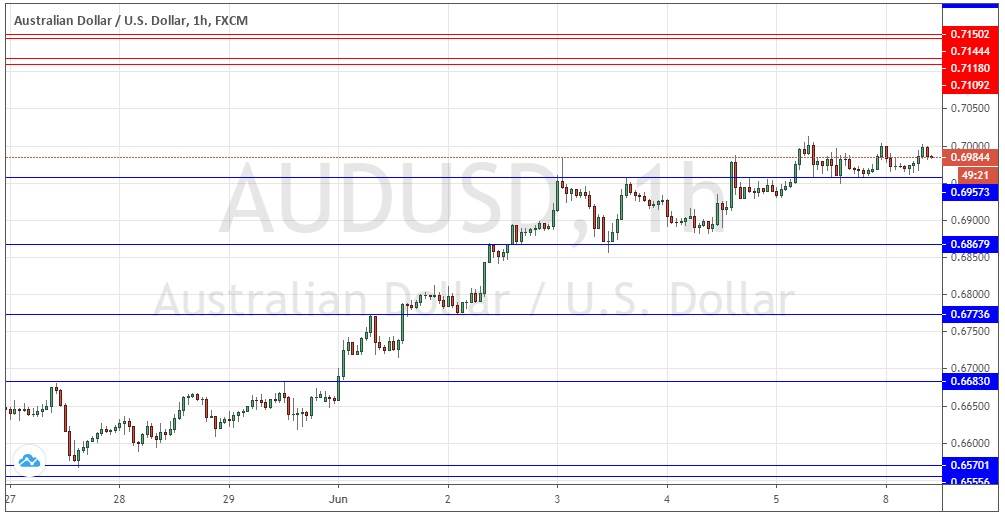

AUD/USD: Breakout imminent?

Last Thursday’s signals were not triggered, as there was no bearish price action even on the shorter time frames when the price first hit 0.6950.

Today’s AUD/USD Signals

Risk 0.75%.

Trades must be entered between 8am New York time Monday and 5pm Tokyo time Tuesday.

Long Trade Ideas

- Go long following bullish price action on the H1 time frame immediately upon the next touch of 0.6957 or 0.6868.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade Ideas

- Go short following bearish price action on the H1 time frame immediately upon the next touch of 0.7109.

- Put the stop loss 1 pip above the highest price made today.

- Move the stop loss to break even once the trade is 10 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Thursday that we were seeing a bearish retracement in this pair, but it just looked like a normal pullback within a long-term bullish trend.

I also thought we were likely to see scalping opportunities when the levels at 0.6950 and 0.7000 were reached.

This was a pretty good call as the price has continued to act bullishly while failing to break 0.7000 when it was tested.

Risk-on sentiment remains strong and stock markets are rising healthily. The Australian Dollar is a great risk barometer and rises with risk appetite, and it has gained strongly in line with the dramatic recovery seen in global stock markets since the March low.

There is no reason not to be bullish except for the fact that 0.7000 is still holding the price down. However, I think the price is likely to break up above it, where it would have about another 100 pips to rise with little likely resistance. This may not happen today but will probably happen over the next few days.

I will take a bullish bias today if we get two consecutive hourly closes above 0.7000 after New York opens.

There is nothing of high importance due today concerning either the AUD or the USD.