New Zealand’s Finance Minister Robertson is defending his government's response to the Covid-19 pandemic. Prime Minister Ardern enjoys overwhelming domestic support and international praise for implemented measures to curb the spread of the virus. It is evident in infection and death figures, with the country on track to be declared virus-free as soon as the end of June. An article in The Australian brutally criticized the future costs of the measures, remarking they will drive New Zealand’s economy off a cliff. Mixed Chinese PMI data sufficed to push the New Zealand Dollar higher, resulting in a breakdown in the EUR/NZD below its short-term resistance zone with a collapse in bullish momentum.

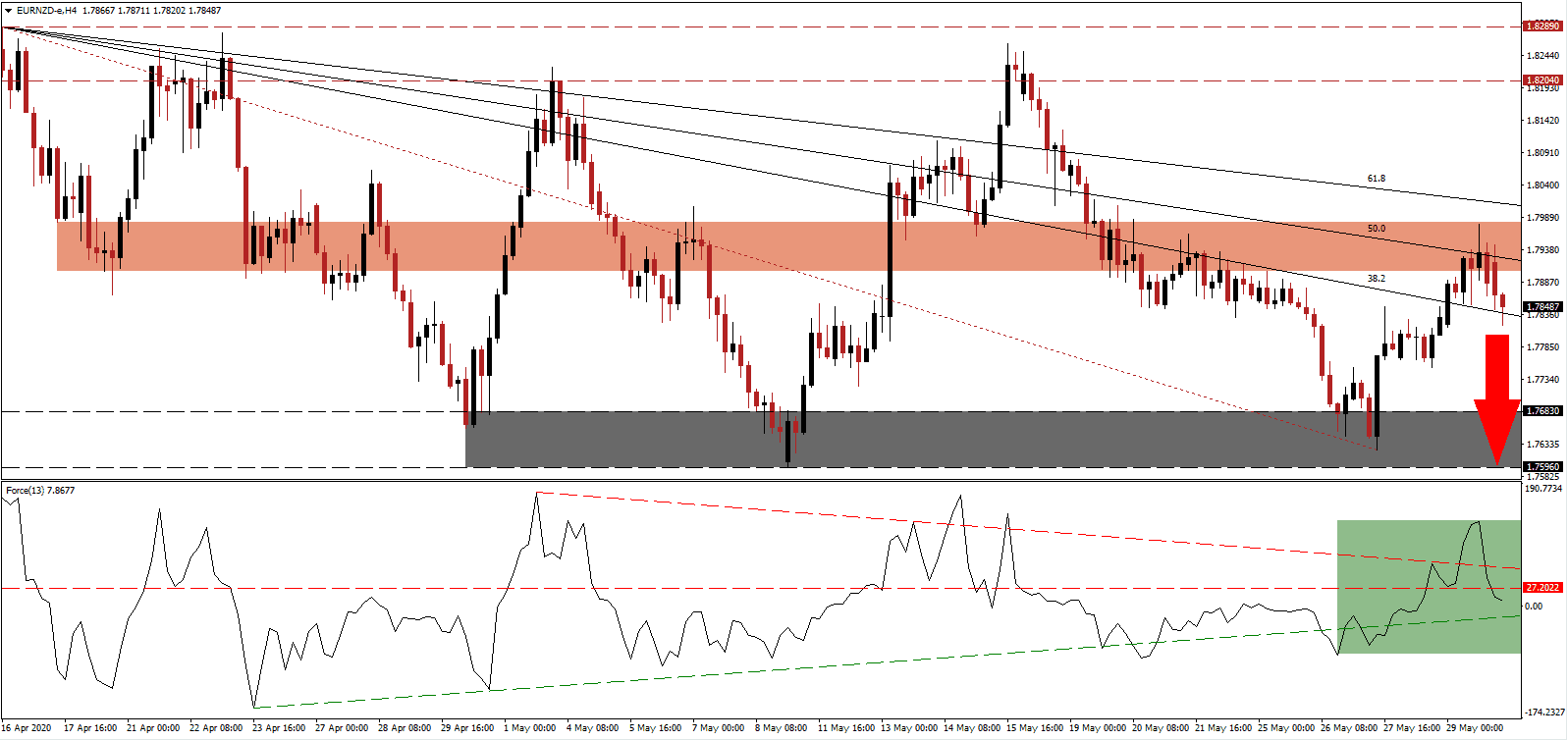

The Force Index, a next-generation technical indicator, retreated from a multi-week peak and plunged below its descending resistance level. It then converted its horizontal support level into resistance, as marked by the green rectangle. This technical indicator is on track to move below its ascending support level and cross below the 0 center-line into negative territory, granting bears complete control of the EUR/NZD.

OECD data shows New Zealand is last in multi-factor productivity growth and fourth-last in labor productivity growth. The article was based on this data, and while Finance Minister Robertson did acknowledge he did not read the article, he disagrees with it. At the same time, he blamed inaction by governments over the past four decades on today’s economic problems. Despite a long-term bearish outlook, Euro weakness is anticipated to extend the breakdown in the EUR/NZD below its short-term resistance zone located between 1.7982 and 1.7905, as identified by the red rectangle.

Prime Minister Ardern is set to follow the same path, as her government lacks a clear plan forward and hopes infrastructure, domestic tourism, and food exports will suffice. One essential level to monitor is the 38.2 Fibonacci Retracement Fan Support Level. A breakdown is favored to provide the necessary downside volume for the EUR/NZD to accelerate into its support zone located between 1.7596 and 1.7683, as marked by the grey rectangle. An extension of the correction is possible but will require a new short-term catalyst.

EUR/NZD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.7850

Take Profit @ 1.7600

Stop Loss @ 1.7930

Downside Potential: 250 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 3.13

In the event the Force Index spikes above its descending resistance level, the EUR/NZD may attempt a breakout. A sustained push above its 61.8 Fibonacci Retracement Fan Resistance Level may allow this currency pair to challenge its next resistance zone located between 1.8204 and 1.8289. It will provide Forex traders with an excellent secondary short-entry opportunity to consider unless a significant fundamental change materializes.

EUR/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.8050

Take Profit @ 1.8210

Stop Loss @ 1.7970

Upside Potential: 160 pips

Downside Risk: 80 pips

Risk/Reward Ratio: 2.00