Germany’s economy is faced with a steep recession in 2020, estimated between 6.5% and 8.5%, while it battles a resurgence of Covid-19 infections. Local spikes resulted in the lockdown of over 400,000 individuals, a trend likely to continue. While a complete nationwide measure similar to the one implemented in March is unexpected, localized responses will pose a drag on the economy, prolonging an already tepid trajectory. The DAX 30 is under threat of an accelerated sell-off after ending its bear market rally with a breakdown below its resistance zone.

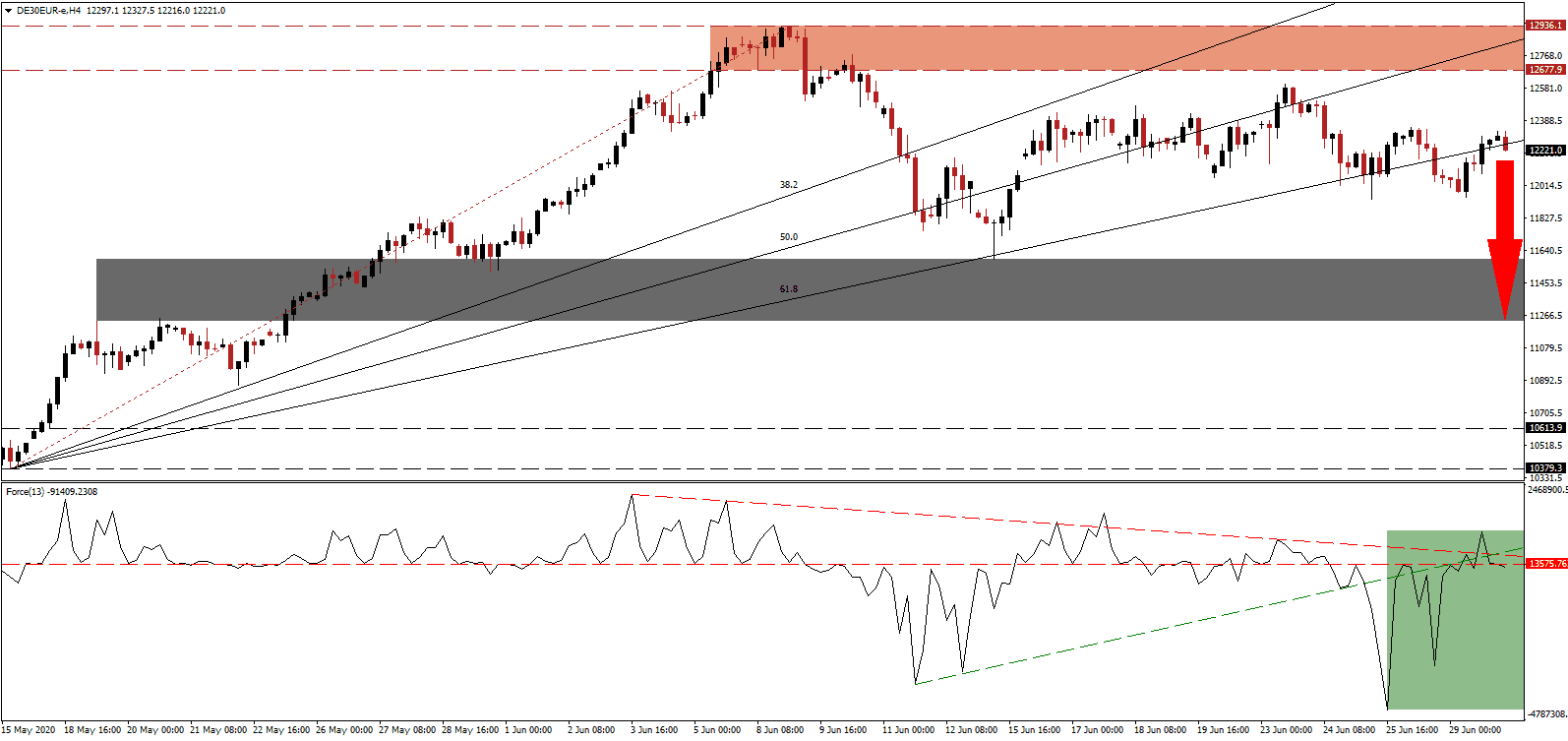

The Force Index, a next-generation technical indicator, recovered from a new multi-month low but reversed its temporary advance with a breakdown below its descending resistance level and its ascending support level. It was followed by a conversion of its horizontal support level into resistance, as marked by the green rectangle. Bears remain in complete control of the DAX 30 with this technical indicator in negative territory.

Following upbeat preliminary PMI data for June, subsequent economic reports continue to disappoint. Yesterday’s Eurozone service sector and industrial sentiment recovered well below estimates. It severely limits the positive impact of border reopenings within the Eurozone, unlikely to deliver the results anticipated by the German government. The DAX 30 is presently challenging its ascending 61.8 Fibonacci Retracement Fan Support Level, the final one preventing price action from detaching farther from its downward revised resistance zone located between 12,677.9 and 12,936.1, as marked by the red rectangle.

Investor confidence is under additional pressure the accounting scandal at Wirecard, which has been labeled the Enron of Germany, referring to the collapse of the US-based energy firm leading to the passage of the Sarbanes-Oxley Act. The German government is now considering an overhaul of the regulatory environment, likely to result in unfavorable policy decisions. The DAX 30 is well-positioned to accelerate into its short-term support zone located between 11,230.1 and 11,589.1, as identified by the grey rectangle. Given the ongoing Covid-19 pandemic, the breakdown may extend into its support zone between 10,161.1 and 10,445.2.

DAX 30 Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 12,240.0

Take Profit @ 11,230.0

Stop Loss @ 12,500.0

Downside Potential: 10,100 pips

Upside Risk: 2,600 pips

Risk/Reward Ratio: 3.89

In the event the Force Index reclaims its ascending support level, serving as resistance, the DAX 30 may spike into its resistance zone, from where more upside is unlikely. With global trade expected to plunge by 11.9% in 2020, the export-oriented German economy faces a long road to recovery. The move from Europe’s most austere government to the most excessive spender is favored to diminish fiscal stability moving forward. Any advance will offer traders a secondary selling opportunity.

DAX 30 Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 12,650.0

Take Profit @ 12,930.0

Stop Loss @ 12,500.0

Upside Potential: 2,800 pips

Downside Risk: 1,300 pips

Risk/Reward Ratio: 2.15