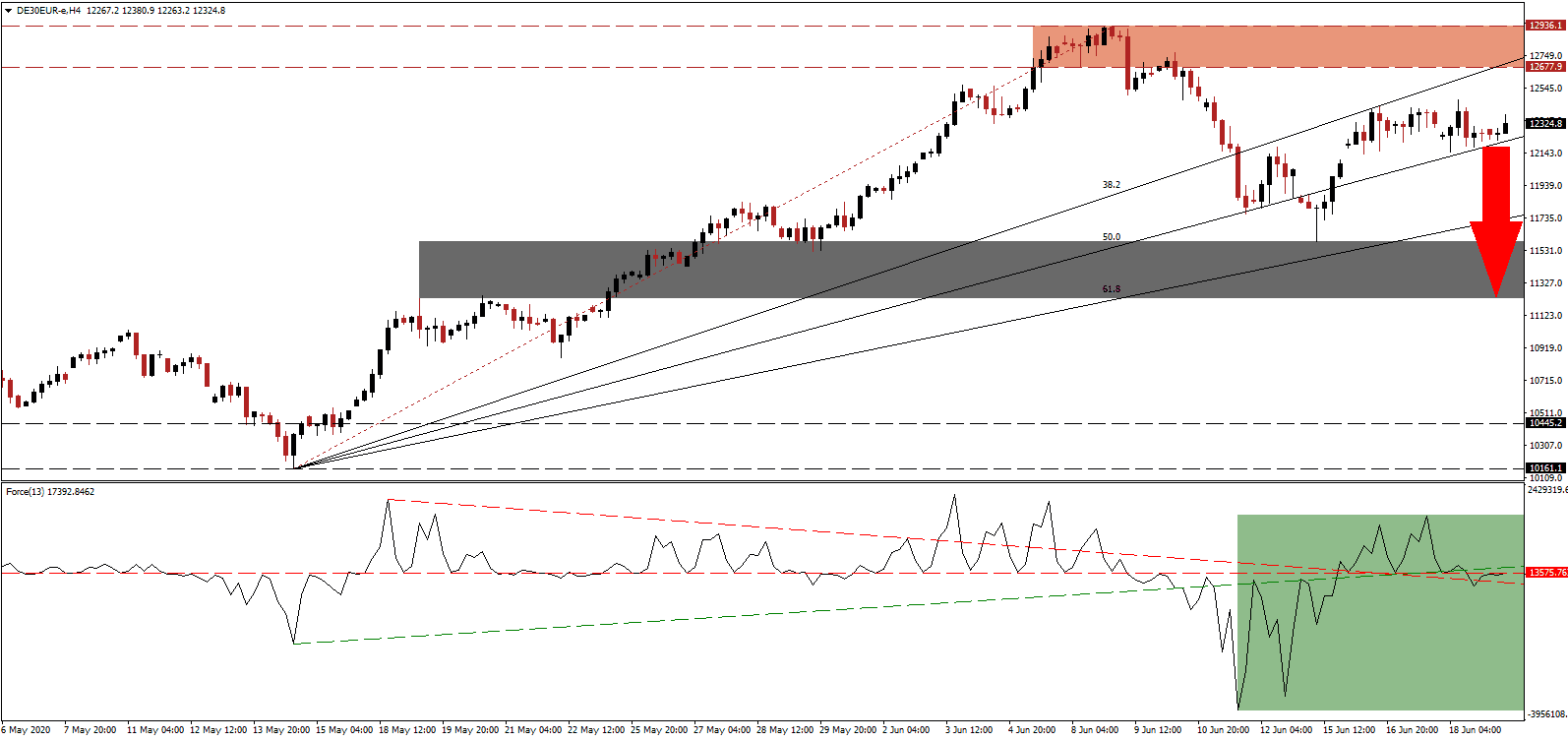

According to the latest ZEW survey for June, investors believe continental Europe’s largest economy is in the early phases of recovery. The outlook over the next six months is also improving, fueling hopes for an expanding economy in the second half of 2020. After Chancellor Merkel’s government provided €1.3 trillion in bailouts and stimuli, the Bundesbank believes the economy reached the bottom in Germany’s most massive post-war contraction. The DAX 30 remains under selling pressure after it recovered from the breakdown below its resistance zone with a significantly lower high.

The Force Index, a next-generation technical indicator, retreated quickly from a lower high of its own, which led to a breakdown below its ascending support level. Bearish momentum sufficed to convert the horizontal support level into resistance, as marked by the green rectangle. A collapse below its descending resistance level is favored to take this technical indicator into negative territory, ceding control of the DAX 30 to bears.

With the German Kiel Institute for the World Economy (IfW), ranked among the Top 50 most influential global think tanks, confirming the dominant conclusion of an economic bottom recorded in April, the 2021 outlook suggests the German economy will not fully recover until 2022. The IfW forecasts a 6.8% GDP contraction in 2020, followed by a 6.3% expansion in 2021. A second Covid-19 infection is not part of the prediction and could derail any forward-looking assessment. More selling pressure in the DAX 30 is favored, after the breakdown below its resistance zone located between 12,677.9 and 12,936.1, as marked by the red rectangle, to reflect the realization of a slow economic recovery globally.

Confirming the severity of the Covid-19 induced economic collapse is the Bundesbank’s weekly activity index (WAI), developed to measure real economic activity. It suggests a GDP drop of 7.78% for the period between March 16th and June 14th. While it does not measure GDP directly, it is deployed for trend identification. The DAX 30 is well-positioned to correct below its ascending 50.0 Fibonacci Retracement Fan Support Level and challenge its short-term support zone located between 11,230.1 and 11,589.1, as identified by the grey rectangle. More downside cannot be excluded, given the intensifying bearish outlook.

DAX 30 Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 12,330.0

Take Profit @ 11,230.0

Stop Loss @ 12,600.0

Downside Potential: 11,000 pips

Upside Risk: 2,700 pips

Risk/Reward Ratio: 4.07

In case the Force Index accelerates above its ascending support level, the DAX 30 may attempt to challenge its resistance zone. Any breakout attempt will provide traders with a secondary short-selling opportunity. Due to the spike in new Covid-19 cases following the reopening of economies, the upside potential is limited to its resistance zone. A brief spike above it remains a probability, but the 13,000 psychological resistance level is expected to keep the bearish chart pattern intact.

DAX 30 Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 12,730.0

Take Profit @ 12,930.0

Stop Loss @ 12,630.0

Upside Potential: 2,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 2.00