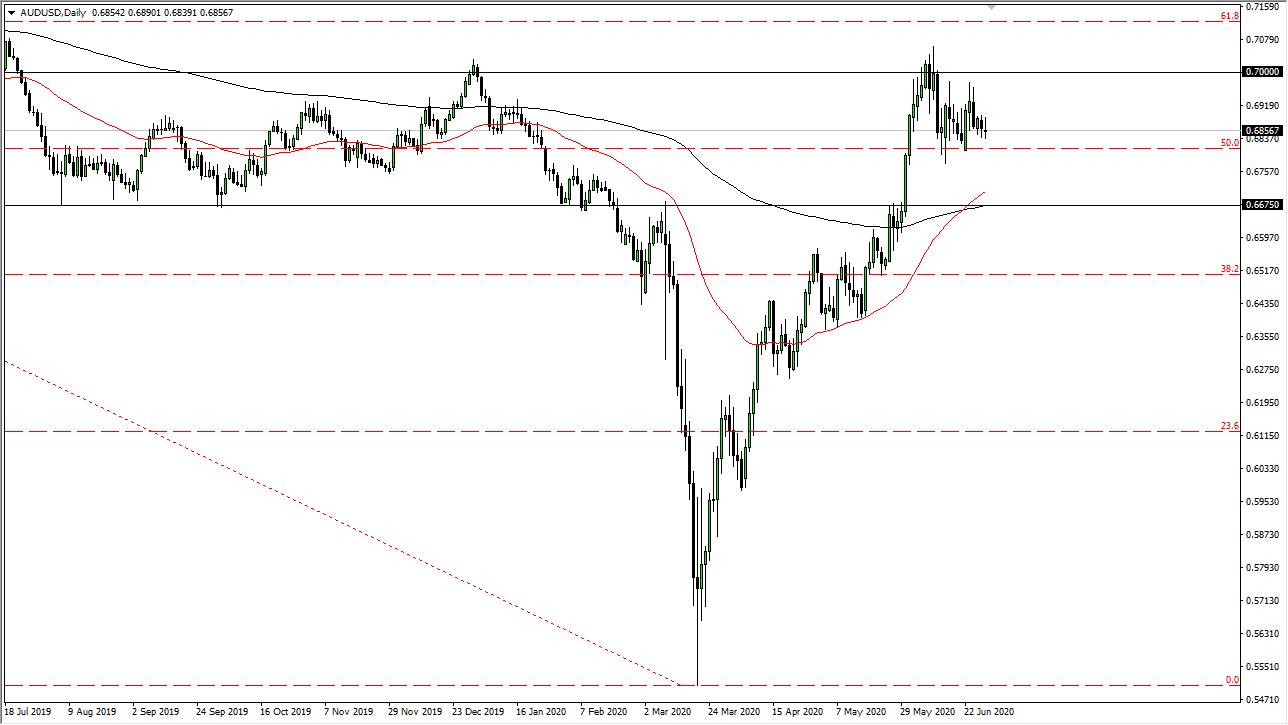

The Australian dollar has done almost nothing during the trading session on Monday, as we have gone back and forth to show signs of lackluster behavior. After all, this is a market that had recently reached towards the 0.70 level above, which of course is a significant large, round, psychologically significant figure. At this point, it is only a matter of time before rallies will be sold, as the market continues to respect the 0.70 level.

At the 0.70 level, I believe there is a significant amount of resistance between the level and the 0.71 handle, which of course is a range of issues. Because of this, it is only a matter of time before sellers would get involved and push the pair back down. Having said that, if the market was to break above the 0.71 handle, then it is likely that we could break out significantly, perhaps more of a trend change than anything else. If we do break above the 0.71 level, I am more likely to simply “buy-and-hold” the Australian dollar as it is showing resiliency and a continuation of the massive move to the upside.

To the downside, the United States dollar is considered to be a safety currency, and as long as we are concerned about the coronavirus and the lack of growth in the global economy, there could be a significant amount of demand for US Treasuries, which of course are denominated in the US dollar. Ultimately, this is a market that will continue to see a lot of volatility, and at this point it is likely that the market would break down from there, perhaps reaching down towards the 0.6675 handle. The 200 day EMA of course is an area that is likely going to cause a certain amount of support as per usual. A breakdown below that level then opens up fresh selling to the 0.75 handle. At this point, I think that the market is likely to continue to chop around and try to figure out which way we are going. This is a market that has been very noise for a couple of weeks, so I think at this point it is highly likely that we are building up momentum for some type of bigger move. As soon as we get the impulsive candlestick, then we will know which direction we go. Below the 0.68 level, it is highly likely that the sellers will start to take over again. I find it exceedingly difficult to think that we are simply going to break above the 0.71 level easily though.