Preliminary June PMI data out of the Eurozone releases on Tuesday surprised to the upside but did little to rally the Euro. With new Covid-19 infections rising, renewed regional lockdown measures may resurface. The German manufacturing sector remains in a recession, which started in 2019 before the global pandemic forced and abrupt halt across the world. New clusters in Germany, praised by the international community for its handling of the virus and relatively low death rate, are adding to mounting economic concerns moving forward. The EUR/JPY reversed the breakdown below its short-term resistance zone following the PMI data, but the dominant bearish chart pattern remains intact.

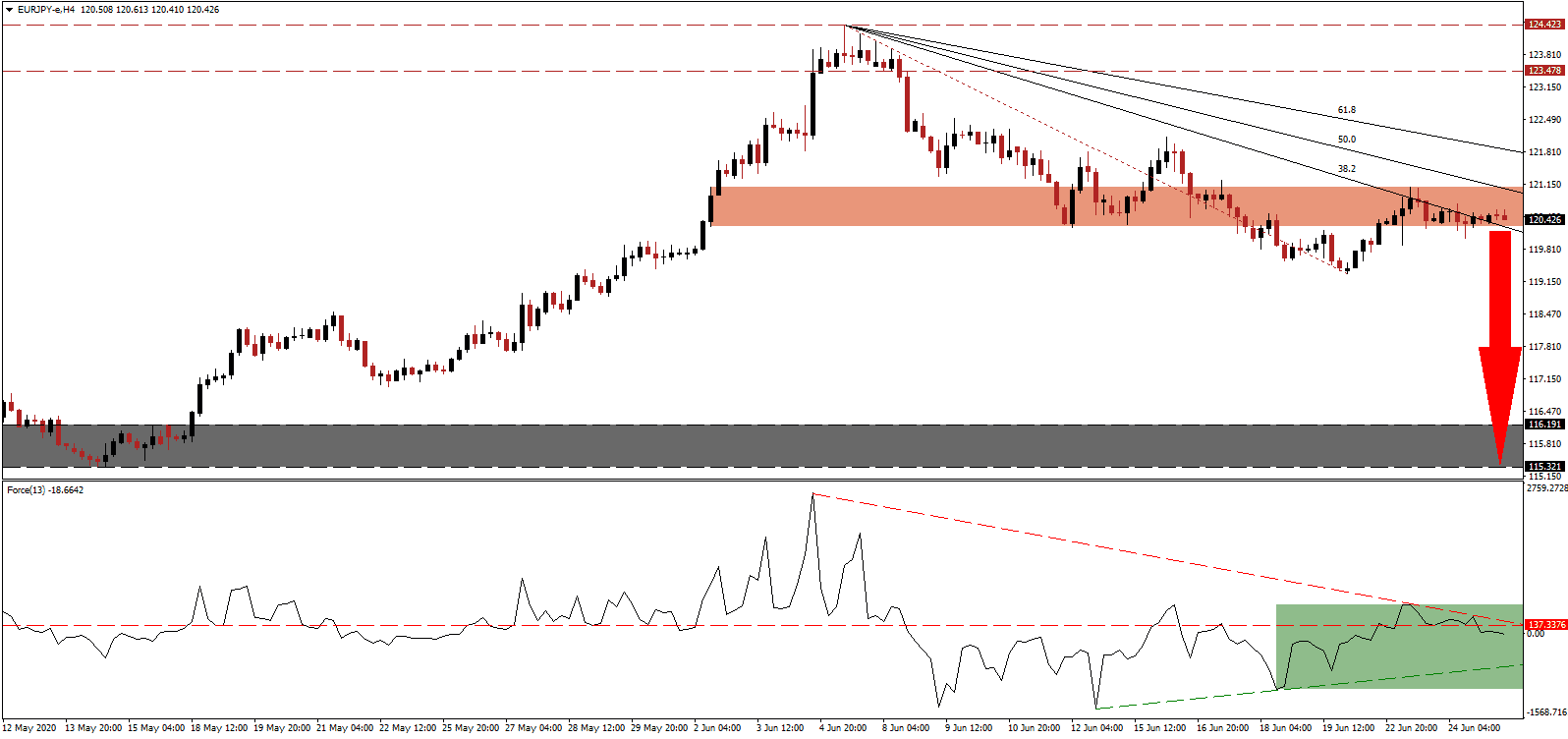

The Force Index, a next-generation technical indicator, reversed a temporary advance and converted its horizontal support level into resistance, as marked by the green rectangle. Adding to downside pressures is the descending resistance level, favored to guide the Force Index below its ascending support level. Bears started to regain control of the EUR/JPY after this technical indicator moved into negative territory.

According to the latest International Monetary Fund global economic assessment, GDP will contract by 4.9% in 2020. Expectations for the Eurozone economy are for a plunge of 10.2%. Increasing downside pressures for the export-reliant currency bloc is an estimated 11.9% contraction in global trade. Germany, France, Italy, and Spain, the four dominant Eurozone members, are forecast to shrink by 7.8%, 12.5%, 12.8%, and 12.8%, respectively. It positions the EUR/JPY for a renewed breakdown below its short-term resistance zone located between 120.277 and 121.090, as identified by the red rectangle.

Safe-haven demand for the Japanese Yen, the primary currency for risk-averse traders, is expected to add to selling pressure in this currency pair. Economic data out of Japan remains grim, and the government is preparing for a new surge in Covid-19 infections. It highlighted concern over new clusters forming in office buildings. The descending 50.0 Fibonacci Retracement Fan Resistance Level is anticipated to enforce the corrective phase in the EUR/JPY, as the Eurozone is faced with more economic pressure from Trump’s renewed tariff threat. A breakdown will clear the path for price action to accelerate into its support zone located between 115.321 and 116.191, as marked by the grey rectangle.

EUR/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 120.400

Take Profit @ 115.350

Stop Loss @121.400

Downside Potential: 505 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 5.05

In case the Force Index advances, aided by its ascending support level, the EUR/JPY could be inspired to attempt a breakout. Due to the intensifying stress on the Eurozone economy, and a surge in new Covid-19 infections globally, Forex traders are recommended to take advantage of any price spike with new net short positions. The upside potential remains confined to its resistance zone between 123.478 and 124.423.

EUR/JPY Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 122.600

Take Profit @ 124.100

Stop Loss @ 121.800

Upside Potential: 150 pips

Downside Risk: 80 pips

Risk/Reward Ratio: 1.88