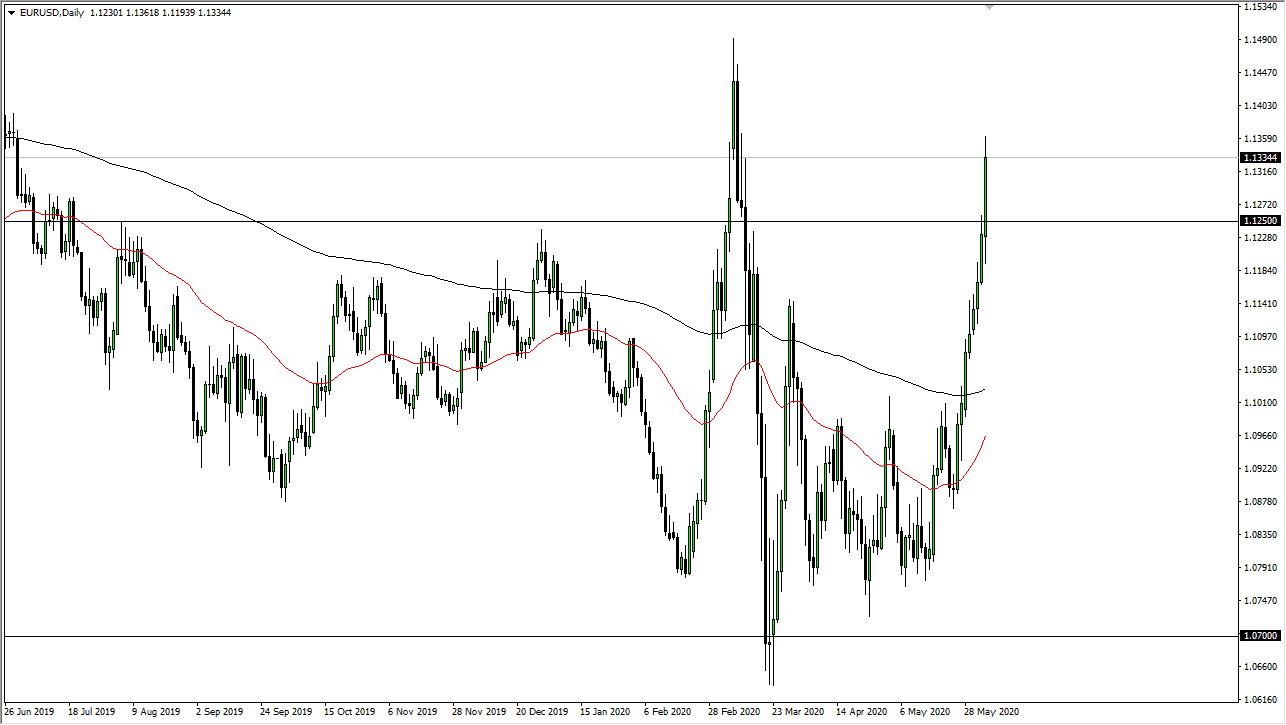

The Euro has hit the stratosphere during trading on Thursday and there really is not much showing on the chart that suggests it is ready to give up the massive rally that we have seen. Quite frankly, this is getting a bit ridiculous, just as it had a couple of months ago. Because of this, and the fact that it is Nonfarm Payroll Friday, I think there is a really good chance that we see some type of reversal soon.

The 1.15 level will cause a lot of resistance, and the higher this pair goes, the more likely I am to be looking for selling opportunity. Even if you are bullish of the Euro and we had a longer-term move to the upside, it is difficult to imagine we simply go straight up from here without printing a negative candlestick at one point in our lifetime. With that in mind, the correction could be rather brutal and could wipe a lot of people out who are expecting some type of change, which would be expected. I think at this point the 1.15 level could open up moves to much higher levels, but I think it is obvious that the market needs to pullback between now and then to have any real shot at breaking above there.

Keep in mind that the unemployment figure is likely to be horrific, so there will be a lot of algorithm trading that could come into play. The expected unemployment rate in the United States is 19.5%, something that is completely unheard of in the last several decades. However, Wall Street has an extraordinarily strong ability to “look past the numbers” and buy that dip every time it is offered. Because of this, it is possible that they short the US dollar after an initial knee-jerk reaction, so I think this sets up for a really ugly day one way or the other. You need to be overly cautious, but I do think that gravity eventually returns this pair. I also believe that the 1.11 level will offer significant support, so the question now is whether or not we get some type of repeat from the last time we got towards the 1.15 handle? The market continues to be a complete mess, and there still a major shortage of US dollars. If you look at a long-term chart of the Euro, this rally is still within the realm of normalcy, it is just the velocity that is so extraordinary.