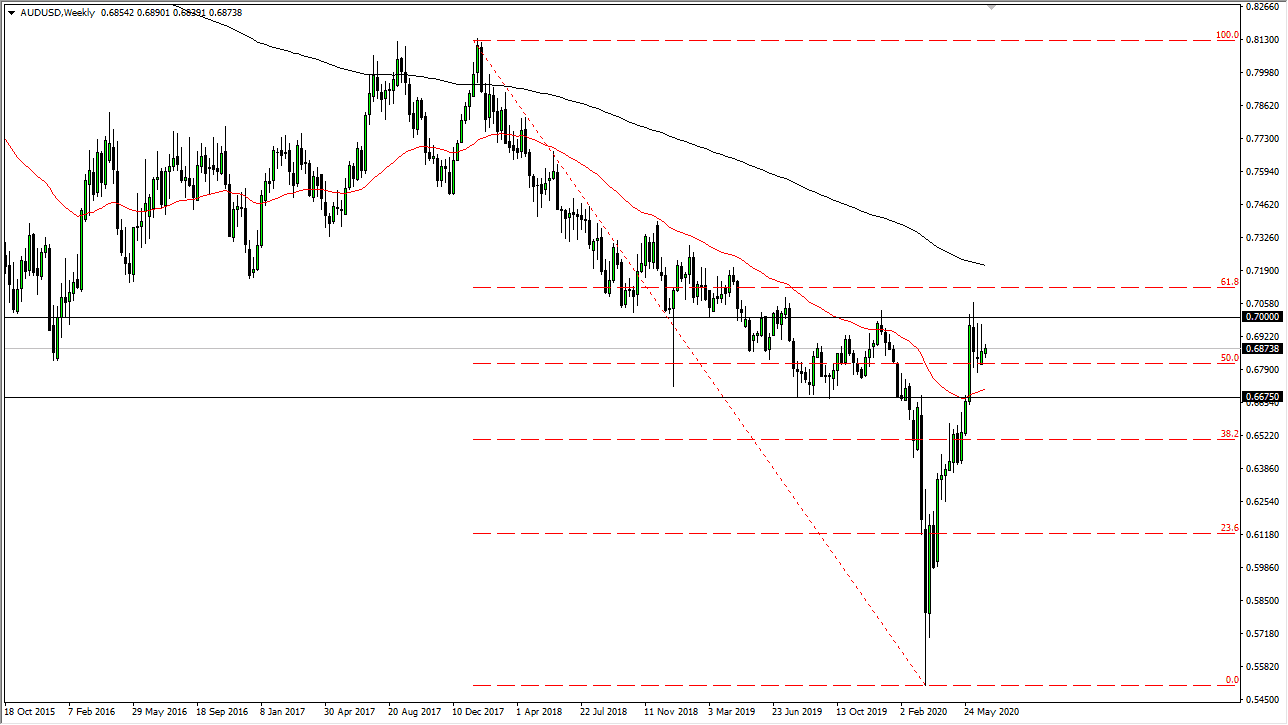

The Australian dollar is a currency that has been rather bullish for some time, however in the last several weeks we have seen the market struggle a bit, as we are at the scene of the major breakdown to send the Australian dollar plunging. At this point, the market looks likely to continue struggling to get above the 0.70 level above, which was where the market fell apart. I look at this as a level that extends all the way to the 0.71 handle above. There is a massive amount of resistance in that area, so I think breaking above there would be exceedingly difficult. In that sense, it is essentially the “ceiling” in the marketplace.

On the other side of the equation we have the US dollar which of course is the “safety currency” for most of the world. You have the US Treasury market which can be used at times for safety, and of course to stash liquidity. Ultimately though, the market looks as if we are trying to test this area of resistance yet again, and the question now is a whether or not the market is going to either build up enough momentum to break out, or if it is going to run out of momentum. One thing that you can see on the chart is that there is a bit of tenacity here. However, one also has to ask how long can this go on without some type of other catalyst to drive the market higher?

At this point, the pair could be greatly influenced by external factors, not the least of which would be the coronavirus figures. If the coronavirus continues to cause major issues worldwide, that could drive down the value of the Australian dollar as it is so highly levered to commodities and demand for riskier assets. After all, Australia provides raw materials for places like China that are going to be manufacturing for consumption by people around the world. If global trade is slowing down, then obviously the demand for those commodities will drop. However, there is also the potential move in the other direction due to the fact that the Federal Reserve is doing everything it can to flood the market with US dollars. If that is going to be the case, then it does provide a little bit of a bullish case. However, it is highly likely that we will run out of momentum. A breakdown below the 0.68 level could signal fresh selling, while a break above the 0.71 level should send this market much higher.