The Australian dollar initially plummeted during the trading session on Monday as traders were concerned about the coronavirus having an effect on the global growth situation, as we broke down below the bottom of the neutral candlestick for the trading session on Friday. That in and of itself would have been a selling signal, but we had Federal Reserve intervention during the trade session in New York, thereby turning the entire market around.

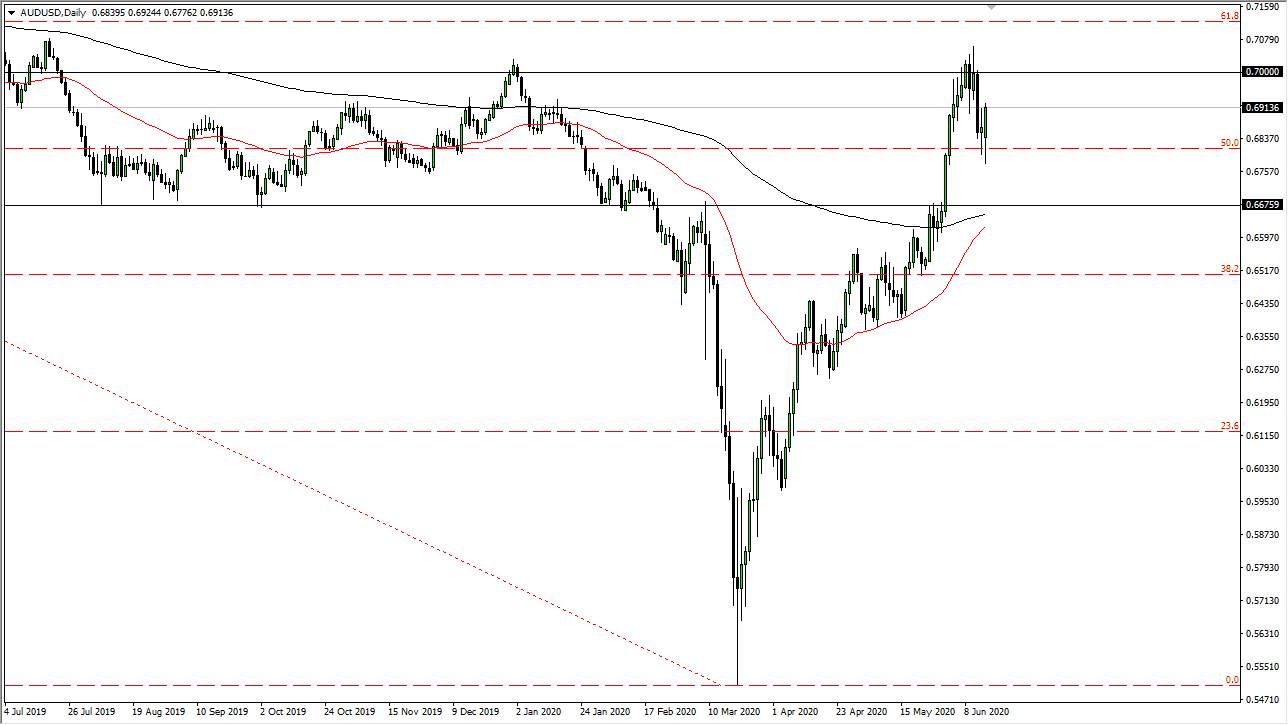

The Federal Reserve has announced that it is going to start a bond portfolio of the largest companies in the United States, liquefying the market in yet another way. That has worked against the US dollar and more specifically has helped risk appetite. That suggests that the Aussie should go higher, but at this point it still looks like we have massive resistance above. The 0.70 level above continues to be crucial, and thereby I think what we are looking at is an opportunity to short this market near that area. I believe that the resistance extends all the way to the 0.71 handle still, but this does not necessarily mean that we can jump in and start selling right away. This also does not mean that we are going to be able to break down significantly, just that the market continues to be noisy overall.

I think that traders will continue to fade the Australian dollar, at least until we get some type of clarity when it comes to China. After all, a lot of people are concerned about the China infection rate as Beijing is starting to see a spike in infection again. Beyond that, the Australian economy is going to run at a deficit for the first time in ages, and thereby the RBA is likely to continue to be very loose with its monetary policy. We are in an environment where all of the central banks around the world are trying to kill their home currencies, which is part of the reason the Australian dollar has strengthened. There has been the usual media buzz about random headlines, most specifically the iron price as of late, but the reality is that the market has been rallying but cannot break above this 0.70 - 0.71 level, and until we do it is likely a “fading the rallies” type of scenario. If we do break above there, then we probably have a longer-term “buy-and-hold” scenario.