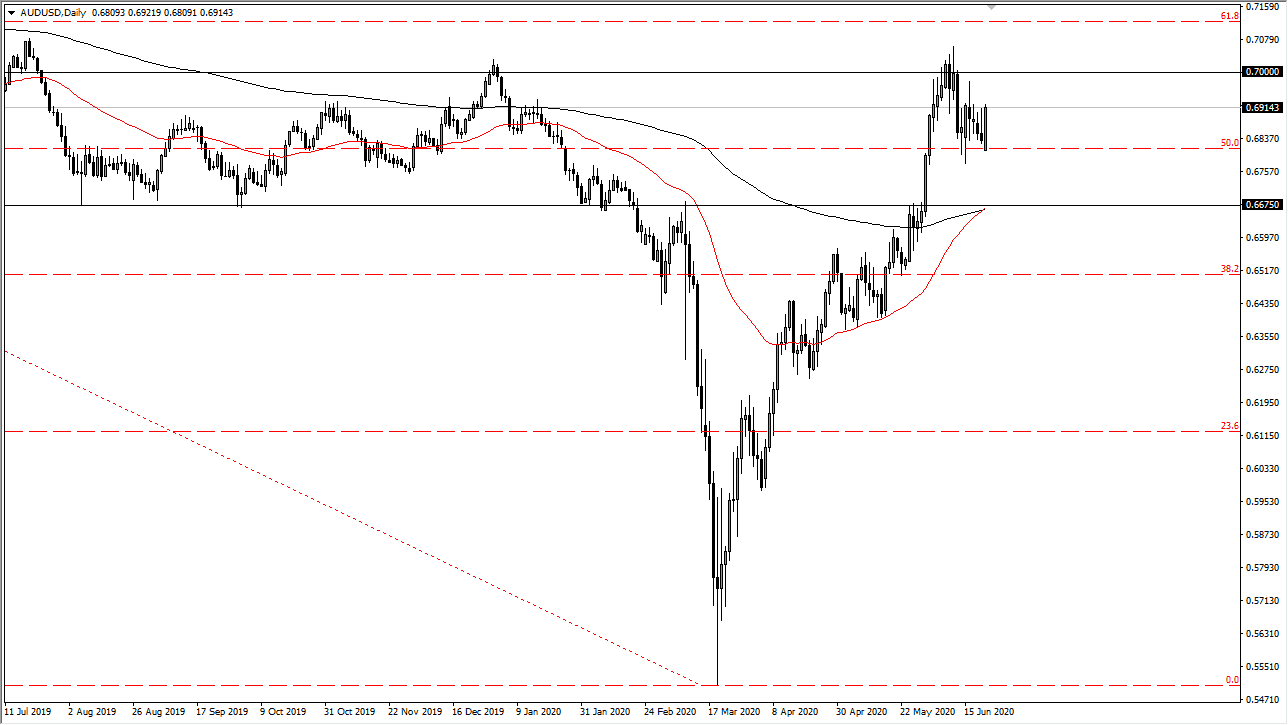

The Australian dollar has shot straight up in the air during trading on Monday, as we continue to see hopium take over the markets. After all, the Federal Reserve is going to save everybody and everything, so what we are seeing as people dumping the US dollar. However, there is a significant amount of resistance just above and I do think that the Australian dollar is living on borrowed time at the short term, but I think it is only a matter of time before we see sellers, especially near the 0.70 level.

To the downside, I believe that the 0.6675 handle is the target, where the 200 day EMA currently resides. I think that will be a fairly significant support level, but right now we are essentially going back and forth in a range between 0.68 and 0.70. With that, I think the market just has nowhere to be as although the Australian dollar is considered to be a “risk on currency”, there is only so much “risk on” going on out there. Stock markets were relatively quiet during the trading session, so it makes sense that the Australian dollar stayed in the same range that it has been in for some time. Ultimately, I think it is only a matter of time before the market would break out, but right now volume seems to be noticeably light and a lot of markets, so I suspect it might be here as well.

All of this being said, I am going to fade the Australian dollar near the 0.70 level again, with the 0.71 level being the top of that resistance. If we break out above there, then fine, I am wrong, and I will start to be a buyer. At this point, the market is likely to see a lot of people start to become “buy-and-hold” as it would be the beginning of a new bullish market for the longer-term charts. That being said, it is exceedingly difficult to imagine a scenario where we just take off to the upside and never look back. There are far too many issues in China and the rest of the world right now to think that the Australian dollar has a free pass to suddenly explode to the upside. Because of this, I do believe that it is only a matter of time before the sellers come back, and at the very least push back towards the bottom of the daily candlestick for Monday.