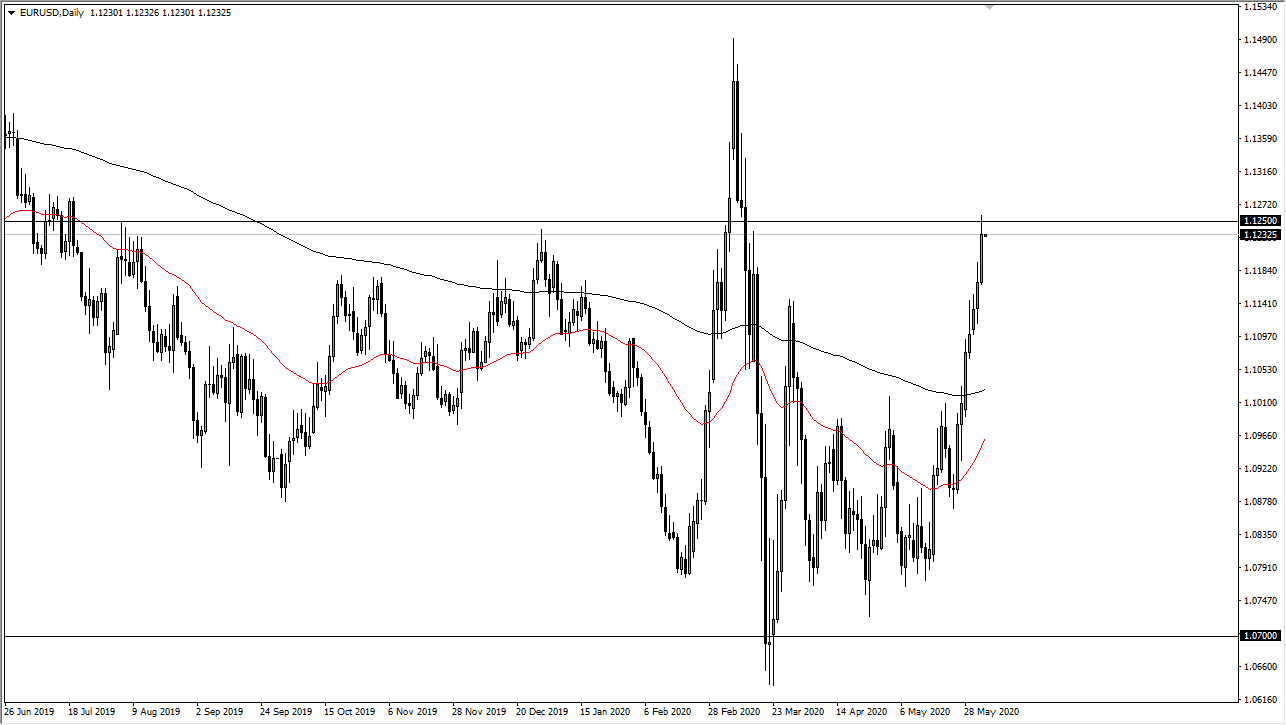

The Euro has extended its gains during a very volatile session on Wednesday, reaching towards the 1.1250 level. That is an area that is significant resistance, and as a result is not a huge surprise to see that we have pulled back from there towards the end of the day. That being said, the market has gotten way ahead of itself so one would have to think that we could look at some type of major breakdown coming. I believe at this point it is likely that we will continue to see difficult sliding to the upside, and with the ECB likely to expand its bond buying program, I find it extremely hard to get overly aggressive to the upside.

The 200 day EMA is all the way down at the 1.1025 level and starting to curl higher. However, you can see that during the month of February we had seen a remarkably similar move that got slammed to the upside and then slammed to the downside. It is likely that we could see that happen again. After all, we sought door about the Brexit and of course the global growth situation. The US dollar has gotten absolutely crushed as of late, and it is difficult to short this pair. It is because of this that you need to see some type of major exhaustion candle to get involved.

If we can break above the 1.1275 handle, then the market is just simply going to continue to extend to the 1.15 handle again. This pair is one that will put you to sleep for months at a time, so this type of volatility is a bit difficult to get your head around, considering that this is a normal behavior of the pair. To the downside, one has to think there is much easier moves just waiting to happen, but the US dollar has quite a bit of negativity attached to it due to the fact that the Federal Reserve is trying to kill it.

It will be interesting to see how this plays out but one would have to think that we are most certainly overbought so signs of exhaustion will probably get jumped upon. As we are starting to see a lot of panic buying when it comes to risk appetite, that could be a bad sign for this market. I do not necessarily think that we are going to melt down, but clearly, we need some type of break.