The Euro rallied significantly during the trading session on Tuesday but continues to find resistance above, close to the 1.1350 level. Ultimately, this is a market that may have gotten a bit ahead of itself not too long ago, so it makes sense that we will see a lot of pressure up here, and I think that the Euro is a currency that has a lot of issues that come with it. Quite obviously, the only thing that is lifting this market is the fact that the Federal Reserve is pumping liquidity as quickly as they can, thereby trying to devalue US dollars.

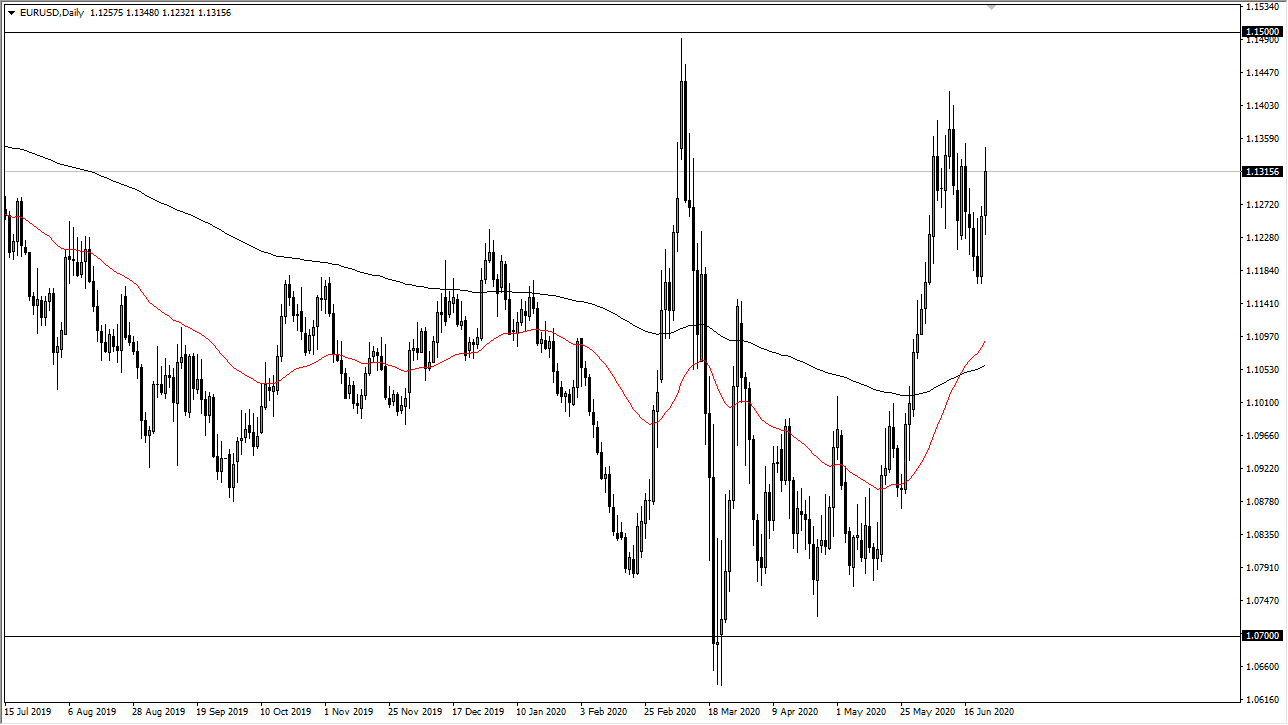

Looking at this chart, I think that the 200 day EMA underneath could be the initial target, somewhere near the 1.1075 level to the downside. If the market breaks below there, then it is likely that we go looking towards the 1.10 level, where I see significant buying pressure as well. Remember, this pair is extraordinarily choppy, and range bound most of the time, so I would anticipate more of the same behavior. After all, you have the European Central Bank on the other side of the Atlantic Ocean doing the same thing that the Federal Reserve is doing, which is everything that can stimulate the economy.

One of the biggest problems that Europe has is that it cannot seem to get its act together. The one major advantage that the US dollar has over the Euro is the fact that the Federal Reserve only has to deal with the central bank. That continues to be one of the biggest problems for the ECB, as countries continue to bicker back and forth about pandemic rescue packages and the like. With this, I think we are going to drift a bit lower, but in general, I believe that we will go back and forth more than anything else, as the pair typically does. It chops around and cons as much havoc in trading accounts as possible. Moves like the one we have just seen are the exception, not the norm. If we were to somehow break above the 1.15 level though, that would change everything but seems very unlikely to happen anytime soon. Ultimately, this pair could be forming a flag, but we need some type of catalyst to make that kick-off to the upside. Right now, I just do not see it.