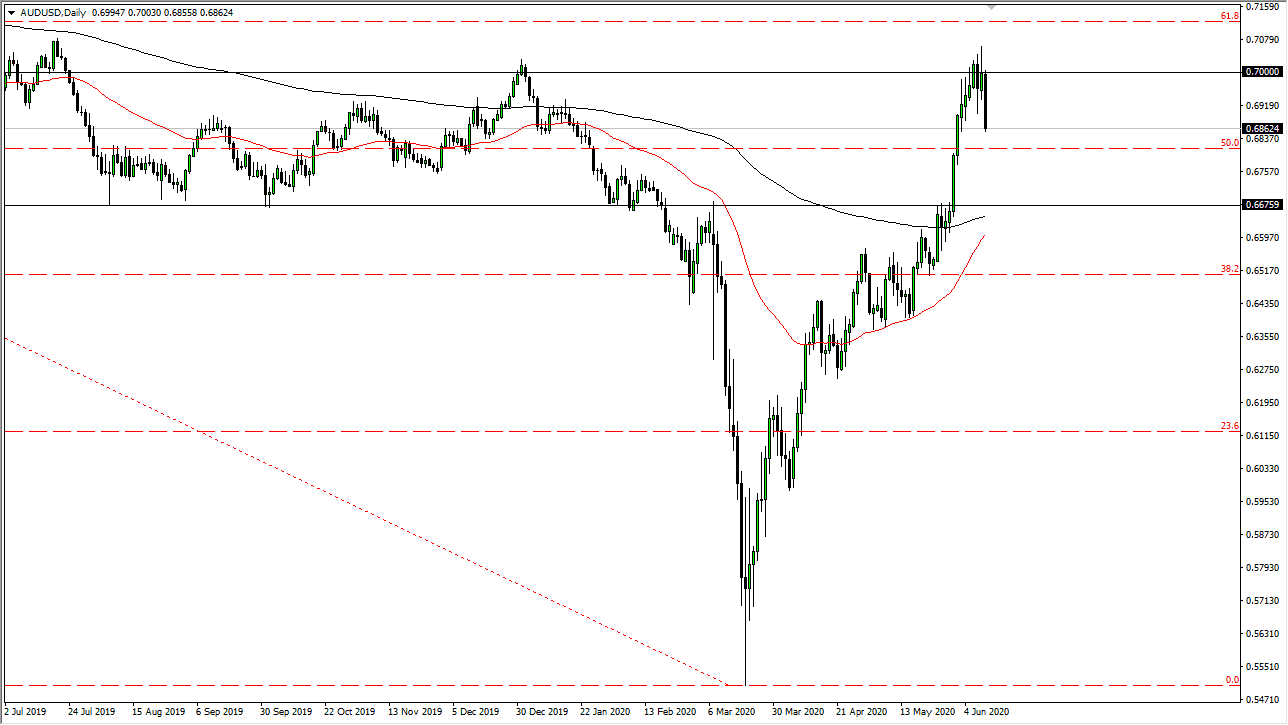

The Australian dollar has broken down significantly during the trading session on Thursday, ripping through the bottom of several candlesticks that had led the market up to this area. Looking at the 0.70 level, you can see that there has been massive resistance. It is an area where we had seen a lot of selling in the past, so it does make sense that we cannot hang on to this.

At this point, we are more than likely going to see a continuation of selling, at least in the short term, and the 0.6675 level is likely to be a target. At this point the 200 day EMA is sitting in that area, so it makes sense that we may go looking towards it.

I am not a fan of buying at these highly elevated levels, and I do think that it is only a matter of time before the Australian dollar has to come back. However, if we were to break above the 0.71 level on a daily close, then it could send this market much higher, perhaps reaching towards the 0.80 level, which would assume that the market is pricing in some type of massive recovery.

Yes, the Australian dollar is extraordinarily cheap at this time from a historical perspective, but it is difficult to imagine that there is going to be a lot of risk-taking when the economy seems to be on such shaky footing. At this point, it is highly likely that we will see this area just above and for it to continue to cause quite a bit of trouble.

When you look at this candle, you can see that it wiped out six previous candles. This is something worth paying attention to and therefore I think that rallies will be sold into. However, I do not necessarily think that it is going to be an easy breakdown, because the market is so overbought at this point, and we need to break through a lot of positions to have that move. In other words, there are a lot of buying orders that need to be broken down. It does not look like it will be easy, but it clearly looks as if there is a possibility that we are going to try. The length of this candlestick certainly tells you a lot.