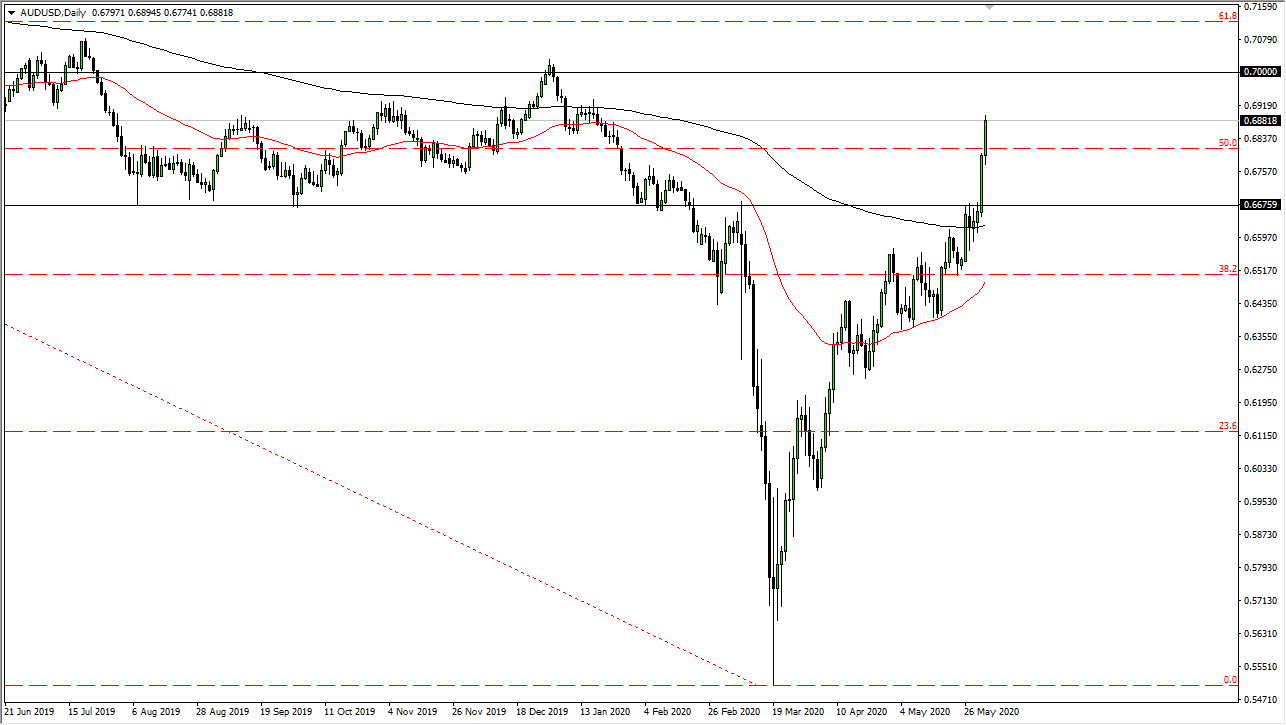

The Australian dollar has rallied yet again during the trading session on Tuesday as the risk appetite trade has gotten a bit out of control. The 0.70 level above is a major round figure that will attract a lot of attention, so if we do get a daily close above there then it is likely that the Australian dollar will simply continue going higher for the next several years. The biggest problem of course is that the Australian dollar needs a strong and healthy global supply chain and global demand in order to push it higher from the longer-term standpoint.

One of the biggest drivers of the Aussie going higher lately has been the idea that the Reserve Bank of Australia has taken the idea of negative interest rates off the table, and that of course makes the currency much more attractive as the market has been priced in and the idea of a massive amount of bearish pressure on the currency. Now that we have had this snapback rally, the market is likely to go looking towards the 0.70 level. At that point, it then becomes a longer-term “buy-and-hold” type of situation. The next couple of days are going to be exceedingly difficult to trade and to sit through, because quite frankly the market has seen a lot of action in this area, and therefore it is likely that the area will cause a lot of choppiness. Ultimately, the market looks likely to see questions asked, and if we break above the 0.70 level could lead to massive US dollar selling across-the-board. After all, the Australian dollar is overly sensitive to the global economic situation, so if that is going to be the case then it makes sense that the US dollar weakness in this pair will translate into other currency pairs.

The US Dollar Index is reaching towards lower levels, and at this point it is likely that the market is going to try to figure out what to do next, and if it breaks down below the 96 handle we could see quite a bit of selling pressure as well. All things being equal, it is very likely that the week should see whether or not we are going to see the greenback hold its strength that it is seen over the last couple of days, or if it finally is starting to change the overall trend, which has seen so much attention over here.