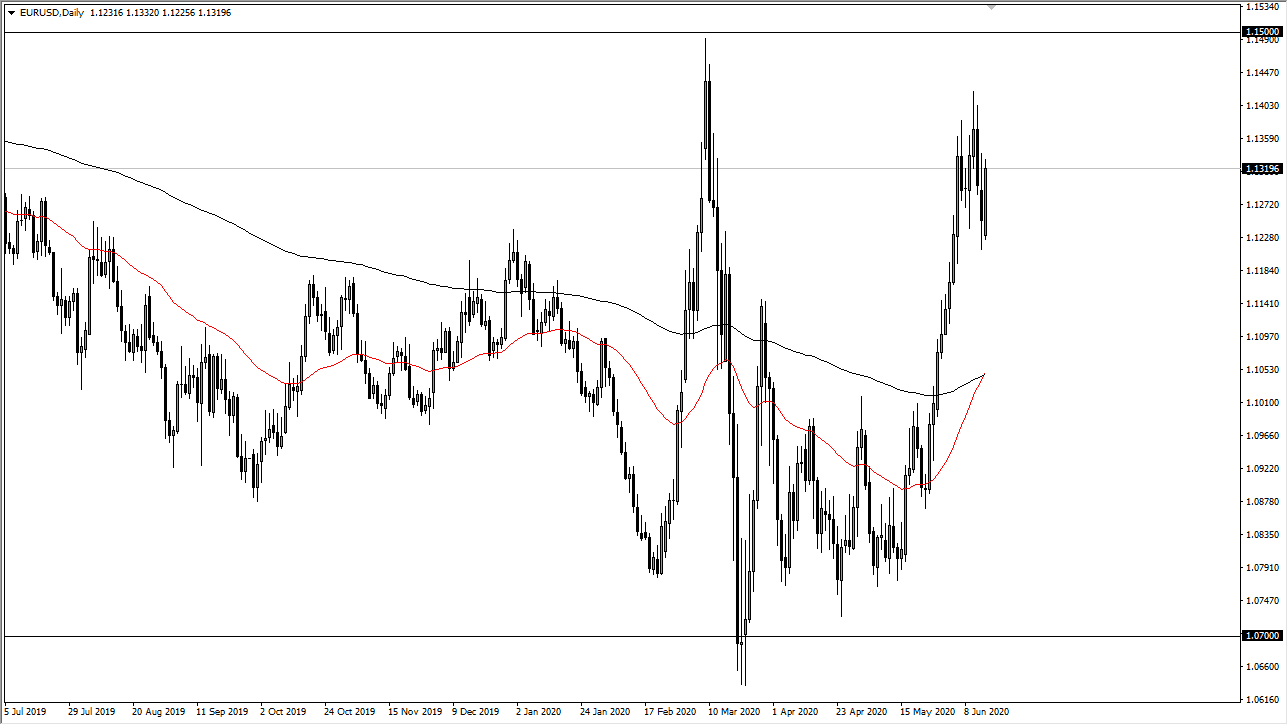

The Euro has gapped lower on Monday to turn around and show signs of negativity as markets sold off anything related to risk. However, the Euro has rallied most of the day and not only broke above the gap but continue to go above the 1.13 level. Most of this was probably due to the Federal Reserve offering to buy corporate bonds from several US companies, meaning that they were willing to bankroll Wall Street debts. Because of this, the US dollar take a hit and gold spiked. This by extension almost always means that the Euro is going to turn around and start gaining.

I still believe that there is a significant amount of resistance near the 1.14 handle, extending all the way to the 1.15 level. All things being equal, I think that it is only a matter of time before the sellers jump in and push this market lower. Furthermore, when I look at this market, it is hard not to notice the fact that we have seen a lower dip recently. At this point, I am looking for opportunities to short the Euro still, despite the fact what the Federal Reserve is doing.

After all, the European Central Bank will be outdone when it comes to killing it is own currency and buying bonds in its own region. Ultimately, this is a market that will continue to see a lot of volatility, as the US dollar is all over the place. If we did somehow break above the 1.15 handle, then it could send the Euro to much higher levels and perhaps even into a “buy-and-hold” type of situation. To the downside, the 200 day EMA is closer to the 1.10 level, and I do think that we could end up in that area. It will be interesting to see how this level plays out though, because in the immediate area that seems like we are chopping around and trying to find some type of move, but market participants have no idea what to do with themselves these days. The Federal Reserve is doing everything they can to break down the value of the greenback, but the ECB is almost certainly going to do its own thing to push the issue as we enter a new level in the currency wars. Everybody is trying to get cheaper, so expect more of this behavior. Currently, I believe that the market is trading between the 1.15 handle and the 1.07 level longer-term.