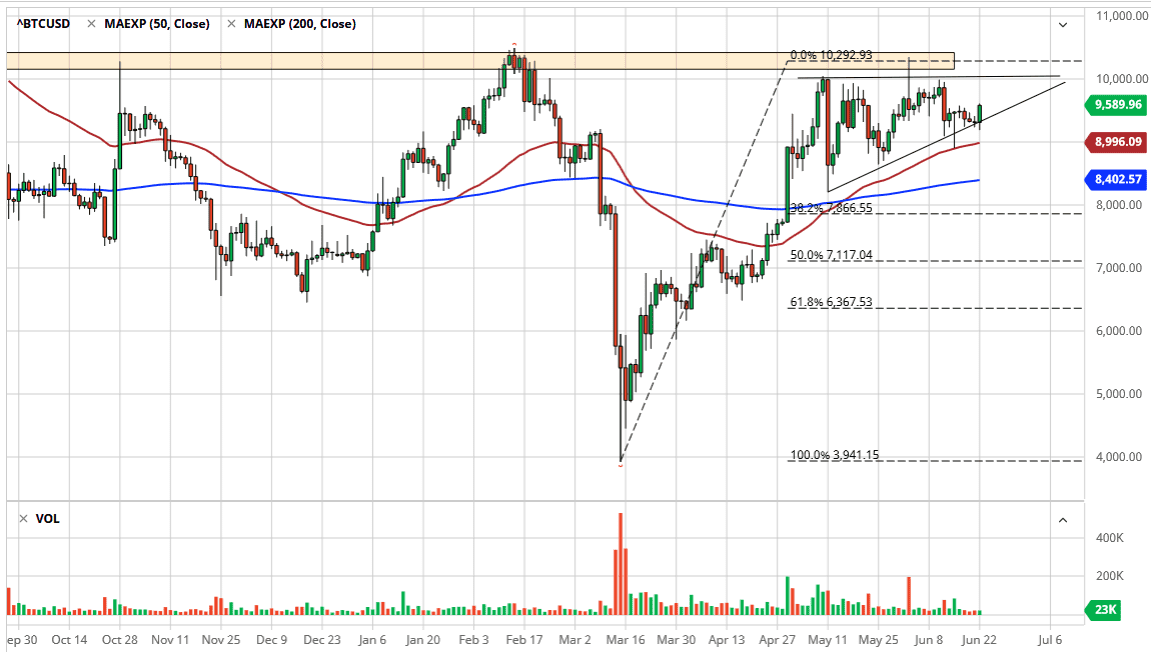

Bitcoin markets have initially fallen during the trading session on Monday when we got back to work, but as you can see, we have turned around to show signs of strength again. The 9500 level has been broken to the upside during the trading session, which is a strong sign as we have broken above the last several days’ worth of noise. Furthermore, we have also confirmed a bit of a trend line which is essentially the bottom of an ascending triangle. This ascending triangle, although not necessarily the cleanest ascending triangle the world, certainly shows itself as being somewhat important. It suggests that Bitcoin will go higher over the longer term, which giants quite well with the nice move that the market has seen since the middle of March.

Bitcoin has rallied right along with the S&P 500. This is a correlation that I draw very often, but it does look as if it is a “risk-on” type of trade. That is a bit counterintuitive as a lot of people will look at Bitcoin as a way to get away from fiat currencies. You can also draw some parallels between Bitcoin in gold, which could drive the HODL crowd nuts, but at the end of the day it is true. In that sense, Bitcoin is a hedge against the US dollar losing strength.

Just above, I see the $10,000 level as crucial, and I think that extends to the $10,500 level which is an area that has been important more than once. I think that breaking through there is going to take a certain amount of work. I would not be surprised at all to see this market rally a bit, pulled back again, and then rally again. The 50 day EMA underneath it looks to be supportive and the fact that it is sitting at the $9000 level does not hurt that case either. If we can break out to the upside, then it is highly likely that we will go looking towards the $11,500 level based upon the height of the triangle. Quite frankly, I would not be surprised to see that accomplished, but it is going to take some time. Bitcoin is a bit strange, because it will do nothing for the longest time, and then suddenly take off like it is on fire.