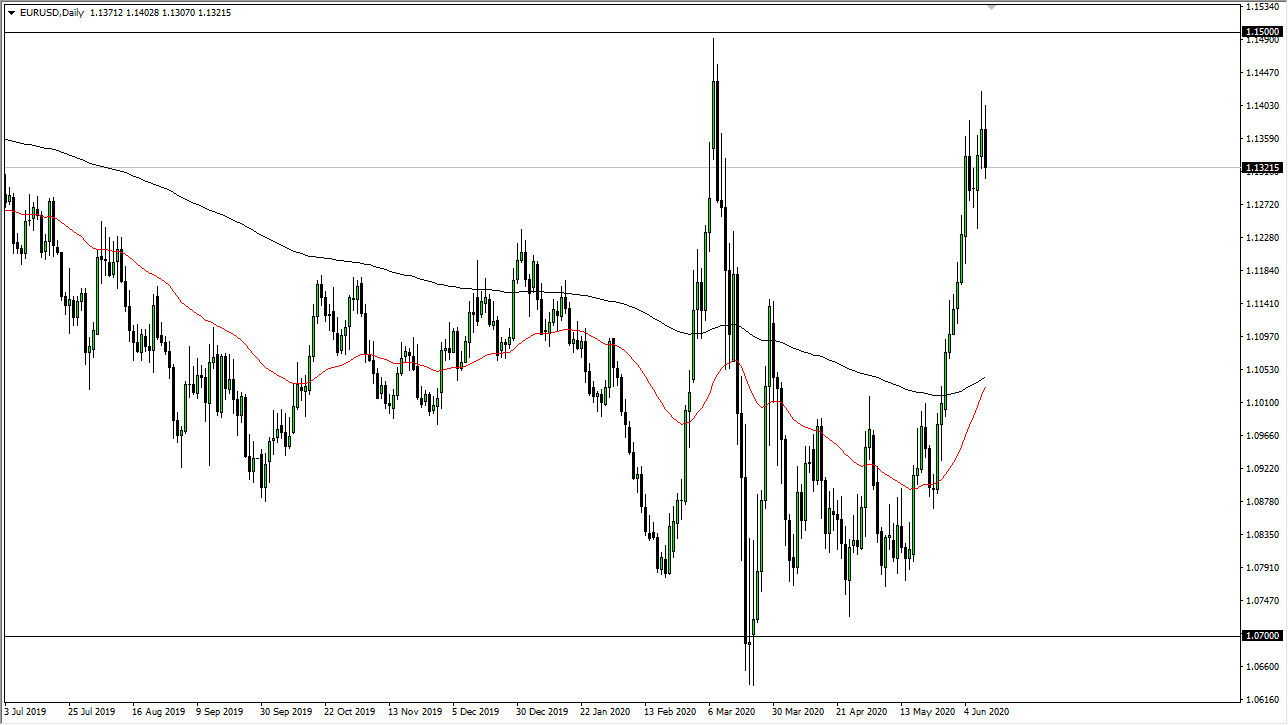

The Euro initially tried to rally on Thursday but continues to see a lot of resistance at the 1.14 handle. At this level, we have seen a couple of days’ worth of selling near that area, so it does suggest that we are going to see continued resistance. The 1.14 level extends all the way to the 1.15 level as far as selling is concerned, and therefore it is likely that we will see pressure to the downside every time we rally.

If the market breaks down below the 1.1250 level, then it is likely to go much lower, perhaps reaching down towards the 1.1050 level.

That is an area where we see the 200 day EMA, and of course the 50 day EMA. The 50 day EMA is getting ready to cross above the 200 day EMA, forming the “golden cross.” Ultimately, this is a market that I think will continue to see a lot of volatility, and when you look at the long-term chart it looks as if the 1.15 level is significant resistance, just as the 1.07 level underneath is significant support. We are in an area right now that is closer to the top of the overall range than it is the bottom, so I think that also comes into play as well. Furthermore, all one has to do is look at the chart and recognize just how overbought we are.

At this point in time, it looks like short-term buying and selling will continue to push his market back and forth in this tight range. The Friday session will be interesting because it could lead to what we see for the second half of the month, but this will be further confirmed if we get a massive candle on Friday as well. At this point, it seems to me as if we are simply trying to figure out whether or not we can continue showing bullish pressure due to the fact that the Federal Reserve is going to liquefy the markets, or essentially support markets as much as they can. This should be dollar negative, but if we continue to see a lot of concern around the world, that could also throw a lot of money into the bond markets, thereby driving the dollar higher. I expect a lot of choppiness more than anything else right now and will be looking for the next impulsive candle to tell me which direction to go.