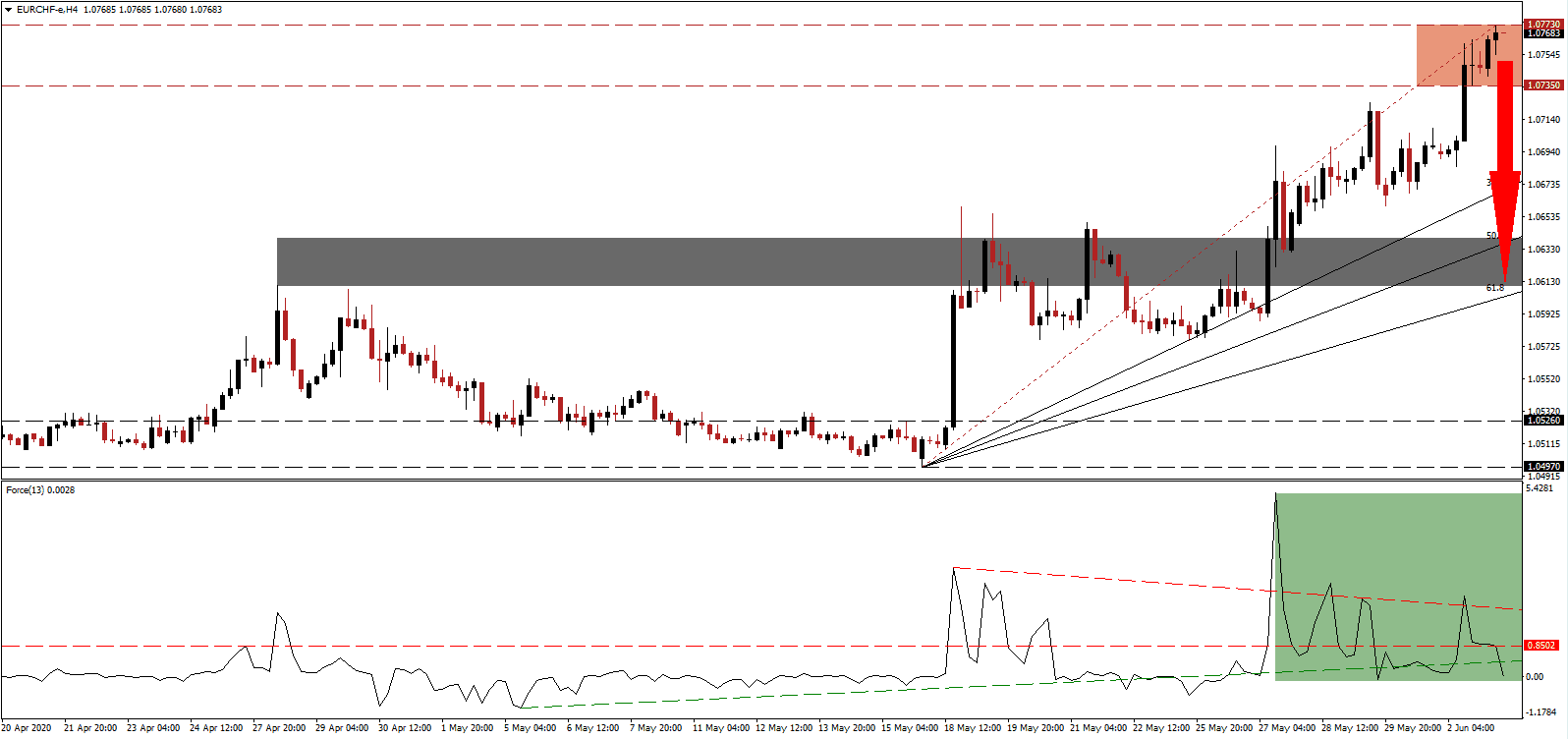

Deflation fears across the Eurozone are on the rise, adding to a growing list of concerns for the European Central Bank to address. The global preference for issuing debt has been intensified by the Covid-19 pandemic, and market participants are willing to ignore all warning signs as long as central banks continue to support inflated financial markets. Despite the acknowledgment by the ECB that the economy is significantly worse than previous forecasts, the EUR/CHF extended its advance into its resistance zone. The bullish momentum retreat is signaling the end of the advance with upside volume drying up.

The Force Index, a next-generation technical indicator, created a series of lower highs while this currency pair pushed higher. It allowed for the emergence of a negative divergence, indicative of a pending trend reversal. After the descending resistance level assisted the conversion of the horizontal support level into resistance, as marked by the green rectangle, more downside pressure resulted in the breakdown below its ascending support level. Bears wait for this technical indicator to collapse into negative territory to regain complete control of the EUR/CHF.

Complacency and debt emerged as the primary risks moving forward. While the Eurozone economy started to lift lockdown restrictions, new Covid-19 infections are on the rise. Economic activity remains depressed but has likely bottomed out as PMI data points towards recovery from all-time lows. The EUR/CHF is challenging the top range of its resistance zone located between 1.0735 and 1.0773, as identified by the red rectangle. The loss in bullish momentum makes this currency pair vulnerable to a profit-taking sell-off.

Swiss retail sales for April confirmed the collapse of economic activity, and the focus has shifted to May and June data to assess if consumers are rushing back to spur domestic demand. The Swiss National Bank continues to interfere in the Forex market, adding to its CHF800 billion-plus balance sheet, which is bigger than the Swiss economy. A breakdown is favored to close the gap between the EUR/CHF and its ascending 38.2 Fibonacci Retracement Fan Support Level. An extension into its short-term support zone located between 1.0610 and 1.0640, as marked by the grey rectangle, is probable.

EUR/CHF Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.0770

Take Profit @ 1.0610

Stop Loss @ 1.0820

Downside Potential: 160 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.20

A breakout in the Force Index above its descending resistance level is expected to pressure the EUR/CHF higher. Safe-haven demand for the Swiss Franc is depressed but exposed to a violent comeback if markets refocus on economic data rather than hope. Forex traders are recommended to view any advance as an excellent selling opportunity due to the dominant bearish outlook for the Eurozone economy. The next resistance zone is located between 1.0883 and 1.0910

EUR/CHF Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 1.0850

Take Profit @ 1.0910

Stop Loss @ 1.0820

Upside Potential: 60 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.00