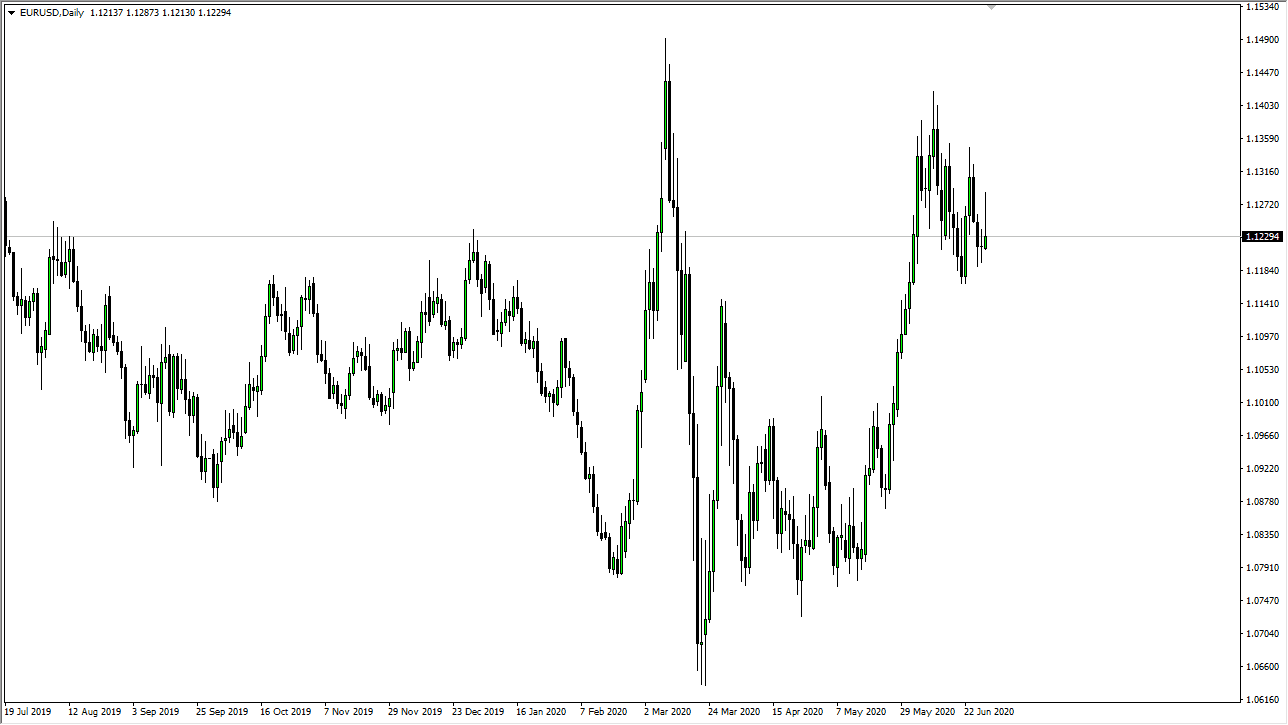

The Euro has initially rallied during the trading session on Monday, but then gave back quite a bit of the gains once the market reached towards the 1.13 level. At this point, the market is likely to continue to show a lot of selling pressure above, and I do not have any interest in trying to fight what has been an obvious trouble area above. At this point, I think it is only a matter of time before the Euro starts to rollover, as the rally in the Euro has been due to the Federal Reserve looking to liquefy markets, but quite frankly the European Central Bank is doing the same thing.

The 1.14 level above is the beginning of significant resistance extending all the way to the 1.15 level, which of course is a large barrier that we have tested previously. We have failed every time we get in that area, and it is likely that we could see sellers coming in. If we were to break above the 1.15 handle, then it would be a very bullish sign and it could be a bit of a trend change. If we can break above the 1.15 handle, then the market could go looking towards the 1.1750 level, and therefore change the overall tone of this market.

Looking at the candlestick, it is an obvious bearish candlestick and it is likely that if we break down below the bottom of the range, the market is likely to go looking towards the 1.10 level. That of course is an area that had been resistance previously, and therefore would make a significant target. All things being equal, it is likely that we continue to see a lot of troubles, and with that being the case I think that simply fading the rallies as they occur. Ultimately, the market is likely to see plenty of selling pressure given enough time, as the Euro faces a whole host of issues. The European Union of course is continuing to struggle, and we have a major problem with the banking system there as well. At this point, the market is likely to continue to see a lot of problems, as it is simply a matter of time before the sellers take over. If we were to break out to the upside, then it is likely we could go higher, but I think at this point it would take an extreme amount of bullish attitude and change in momentum to make that happen.