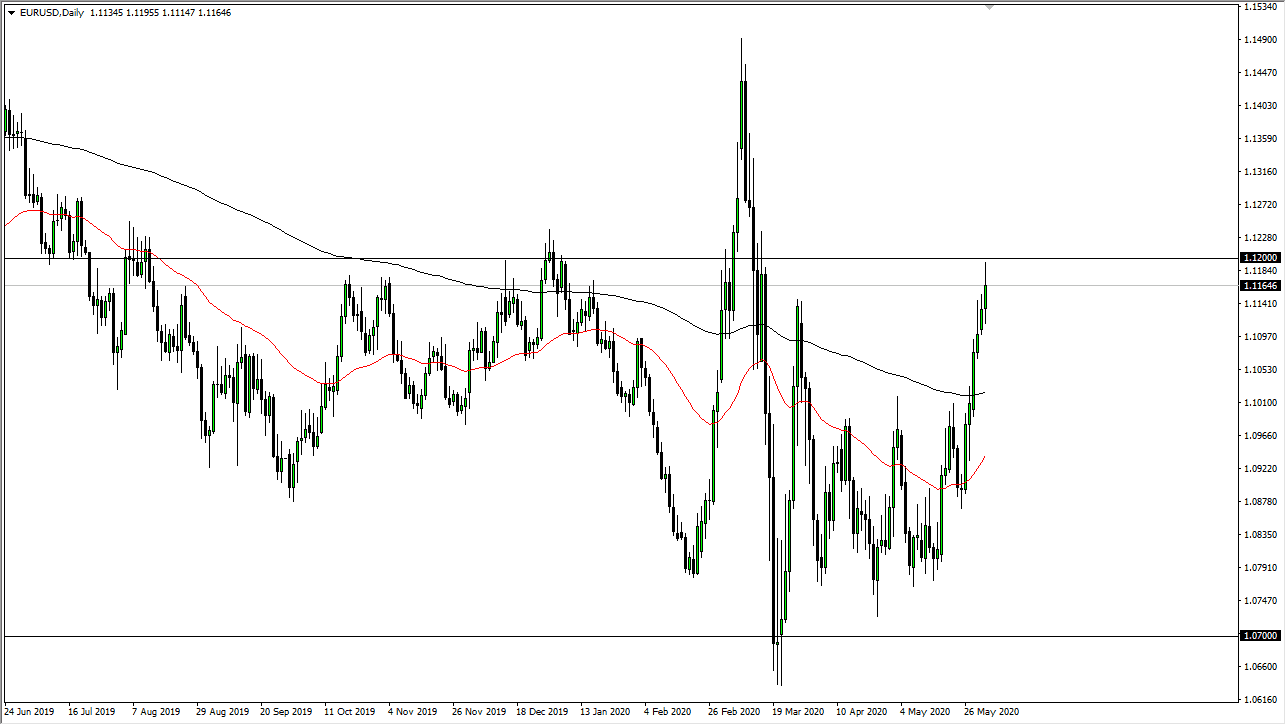

The Euro rallied significantly again during the trading session on Tuesday, after initially pulling back. We ran towards the 1.12 level but then saw quite a bit of selling pressure. This coincided nicely with other currency pairs during the day, as the US dollar may be trying to bottom out. When you look at the US Dollar Index, we are most certainly in an area that will be important from a longer-term standpoint. If the rally in the US dollar can continue, then almost by definition we need to see this market break down.

If we break down below the 1.1150 level, I think that the Euro will go looking towards the 1.10 level after that. A breakdown below that level then it could open up doors to bigger losses, and I certainly think that it is only a matter of time before we have to ask the question as to whether or not the US dollar is going to rise or fall. It will be seen here more specifically that will many other places. If we break above the 1.12 level, then we have a real chance of seeing the US dollar selloff everywhere else.

Above the 1.12 level opens up a move towards 1.15 handle, which was where we had seen quite a bit of selling pressure previously. This is a market that has been extraordinarily noisy, and I think it is only a matter of time before we have to pick a direction. There are a multitude of reasons why this market could move in either direction, not the least of which is simple fear. The US dollar of course is a safety currency, but at the same time it should be noted that the Federal Reserve is trying to print as many US dollars as humanly possible. As long as that is part of the equation, that puts downward pressure in the greenback. Ultimately though, we need to keep in mind that the European Central Bank is also starting to look very loose with its monetary policy yet again, and of course Germany is now talking about even more stimulus. In other words, this market is going to continue to be just as confused as it has been for some time. In the short term, we probably are overdone so I would look to see some type of pullback. However, if we break that 1.12 level on a daily close then we have 300 pips to the upside.