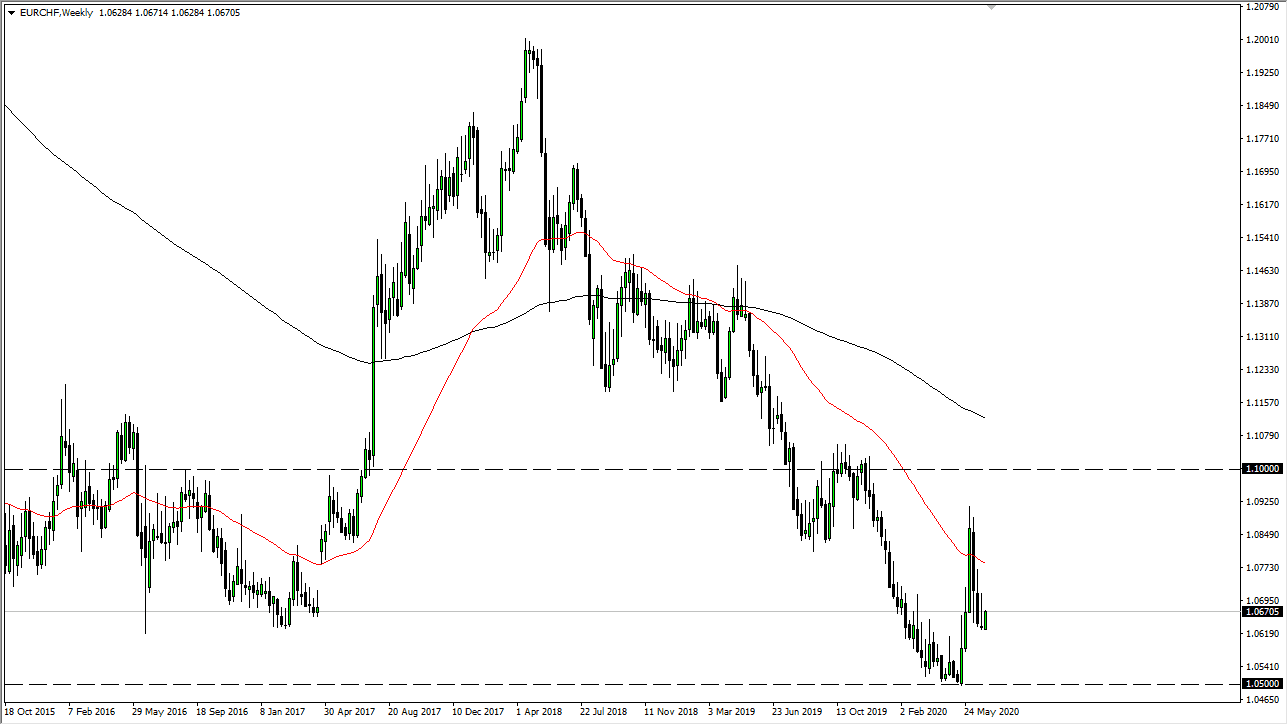

The Euro has tried to rally several times during the month of June but has given back those gains every time it tried. The market has clearly seen a massive shot higher but has given back about three quarters of that move. When you look at the moving averages, the 50 week EMA is driving much lower, and it looks as if it is going to be resistance as we have seen it act as such during the second week of June. At this point, the Euro has seen some strength, but it seems as if it is running out of momentum, not only against the Swiss franc, but against the US dollar and several other currencies.

Keep in mind that the Swiss franc is considered to be a bit of a safety currency, and therefore money will go flowing towards that currency if we have some type of negative headline out there that spooks the market. With that being the case, the market is likely to see the dynamic in this pair continue, because we have been in such a massive downtrend for so long. In fact, one has to wonder how low we would be at this point if it were not for the Swiss National Bank supporting this pair for so long a few years ago. Once the Swiss stepped out of the marketplace, the Euro got hammered against the Franc.

At this point, it looks as if the 1.08 level is significant resistance and most certainly the 1.10 level above there is. To the downside, the 1.05 level looks to be supportive, and therefore a potential target given enough time. This is not a market that moves very quickly most of the time, so do not be surprised at all if you see some type of grind lower more than anything else. However, if we get some type of negative headline out there that really gets people looking for safety, this pair will speed up to the downside. As far as momentum to the upside, we are going to need a lot of “risk on” trading, which would probably take some type of catalyst due to the fact that we are in a downtrend anyway. What that massive “risk on” catalyst is remains to be seen, and therefore I would be a bit skeptical about anything that crosses the wires. Having said that, this pair does move at a snail’s pace sometimes, due to the fact that they do so much cross-border transactions between the economies.