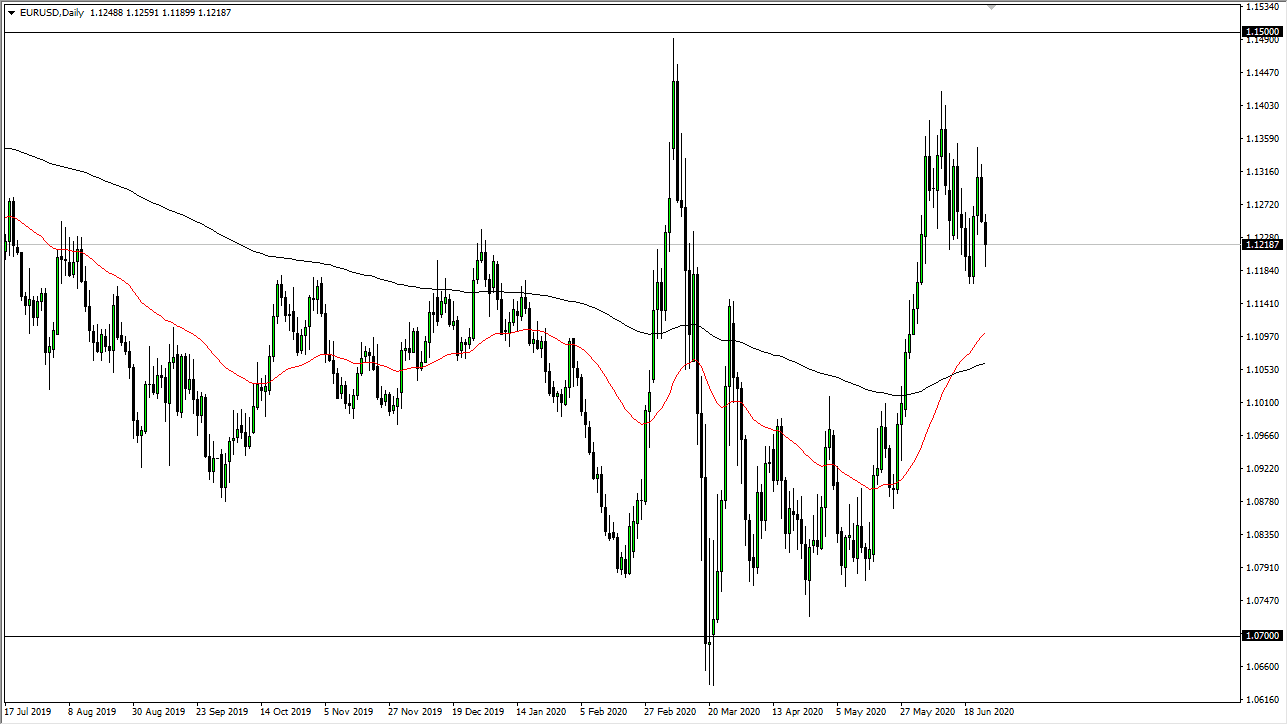

The Euro fell a bit during the trading session on Thursday but found quite a bit of support near the 1.12 level yet again, and this is an area that has seen a bit of buying pressure underneath. Ultimately, the market has bounced from there multiple times, but when you look at the highs, we have pulled back slightly every time we have rallied. At this point, it looks like the market is getting a little bit “heavy”, and then typically is something that you see before you make some type of bigger move. The question now is whether or not this is going to be a bullish flag, or is it going to be the market rolling over?

Looking at the candlestick for the trading session on Thursday, it is a bit of a hammer, and that does suggest that we might get another attempt to reach higher, but the 1.1350 level above is the beginning of resistance that extends to the 1.14 handle. At this point, the market is going to see a massive amount of selling pressure all the way to the 1.15 handle. In other words, I think that rallies at this point continue to offer selling opportunities, but signs of exhaustion should be looked for before acting on this. I believe that the next 24 hours could be slightly bullish, but I think at this point it is only an opportunity to sell at higher levels. On the other hand, if we turn around a break down below the lows of the week, then we probably go looking towards the 200 day EMA below there, which is going to be near the 1.1050 level. The 1.10 level underneath could be the next target after that, but I think what we are looking at is a market that is in a larger consolidation area, between the 1.07 level on the bottom and the 1.15 level on the top.

I think at this point, the market is likely going to see a lot of volatility, which I think is probably going to be the mainstay for most of the summer. We have so much in the way volatility going forward that we will continue to see a lot of choppy trading. It is difficult to hang on for a bigger move, so that is why I am more than willing to wait for a rally that I can start fading again.