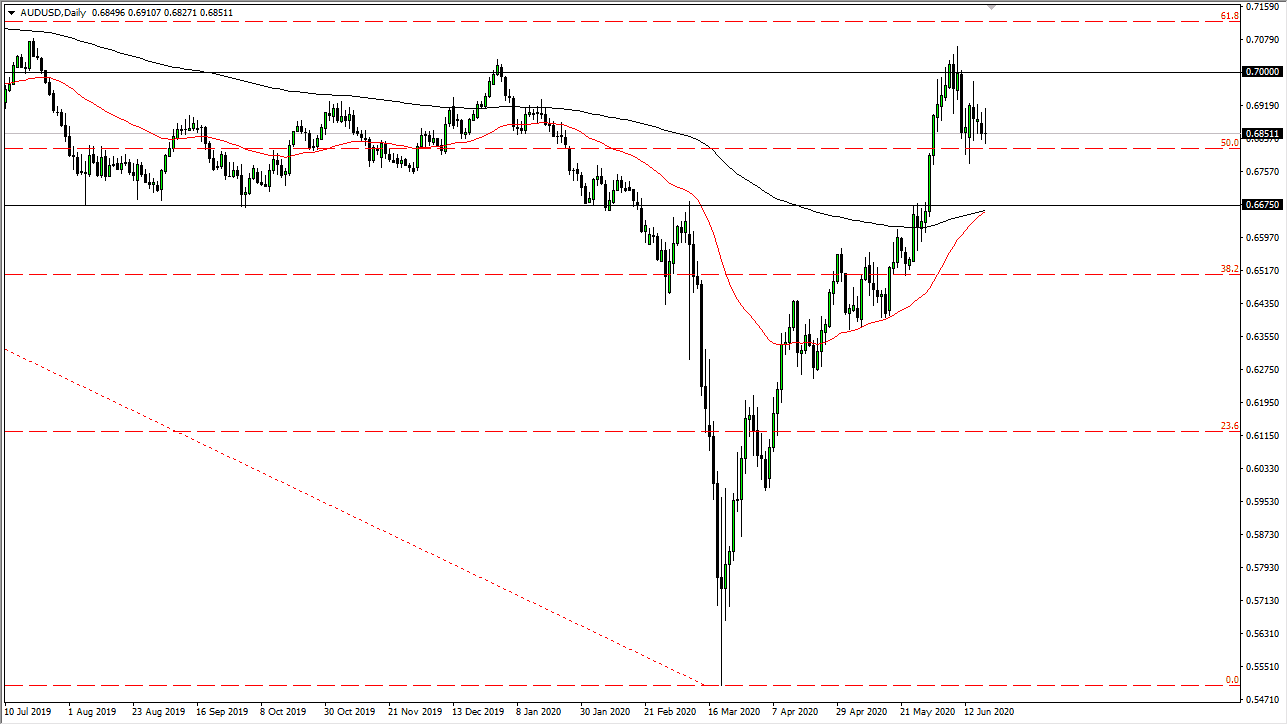

The Australian dollar initially rallied during the trading session on Friday but gave back significant gains in order to form a bit of a shooting star. The shooting star is likely a sign that we are going to continue to find sellers on rallies, so I am looking for short-term rallies to take advantage of. The Australian dollar has been a bit heavy as of late, because the Aussie shot straight up in the air.

The 0.70 level above has been massive resistance, extending all the way to the 0.71 level. If we can break above the 0.71 level, then it is likely that the market is going to go more “buy-and-hold” at that point. That would be a major trend change and we would probably go looking towards the 0.80 level above. However, that does not mean that we are going to get there very easily. Ultimately, this is a market that I think is going to continue to show signs of confusing in the short term, but as you can see the Aussie simply cannot take out to the upside.

The Australian dollar is highly levered to the Chinese economy, and we are starting to see Beijing get locked up due to the fact of coronavirus hitting more people again. With that being the case, it is likely that we are going to see people looking at shorting the Australian dollar, and we could drive this pair down towards the 0.6675 handle. At that area, the market is going to be dealing with a previous resistance barrier. The resistance barrier is potential support, so that is why I have a target. The 50 day EMA and the 200 day EMA are sitting just below that level, so I think that offers significant support.

The candlestick is very negative, and therefore I think we will continue to see a lot of selling pressures above there, and as a result I do not like the idea of buying this pair and I think it is only a matter of time before we can start fading. Underneath, I would expect to see buyers eventually, but this market is going one of two things right now: consolidating in order to digest all of the gains or distributing and selling off. Ultimately, the market at the very least needs to pull back a bit I think in order to continue to go higher.